Tu fais ce qui te plait, au pire tu vends 1/3 ou 1/2 et tu laisse rider le reste pour 0.40$++

C’est préférable de faire ta propre diligence raisonnable et ton évaluation du titre toi-même pour te fixer des prix d’achat ou de vente cibles. Les fondamentaux des entreprises évoluent constamment et il faut être capable de bien s’adapter à ces changements pour prendre les meilleures décisions. Par exemple, dans le cas de RLV, les termes du financement en lien avec l’acquisition (dette ? équité ? si équité, à quel prix ? etc.) seront très importants à surveiller afin de déterminer la valeur intrinsèque de l’entreprise.

Oui merci pour ton commentaire, je comprend bien qu’il y a des calculs intéressant à faire sur le sujet. Mais je ne cacherai pas que je ne comprend pas les compagnies, les chiffres, les termes et les calculs à faire dans ce genre de situation. C’est un peu le but pour lequel je consulte votre forum, pour avoir des idées d’investissement intéressante et regarder quelque compagnies qui pourrais être un bon achat pour moi. Mais côté ''diligence" et évaluation de titre je suis complètement perdu…

Tu es au bon endroit pour apprendre et t’améliorer! Je te suggère de jeter un oeil à notre discussion Livres: recommandations et critiques, il y a plusieurs bonnes suggestions de lecture pour en apprendre un peu plus sur l’évaluation d’entreprises.

Et j’aimerais aussi te mettre en garde qu’il est parfois dangereux d’écouter les suggestions/recommandations des gens sur les forums (je m’inclus moi-même la dedans), puisque souvent les gens parlent d’un titre lorsqu’ils l’achètent mais pas nécessairement lorsque c’est le moment de vendre. Il se peut aussi qu’une personne tout à fait honnête ait fait une erreur dans son évaluation et que ce ne soit pas une bonne opportunité pour toi. D’où l’importance d’être capable de se faire sa propre opinion sur les titres dans lesquels on investit pour avoir du succès!

FAT.c dans le lithium sur le board du breakout. À surveiller de très prêt

Un autre probleme d’acheter sans trop comprendre, c’est que lorsque les temps sont plus durs la tentation de vendre est beaucoup plus présente, il faut avoir confiance en nos investissements si l’on veut réalisé l’equité de notre placement et ce malgré les aléas du market.

Je suis loin d’etre un expert mais je conseillerais définitivement d’au moins comprendre le produit, les revenus/profitabilité de l’entreprise et comprendre aussi les parts du marché que l’entreprise vise

Un peu plus d’info au sujet de FAT.c

Far Resources drills 23 m of 1.1% Li2O and gets ready for 6 additional pegmatites

Report #3

image: http://rockstone-research.com/images/10xx/FAT4b.jpg

Looking southwest from Zoro‘s Dyke #1 towards the lake that serves as water source for drilling.

Today, Far Resources Ltd. reported assay results from its phase-1 drill program on the Zoro Lithium Project near Snow Lake in mining-friendly Manitoba, Canada.

The initial 7 holes successfully confirmed historic drilling on Dyke #1. Each hole intersected lithium-bearing spodumene mineralization over intervals of up to 28 m, with 2 holes terminated in mineralization.

Based on today’s results, it appears that lithium grades and pegmatite widths are strongest in the northwest portions of Dyke #1, as shown by the wide and high-grade intersection in hole #7 (1.1% Li2O over 23 m). Further exploration, including additional drilling, will focus in this area of the dyke. At the south end, hole #1 intersected multiple thin pegmatite intervals, possibly due to faulting, returning 1.49% Li2O over 2 m.

