CALGARY, May 28, 2020

/NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES./

CALGARY, May 28, 2020 /CNW/ - Renoworks Software Inc. (TSXV: RW) (« Renoworks » or the "Company), the leading end-to-end visualization platform for the building construction industry, yesterday announced financial results for the three months ended March 31, 2020. The financial statements and related management’s discussion and analysis (« MD&A ») can be viewed on SEDAR at www.sedar.com.

Financial and business highlights for the first quarter 2020:

- Highest-to-date Q1 revenue of $1,117,854 for the three months ended March 31, 2020 compared to $1,062,482 in 2019, an increase of 5%.

- Design services revenue of $478,403 for the three months ended March 31, 2020 compared to $319,066 in 2019, up 50%.

- Adjusted EBITDA loss of $7,415, down from a loss of $44,517 in Q1, 2019.

- Gross margins continue to be strong at 69% and 74%, respectively for the first quarter of 2020 and 2019.

- Net loss of $70,667 for the quarter ended March 31, 2020 compared to $116,955 in 2019 as we focus on continued investment in our platform solution to meet client and market demand.

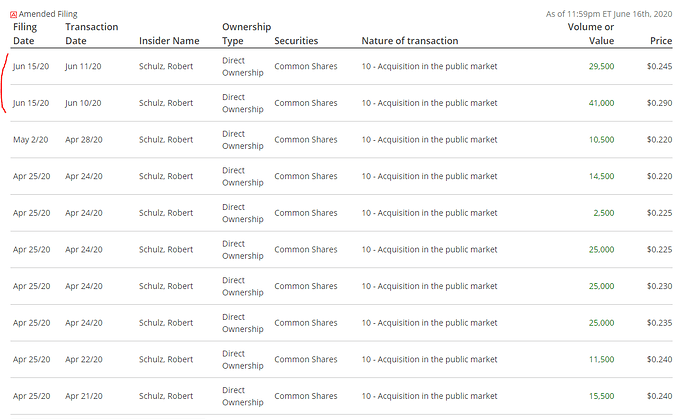

- As at March 31, 2020, the Company had 36,610,507 common shares issued and outstanding.

