Une des faiblesses d’Ackroo a toujours été au niveau du conseil d’administration. Avec Kristaps Ronka et maintenant Jason Donville, Ackroo regagne beaucoup de crédibilité :

Ackroo Appoints Jason Donville to Board of Directors

Ackroo strengthens Board of Directors with seasoned capital markets and M&A expert

OTTAWA, Dec. 17, 2018 (GLOBE NEWSWIRE) — Ackroo Inc. (TSX-V: AKR), (OTC: AKRFF), a gift card, loyalty marketing technology and services provider, announces the appointment of Jason Donville as a member of the Board of Directors.

Jason is the President and CEO of Donville Kent Asset Management (DKAM), a highly specialized asset management firm that manages investments on behalf of individual investors as well as select institutions. Over the course of his career, Jason has enjoyed considerable success investing in Software-as-a-service (SAAS) companies such as Ackroo. These investments include other successful Canadian software companies such as Constellation Software, TIO Networks, Enghouse, and Open Text. Jason has won numerous awards as both an analyst and Hedge Fund Manager in Asia and Canada.

“We are thrilled to welcome Jason to the Board of Directors,” said Steve Levely, Chief Executive Officer at Ackroo. “We have been in search of a capital markets expert to join our board for some time and to find someone who not only has proven ability to guide us in that capacity but also has a strong understanding of strategic acquisition opportunities is a big win for the Company and for our investors.”

Commenting on his decision to join the Ackroo Board, Donville stated, “I have been extremely impressed with Steve Levely and the turnaround at Ackroo over the past few years. With the Company now consistently generating positive cash flow, I expect that Steve and his team will continue to deliver positive results for shareholders and I look forward to working with Steve and his team to make that happen.”

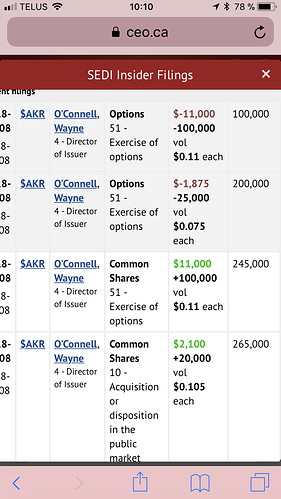

In connection with the appointment of Mr. Donville, Ackroo also announces that it will grant options to purchase 350,000 common shares to directors and officers of the Company at a price of $0.10 for a period of 3 years. The option grant remains subject to the approval of the TSX Venture Exchange.