With a total of 1,140 m completed, the initial 7 holes were only drilled to shallow depths of 163 m on average. Phase-2 drilling is expected to test for mineralization extending at depth.

image: https://www.rockstone-research.com/images/10xx/Zoro3en.png

The average Li2O grade of all 7 holes exceeds 1%, which can be considered a “world-class” when comparing with other hard-rock lithium projects worldwide; e.g. the Mt. Cattlin Project in Australia (Galaxy Resources) with an average resource grade of 1.08% LiO2 (currently being developed into a mine).

image: https://www.rockstone-research.com/images/10L/FAT27.jpg

image: https://www.rockstone-research.com/images/10L/FAT25.jpg

image: https://www.rockstone-research.com/images/10L/FAT31.jpg

As being the case with most hard-rock lithium projects, one single lithium-bearing pegmatite is rarely sufficient to warrant a mining operation. However, pegmatites typically occur in clusters or dyke swarms. To date, an additional 6 pegmatites, outcropping at surface, are known to exist in proximity to Dyke #1 on the Zoro Property. Additional (hidden) pegmatites may get discovered under a shallow cover during the upcoming exploration programs.

According to today’s news, a crew is immediately being mobilized to undertake a field assessment of these 6 known dykes. The upcoming phase-2 drill program is expected to test several of these (in addition to follow-up drilling at Dyke #1).

Keith Anderson, President and CEO, commented today:

“We are pleased that the results from our first drill program on the Zoro lithium property compare favorably with historic data. We have identified higher-grade portions of Dyke #1 which will be the focus of further exploration. Additionally, upcoming field work will assess six other known lithium-bearing pegmatite dykes on the property, where reconnaissance sampling over the summer returned values of up to 6.35% Li2O”.

image: https://www.rockstone-research.com/images/10L/FAT21.JPG

“As global lithium demand increases over coming years, hard-rock operations will be able to respond to market conditions much faster than their brine counterparts…

With the recent lithium feedstock shortage in China, a number of low-grade, high cost deposits have been restarted to sell to downstream processors.“ (Deutsche Bank “Welcome to the Lithium-ion Age“; May 2016)

image: https://www.rockstone-research.com/images/10L/FAT22.JPG

In July 2016, Far Resources reported assays from a rock chip sampling program of 3 separate pegmatites/dykes on its Zoro Property (515 hectares):

• Dyke 2 averaged 3.12% Li2O (2 samples)

• Dyke 4 averaged 2.41% Li2O (1 sample)

• Dyke 5 averaged 3.93% Li2O (4 samples; 2 exceeded 6% Li2O)

Average of all 7 samples: 3.48% Li2O

image: https://www.rockstone-research.com/images/10L/FAT13new2.jpg

In 1956/1957, when lithium prices and demand were very low, a total of 78 shallow holes were drilled at Zoro by Green Bay Uranium Ltd., identifying 7 pegmatites. About 60% of these holes were drilled into Dyke 1, delineating a (historical) “reserve estimate” of 1.8 million t averaging 1.4 Li2O. Historic drilling was shallow to only test for near-surface mineralization, however it was noted that the pegmatites thicken at depth and remain largely untested below 200 m from surface.

“Although lithium metal prices were first reported in trade publications in 1952, demand was very low. From 1952 to 1974, lithium prices remained flat in terms of current dollars; in terms of constant dollars, however, prices decreased. The potential use of lithium in batteries for electric vehicles was first discussed in the Minerals Yearbook in 1972. The downward trend in lithium metal prices reversed in 1974.“ (Joyce A. Ober in USGS 1999)

image: https://www.rockstone-research.com/images/10L/FAT10.png

Criteria facilitating Zoro to quickly advance to a world-class lithium project with the recently completed and upcoming drill programs:

• Highly favourable metallurgy expected due to low impurities, such as iron, and a coarse-grained spodumene mineralization (white to light-greenish colour, similar to Whabouchi).

• Nearby infrastructure (power line: 4 km; road: 11 km; airport: 12 km; rail: 34 km).

• 7 known pegmatites provide significant resource definition potential in 2017. Sampling may identify new anomalies; stripping and trenching of anomalies may discover hidden pegmatites.

• By-product potential (e.g. tantalum, caesium, rubidium) remains unknown. The Tanco Mine (Cabot Corp.) in southeast Manitoba used to produce lithium-bearing spodumene, and tantalum; currently producing only caesium (the world’s largest known pollucite deposit, accounting for 2/3 of known global resources).

• Mining-friendly community (Snow Lake) and province (Manitoba) in a safe and stable mining jurisdiction.