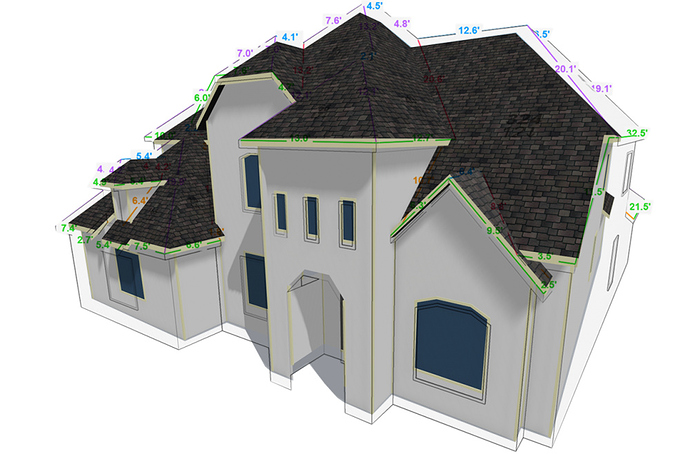

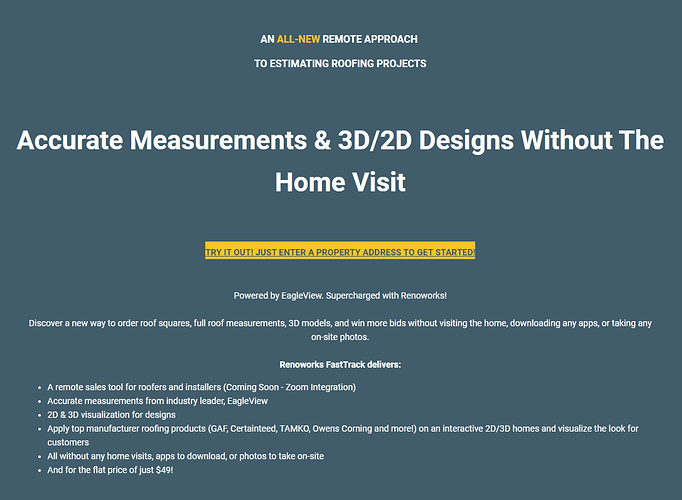

Doug Vickerson, CEO of Renoworks, stated, "We are proud to announce growth in revenue for this quarter despite the impact of COVID-19 on our industry beginning in March, 2020. Demand for online tools and services remains strong as contractors and homeowners are forced to seek virtual solutions to design, measure, estimate and plan their construction and remodeling projects. Our design services growth stands as a testament to this trend, with that business unit achieving a 50% increase in revenue over the same quarter last year.

Mr. Vickerson continued, "With revenue growth also came a net loss this quarter as we continue to invest in R&D, personnel, platform development and marketing to capture the opportunities opened up by our industry’s accelerating adoption of digital technology. We look forward to deploying our remote measurement, estimation, and design solutions to help our clients and the industry as a whole carry on business in this time when virtual solutions are needed now more than ever.

Financial results from operations for the first quarter 2020 with comparatives for 2019 are as follows:

Three Months Ended March 31

2020 2019

Revenue $1,117,854 $1,062,482

Gross Margin $773,604 $785,641

Expenses $862,726 $856,234

Loss $70,667 $116,955

Loss per share ($0.00) ($0.00)

Adjusted EBITDA ($7,415) ($44,517)

Weighted Average Shares Outstanding 36,610,507 33,854,477

The Company’s financial position as of March 31, 2020 with comparatives from 2019 is as follows:

|

March 31, 2020 |

December 31, 2019 |

| Cash Balance |

$444,610 |

$500,751 |

| Accounts Receivable |

$530,507 |

$398,418 |

| Working Capital |

$36,921 |

$108,595 |

| Deferred Revenue |

$1,096,984 |

$1,019,140 |

| Long- term liabilities |

$438,133 |

$471,531 |

| Shareholder’s Equity (Deficiency) |

($56,019) |

($10,942) |

| Deficit |

($7,999,519) |

($7,928,852) |

| Total Assets |

$1,443,694 |

$1,387,516 |

The COVID-19 virus continues to cast significant future uncertainty. The continued spread of COVID-19 in North America and globally could have an adverse impact on the company’s operations and financial results. While the impact of COVID-19 is expected to be temporary, the current circumstances are dynamic and the immediate impact to the Company’s business operations cannot be reasonably estimated at this time. The extent to which the coronavirus could impact the Company’s results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and actions taken to contain the coronavirus or its impact, among other unpredictable events.

The Canadian government has announced various programs to assist companies experiencing significant impacts as a result of the COVID-19 pandemic, one of which was the Canadian Emergency Wage Subsidy (CEWS) program. This program provides a non-repayable subsidy of 75% of employee wages up to a maximum of $847 per eligible employee per program week for eligible employers. The Company is eligible to receive benefits from this non-repayable subsidy. To date the Company has received $116,576 in wage subsidies from this program for the period March 15 to April 11, 2020. A total of $58,288 of this amount is included in the trade and other receivables balance and as a reduction to general and administrative expenses of the financial statements for the period ended March 31, 2020. There can be no assurances that the Company will qualify for additional subsidies under this program.

Regarding COVID-19, management developed detailed mitigation plans commencing March 17, 2020, and meets with the Board of Directors weekly to review the Company status. Firstly, employee safety and health were paramount. Every employee has worked remotely since March 15 and every employee reports vigilance in practicing safe and healthy habits at home. No employees nor their families are known to have contracted the coronavirus as of today’s date. The transition to remote working proceeded as planned. Further, there have been no known negative impacts to deadlines or productivity with regard to customer service, software development, or employee morale. Finally, aided by the CEWS program, no employees were laid off and no employee hours were reduced as at today’s date. We continue to remotely interface with customers and monitor any cash flow impacts that may arise.