• First Nation consultation and engagement not required in the Flin Flon-Snow Lake greenstone belt where the Zoro Property is located.

Previous Coverage

Report #2: Far Resources gains momentum with drill results pending from its Zoro Lithium Project in Manitoba

Report #1: Drill Results Pending From a Potentially World-Class Hard-Rock Lithium Project

Company Details

Far Resources Ltd.

Unit 114B – 8988 Fraserton Court

Burnaby, BC V5J 5H8 Canada

Phone: +1 604 805 5035

Email: info@farresources.com

www.farresources.com

Shares Issued & Outstanding: 57,191,556

image: https://www.rockstone-research.com/images/10xx/Zoro1.png

Canadian Symbol (CSE): FAT

Current Price: $0.09 CAD (01/09/2017)

Market Capitalization: $5 million CAD

image: https://www.rockstone-research.com/images/10xx/Zoro2.png

German Symbol / WKN (Frankfurt): F0R / A2AH8W

Current Price: €0.062 EUR (01/09/2017)

Market Capitalization: €4 million EUR

DYA en mouvement sur belle news aujourd’hui, 0.84$ +!5%

TORONTO, ON–(Marketwired - February 06, 2017) - dynaCERT Inc. (TSX VENTURE: DYA) (OTCQB: DYFSF) (“dynaCERT” or the “Company”) is pleased to announce that it has received purchase orders for 276 HydraGen™ units exceeding $1.8 million, with 25% cash deposits.

The first 500 unit production run is in the final stages with purchase orders and cash deposits received for 276 HydraGen™ units which are scheduled to be shipped later this month. In addition, there are pending sales awaiting final documentation, deposits and/or lease approvals.

dynaCERT currently has seven approved dealer agreements covering Ontario, Quebec, Western Canada and the Northwest Territories, as well as their sales partners throughout the United States.

dynaCERT has hired additional technicians for field representation and installation training of our HydraGen™ products. We are scheduling training seminars for dealers and their installers.

dynaCERT wishes to announce that we have an accepted offer for a VP of Global Sales who is starting in March. He is fluent in English, French, German and Italian and has over 35 years experience in marketing and managing global sales forces.

We are now receiving parts and preparing for the next 500 unit production run as we continue to ramp up for expected growth.

Wayne Hoffman, Chairman of dynaCERT states, “I believe we are on the cusp of a dramatic positive change for both the combustion and fossil fuel industry sectors. A much cleaner burn rate translates into sharply lower toxic emissions, delivered in a cost effective manner, thereby greatly enhancing the viability of both marketplace sectors and going a long way in meeting the requirements of the green-house gas movement.”

Jim Payne, President and CEO of dynaCERT, states, “I am pleased that we have achieved this major milestone and 276 units will be delivered soon. The dynaCERT team has been working very hard as we continue to grow and venture into uncharted waters.”

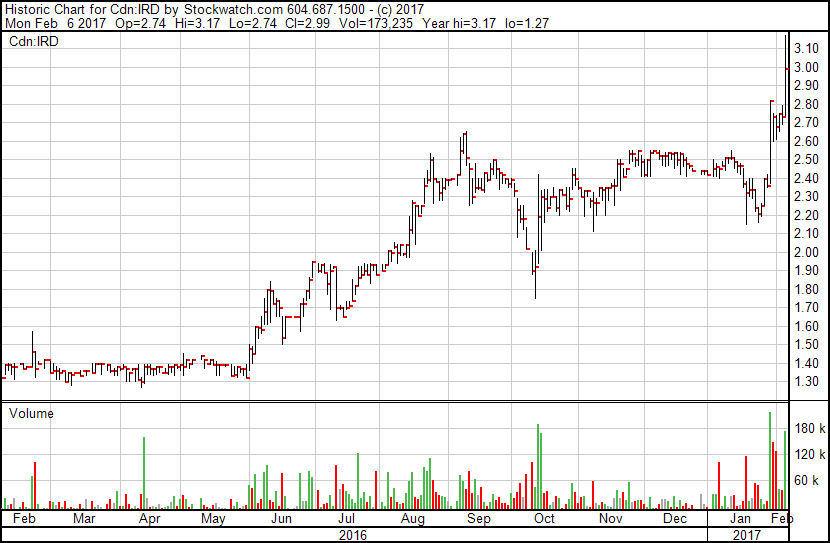

IRD.T a donné un autre coup aujourd’hui, seulement 14 Million d’actions en circulation, le prochain trimestre sera livré vers la fin du mois de février et devrait être comparable au Q3 Int’l Road Dynamics earns $1.41-million in Q3 2016

On me dit que les warrants sont presque tous exercés sur $FAT.c, alors plus grande résistance vers le haut pour le moment. Si les données historiques sont confirmées par les prochains forages je crois que FAT.c pour nous donner le prochain NMX.v version Manitoba. Ca reste très spéculatif évidemment mais le risque en vaut la chandelle ici d’après moi.

Un petit in à 1.20$ dans XMG.c après un repli de 69%. Milliardaire Marc Bruner est à bord du bateau ! Très volatile et spéculatif

VANCOUVER, BRITISH COLUMBIA / January 30, 2017 / MGX Minerals Inc. (“MGX” or the “Company”) (CSE: XMG / FKT: 1MG / OTC: MGXMF) is pleased to announce that Mr. Marc Bruner, a leader in the development of unconventional oil and gas projects throughout North America and internationally, will serve as Chairman of the Board for MGX Minerals as well as direct petro lithium (lithium and oil) acquisitions and development for the Company’s wholly owned subsidiary, PetroLithium Corporation of America.

“MGX is the first Company to separate lithium from oil well wastewater. I am excited about bringing my experience in the unconventional oil and gas business into a new industry where creative thinking is required. Being first positions MGX to be the growth leader in this energy industry paradigm shift,” stated newly appointed MGX Chairman Marc Bruner.

As previously announced, MGX and engineering partner PurLucid Treatment Solutions (“PurLucid”) have successfully extracted lithium from oil sands wastewater (see press release dated January 3, 2017). The Company and PurLucid are now preparing for deployment of the pilot plant shortly with commercial scale deployment expected during the second half of 2017. MGX’s patent pending lithium extraction process, which potentially reduces recovery times of lithium and other valuable minerals from 18 months to one day, compared with conventional lithium extraction.

Mr. Bruner joins Dr. Larry Marks (Geophysics), formerly of Royal Dutch Shell and Shell Oil Canada, as well as Mr. Claudio Manissero, formerly of FMC Lithium and Dr. Preston McEachern, Chief Scientist, on the PetroLithium Corporate Team.

Detailed Biography

Over the past 30 years, Mr. Bruner has founded and held directorships with numerous oil and gas companies, making him a leading expert in unconventional oil and gas development in North America and internationally.

Mr. Bruner was previously the Chairman and CEO of Falcon Oil & Gas Ltd. and served as Ultra Petroleum’s founding Chairman where he was involved in developing the Pinedale Anticline in Wyoming, which is now recognized as one of the largest unconventional natural gas fields in the United States. While serving these companies, Mr. Bruner oversaw negotiations and contracts with global oil and gas companies including Halliburton, Exxon Mobil, Questar Gas and Hess Corporation. Previously, Mr. Bruner founded Pennaco Energy Inc. to explore and develop coal bed methane properties in the Powder River Basin of Wyoming and Montana. In March 2000, the company was sold to Marathon Oil for US $550 million.

Mr. Bruner established Ultra Petroleum in 1996 to develop the unconventional oil and gas project in Wyoming known as the Pinedale Anticline, one of the largest natural gas fields in the United States. During his tenure as Chairman of the Board, Bruner conceived and negotiated 37 different contracts that formed the core value and principal asset base of Ultra Petroleum Corp. During his tenure Mr. Bruner grew Ultra to a market capitalization in excess of $7B and completed deals with global oil and gas companies including Halliburton Corporation, Burlington Northern, and Questar Gas.

Mr. Bruner founded Pennaco Energy Inc. to explore and develop coal bed methane properties in the Powder River Basin of Wyoming and Montana in 1997. In March 2000, the company was sold to Marathon Oil for US $550M, having grown from an initial capitalization of US $1M.

After founding Falcon Oil & Gas in 2005, Bruner served as the company’s President and Chief Executive Officer until 2010 and oversaw its market capitalization rise to in excess of $3.7B. In 2011, Mr. Bruner established Australian-based Paltar Petroleum. The unconventional oil and gas exploration and development company is focused on exploiting its assets in the Beetaloo Basin undeveloped shale deposits.

“It is with great pleasure that we welcome Mr. Bruner to the Company and position of Chairman of the Board of MGX as well as Director of Lithium and Oil acquisitions for PetroLithium Corporation of America,” said MGX President and CEO Mr. Jared Lazerson. “Mr. Bruner is one of the original developers of the unconventional oil and gas business and is a rare breed of visionary businessmen able to recognize and advance fundamental paradigm shifts in the energy industry. Among many other assets, in the past 20 years Mr. Bruner built Ultra, Falcon, and Pennaco, an unrivaled achievement in the unconventional energy industry.”

As compensation Mr. Bruner has the right to acquire up to 17% of the Company over a two-year period, based on current outstanding shares, by achievement of milestones and maintenance of responsibilities. The initial stock vesting will occur in May 2017 and thereafter every three months.

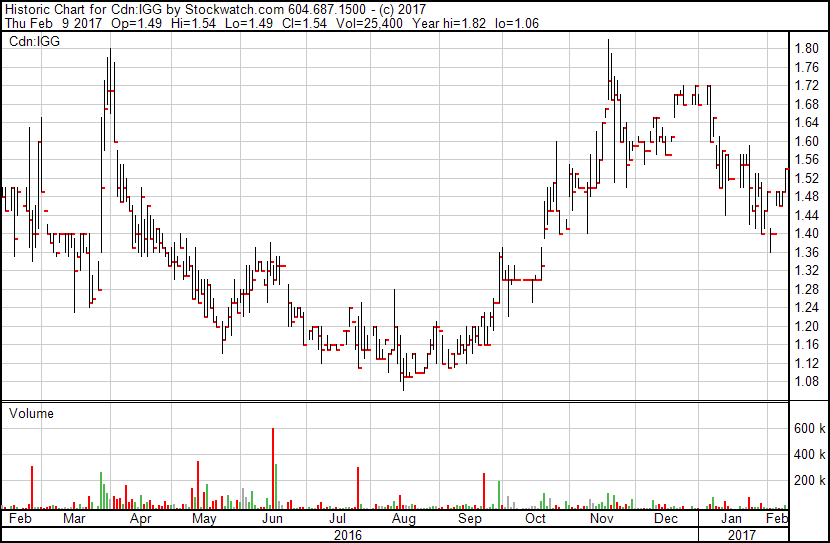

IGG-T Innova Gaming, J’ai pris une petite position cette semaine, Cette compagnie issue d’un spin Off d’ Amaya est maintenant cash flow positif, les prochains résultats sont prévues pour le 23 mars prochain. Avec seulement 20 million d’action en circulation , ce titre pourrait surprendre.

J’ai fait de la recherche sur cette compagnie il y a quelques mois et je l’ai trouvé assez intéressante. Ce qui m’a rebuté, c’est les salaires très élevées du management pour une si petite compagnie.

Même en excluant les bonus non-récurrents en lien avec le IPO, ça reste très élevé selon moi.

Effectivement les salaires sont élevés mais la business a l’air payante avec de fortes marges. Si la direction livre la marchandise c’est un moindre mal. Présentation des investisseurs

Innova Gaming’s LT-3 distribution deals could be hugely lucrative, says Cantor Fitzgerald

Dr. Tina Sampalis M.D., Ph.D. Joins Relevium’s Board of Directors

MONTREAL, QUEBEC–(Marketwired - Feb. 10, 2017) - Relevium Technologies Inc. (TSX VENTURE:RLV)(FRANKFURT:6BX) (the “Company” or “Relevium”) a consolidator of e-commerce assets in Health and Wellness in conjunction with its board of directors, is pleased to announce the addition of Dr. Tina Sampalis to the Company’s Board of Directors.

Tina Sampalis, M.D., Ph.D., is an oncology surgeon trained in physiology at McGill University in Montreal, medicine at the University of Patras (Greece), dermatology at Göttingen University (Germany) and Marselisborg University (Denmark), pediatric, general and oncology surgery at the University of Athens (Greece), graduate training (Ph.D.) in Surgical Research at the University of Athens and a second Ph.D. in Epidemiology and Experimental Surgery at McGill University.

Dr. Sampalis’ leading work in Nutraceuticals includes Neptune Technologies & Bioressources, where she discovered one of the primary reasons krill oil is so beneficial to human health: Phospholipids. Dr. Sampalis is the named inventor of Neptune’s composition and application patents. As the former President of Acasti Pharma Inc. she led the development of a novel patented active pharmaceutical ingredient targeting the prevention and treatment of hypertriglyceridemia and cardio metabolic-disorders.

She is the Founder and President of the AGOO Children’s Health & Wellness Center, a state-of-the-art multidisciplinary comprehensive, pediatric-adolescent medical center and accredited McGill University teaching site in Quebec.

Dr. Sampalis has received several international scholarships and awards for her work on the clinical implementation of retinols for skin and breast cancer, including the Helen Hutchison Award for geriatric medicine. Her work on scintimammography resulted in her appointment at the International Educational Speakers Bureau, the Canadian and U.S. Faculty of Medical Speakers for Breast Imaging.

As an international scholar, Dr. Sampalis leads the development and implementation of innovative micro-invasive and stereotactic robotic surgical techniques for breast cancer, for which a U.S. and Canadian patent application has been filed. She is a member of the American Association of Naturopathic Medicine. Dr. Sampalis has published papers in multiple peer-reviewed publications. She was named one of the 10 most successful women in Quebec (Les Affaires, 18-24 September 2010) and one of the 100 most successful globally by the Princeton Global Network.

Relevium Technologies Inc. (TSX.V - “RLV”) President and CEO, Aurelio Useche, stated, “We are very honored to have Dr. Sampalis join our Company. The addition of Dr. Sampalis closes the value chain by providing deep expertise in scientific and evidence based nutraceutical and medical trends, which can be leveraged through the consolidation of e-commerce assets such as BioGanix as announced on December 22, 2016.”

En effet superbe news sur RLV.v, le CV de Dr. Sampalis est très impressionant. Les canards s’enlignent pour Relevium et je suis pesant sur le titre

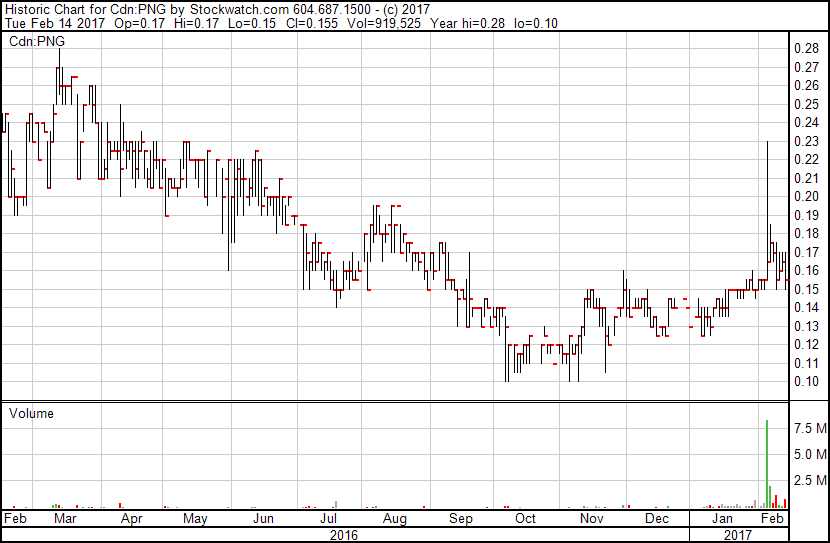

Grosse news sur MMS.v - Fianncement de 200M$ AU pour la mine.

J’ai fait un in ici à 0.105$

Macarthur arranges up to $200M (Australian) financing

2017-02-14 10:02 ET - News Release

Mr. David Taplin reports

SINGAPOREAN STEEL AND SHIPPING GROUP SIGNS FUNDING MANDATE FOR MACARTHUR MINERALS AUSTRALIAN IRON ORE PROJECT

Macarthur Minerals Ltd. has entered into a non-exclusive mandate with the Tulshyan Group to raise up to $200-million (Australian) with an initial tranche of $50-million (Australian) to develop the company’s Ularring hematite iron ore project located in Western Australia.

The Tulshyan Group made a strategic investment in the Company in January this year. The Tulshyan Group, based in Singapore, is one of the largest recyclers of scrap steel in the world, has a significant shipping business with a fleet of over 30 ships and is expanding its commercial aircraft leasing business. The Tulshyan Group has significant experience in sales, marketing of steel and iron ore and access to capital for potential development of the Company’s Western Australian iron ore projects.

David Taplin, President, CEO and Director of Macarthur commented:

“Macarthur Minerals is pleased to be working with Tulshyan Group to raise funds to develop the Company’s Ularring hematite project. Tulshyan brings to Macarthur significant experience in shipping, sales, marketing of steel and iron ore and has access to capital to assist in potential development of the Company’s Western Australian iron ore projects. We are now observing good indications that the price of iron ore has recovered from its 2015 low of US$38.30 1 per tonne to a spot price today of US$92.23 2 per tonne with the advantage of a favourable exchange rate due to deprecation of the Australian dollar against US dollar.”

Australian Iron Ore Projects

Macarthur Minerals’ iron ore projects are located on mining tenements covering approximately 62km2 located 175 km northwest of Kalgoorlie in Western Australia (Figure 1 and Figure 2). Within the tenements, at least 35 km strike extent of outcropping banded iron formation (“BIF”) occurs as low ridges, surrounded by intensely weathered and mostly unexposed granites, basalts and ultramafic rocks.

The Iron Ore Projects consist of two distinct mineral projects:

The Ularring hematite project: encompassing hematite iron ore (“hematite”), to be marketed as potential direct shipping and/or beneficiated iron ore; and

The Moonshine magnetite project: encompassing magnetite iron ore (“magnetite”), to be marketed as a beneficiated magnetite concentrate.

The Company has been maintaining the core iron ore projects’ assets and they remain valuable assets having previously spent over $60 million to develop them. There is real potential for the iron ore projects to add significant value with the recovery of global iron ore markets.

Since July 2006 Macarthur Minerals has drilled 1,841 reverse circulation percussion drill holes (142,443 metres) and 49 diamond holes (4,170 metres) targeting iron mineralisation associated with BIF units. Exploration at both Ularring hematite and Moonshine magnetite projects has been sufficient to allow the estimation of Mineral Resources for both projects.

The Ularring hematite project’s Mineral Resource consists of Indicated 54.46 Mt @ 47.2% Fe and Inferred 25.99Mt @ 45.4% Fe3. Macarthur Minerals published a Pre-Feasibility Study in 2012, reporting Mineral Reserves4.

The Company has received approval to develop an iron ore mine for the Ularring hematite project and associated infrastructure at the project location under the Environmental Protection Act 1986 and the Environmental and Biodiversity Conservation Act 1999.

The Inferred Mineral Resource estimate for the Moonshine Magnetite Project was initially prepared by CSA Global Pty Ltd5 and was updated by Snowden Mining Industry Consultants, with an Inferred Mineral Resource consisting of 1,316 Mt @ 30.1% Fe6.

A Preliminary Assessment Report was prepared on the Moonshine magnetite project by Snowden Mining Industry Consultants in 20117.

Terms of Mandate

The Company, through its 100% owned subsidiary, Macarthur Australia Limited (MAL), has entered into a mandate with Jewel Bright Limited, part of the Tulshyan Group. Jewel Bright Limited will raise up to A$200 million via various tranches to fund the Ularring hematite project, for a 10% fee on monies raised, a specified amount of options in MAL and other conditions.

QUALIFIED PERSONS

Mr David Williams, a member of the Australian Institute of Geoscientists, is a part-time employee of CSA Global Pty Ltd and is a Qualified Person as defined in National Instrument 43-101. Mr Williams has reviewed and approved the technical information in relation to the Iron Ore Projects contained in this news release.

ABOUT MACARTHUR MINERALS LIMITED (TSX VENTURE: MMS)

Macarthur Minerals Limited is an exploration and development company that is focused on identifying and developing high grade lithium and counter cyclical investments, with significant lithium exploration interest in Australia and Nevada. In addition, Macarthur has two iron ore projects in Western Australia; the Ularring hematite project and the Moonshine magnetite project.

UPCOMING EVENTS

MACARTHUR will be attending the 2017 Prospectors and Developers Association of Canada (PDAC) International Convention and Investors Exchange in Toronto, March 5-8 at the Metro Toronto Convention Centre.

We invite you to meet the Macarthur team at Booth #2344. The conference will provide current and prospective shareholders an opportunity to speak with management about the Company’s recent developments.

1 Jasmine Ng, ‘Iron ore sheds 4.3pc on week, ending at record low’, Australian Financial Review, Dec 12, 2015.

2 Australian Financial Review, February 14, 2017

3 Previously announced on August 16, 2012 NI 43-101 Technical Report filed October 1, 2012, titled "NI 43-101 Technical Report, Macarthur Minerals Limited, Pre-Feasibility Study, Ularring Hematite Project, Western Australia

4 Previously announced on August 16, 2012 NI 43-101 Technical Report filed October 1, 2012, titled "NI 43-101 Technical Report, Macarthur Minerals Limited, Pre-Feasibility Study, Ularring Hematite Project, Western Australia

5 NI43-101 Technical Report filed December 17, 2009, titled "NI43-101 Technical Report on Lake Giles Iron Ore Project: Western Australia

6 NI43-101 Technical Report filed March 25, 2011, titled "Macarthur Minerals Limited: Moonshine and Moonshine North Prospects, Lake Giles Iron Project, Western Australia, NI43-101 Technical Report - Preliminary Assessment

7 NI43-101 Technical Report filed March 25, 2011, titled "Macarthur Minerals Limited: Moonshine and Moonshine North Prospects, Lake Giles Iron Project, Western Australia, NI43-101 Technical Report - Preliminary Assessment

We seek Safe Harbor.

MMS.v est ce qu’il y en a d’autres qui sont dans le bateau avec moi ?

IRD-T Un contrat annoncé aujourd’hui

Int’l Road wins $7.34M (U.S.) traffic contract in N.Y.

2017-02-14 06:35 ET - News Release

Mr. Terry Bergan reports

IRD AWARDED USD $7.34 MILLION CONTRACT IN NEW YORK STATE

The New York State Department of Transportation (NYSDOT) has awarded International Road Dynamics Inc. a five-year traffic data collection installation and maintenance contract valued at $7.34-million (U.S.). Under this agreement, International Road will install, upgrade, repair, operate and maintain permanently installed traffic data collection sites located within the state of New York.

There are six types of traffic data collection sites covered under this contract, including continuous count (CC), automatic vehicle classification (AVC), weigh in motion (WIM), permanent short count (PSC), wireless vehicle detection systems and shared traffic data collection sites.

The NYSDOT uses these sites to collect, summarize and interpret information about the traffic travelling on the state’s highways system. The data are required to assess transportation needs and infrastructure performance, as well as to develop planning and programming recommendations.

“We are pleased to receive this long-term commitment to provide installation and maintenance services to the State of New York. This agreement complements the award IRD previously obtained for permanent traffic data collection maintenance and upgrades within New York City and Long Island,” commented Terry Bergan, International Road’s president and chief executive officer. “Contracts such as this add to our recurring revenues and align with our corporate strategy to pursue growth in our expanding maintenance and data services business.”

International Road is a highway traffic management technology company specializing in supplying products and systems to the global intelligent transportation systems (ITS) industry. Private corporations, transportation agencies and highway authorities around the world use International Road’s products and advanced systems to manage and protect their highway infrastructures.