Courte mais intéressante entrevue au Spring Investor Summit avec Dwayne Kushniruk le CEO de Onesoft Solutions:

Quel connaisseur ce @SimB!

OneSoft Solutions Announces $8 Million Bought Deal Financing

OneSoft Closes $9.2 Million Bought Deal Financing

25 Apr 2019 10:11 HE

ACCESSWIRE

EDMONTON, AB / ACCESSWIRE / April 25, 2019 / OneSoft Solutions Inc. (TSXV: OSS) (“OneSoft” or the “Company”) is pleased to announce that it has closed its previously announced short form prospectus offering (the " Offering ") of 11,500,000 common shares (the " Common Shares ") of the Company at a price of $0.80 per Common Share. The Offering also included 1,500,000 Common Shares issued pursuant to the exercise of the over-allotment option in full, for aggregate gross proceeds of $9.2 million.

The Offering was completed on a bought deal basis and was underwritten by Clarus Securities Inc., as lead underwriter and sole bookrunner, on behalf of a syndicate of underwriters that included Cormark Securities Inc. and Beacon Securities Limited. In consideration for their services, the syndicate of underwriters received a cash commission equal to 6% of the gross proceeds of the Offering and Broker Warrants (each a " Broker Warrant ") equal to 6% of the Common Shares sold pursuant to the Offering. Each Broker Warrant entitles the holder thereof to purchase one Common Share at a price of $1.00 for a period of 12 months following the Offering’s closing date.

The net proceeds from the Offering will be used by the Company to accelerate new product development, marketing and sales initiatives, and for working capital and general corporate purposes.

The shares were offered in each of the provinces in Canada, other than Quebec.

OneSoft Solutions Inc. Reports Q1 2019 Results

[…] the Company’s client list increased during Q1 from two clients as at December 31, 2018 to six clients as at March 31, 2019, that now include one independent pipeline operator, four Fortune 500 companies, and one industry Super-major. These clients collectively operate approximately 51,000 miles of oil and gas pipeline infrastructure […]

Mise à jour qui date de la semaine passée:

Fortune 500 Energy Supplier Engages OneSoft for CIM Machine Learning Solution Pilot Project

EDMONTON, AB / ACCESSWIRE / July 22, 2019 / OneSoft Solutions Inc. (the “Company” or “OneSoft”) (TSX-V:OSS, OTCQB:OSSIF) is pleased to announce that its wholly-owned subsidiary, OneBridge Solutions Inc. (“OneBridge”) has teamed up with Worley [ASX:WOR] to engage a major US-based electricity and natural gas supplier (the “Client”) for a trial use of the Company’s Cognitive Integrity ManagementTM (“CIM”) software-as-a-service (“SaaS”) solution. Over the next several months, the Client will investigate CIM’s advanced Data Science and Machine Learning capabilities for pipeline integrity management of certain infrastructure segments.

Worley Senior Vice President of Global Operations, Integrated Solutions, Mark Ramsden said, “This pilot will be conducted with a progressive, sizeable operator who is currently responsible for supplying natural gas and electricity to over 7.5 million customers across the eastern United States.”

“The Client is an industry leader that is leveraging data science to increase safety and reduce costs,” added Kelly Newnham, Vice President of Onshore Hydrocarbons for Advisian, Worley Group’s global consulting business.

“We are excited to collaborate with the Worley Group on this project, which will involve working closely with the Client’s pipeline integrity team to identify how our software solutions can positively impact and optimize their operational processes,” said OneBridge president, Tim Edward. “We are very pleased that our work to date with Worley and Advisian for this Client has now progressed to the software trial stage, following the preliminary investigative work that has been conducted in the past few months.”

OneSoft Solutions Inc. Reports Results for the Six Months Ended June 30, 2019

August 22, 2019 7:01 AM

Addition of New Customers Drives Revenue Growth of 142% Quarter over Quarter and 126% Year over Year

EDMONTON, AB / ACCESSWIRE / August 22, 2019 / OneSoft Solutions Inc. (the “Company” or “OneSoft”) (TSXV:OSS)(OTCQB: OSSIF) , a North American developer of cloud-based business solutions, is pleased to announce its financial results for the three and six months ended June 30, 2019 (“ Q2 2019 ”). Please refer to the interim unaudited condensed Consolidated Financial Statements and Management’s Discussion and Analysis (“ MD&A ”) for the three and six months ended June 30, 2019 filed on SEDAR at www.sedar.com for more information.

Effective in 2018, the Company changed its financial year-end from February 28 to December 31. The information presented in this News Release is for the three and six months ended June 30, 2019 (the “ current period ”) and for May 31, 2018 (the “ comparative period ”).

Financial Summary for the Three and Six Months Ended June 30, 2019 and May 31, 2018

Three months ended Six months ended

(in $,000)'s, per share in $ June 30,

2019 May 31,

2018 Increase /

(Decrease) June 30,

2019 May 31,

2018 Increase /

(Decrease)

$ $ % $ $ %

Revenue 710 293 142.4 1,302 576 126.1

Gross profit 533 280 90.6 1,046 529 97.5

Loss before other income and expense (459 ) (537 ) (14.5 ) (1,130 ) (1,076 ) 5.0

Net loss (907 ) (767 ) 18.3 (1,822 ) (1,731 ) 5.2

Comprehensive loss (836 ) (767 ) 9.1 (1,804 ) (1,731 ) 4.2

Weighted average common shares

outstanding - basic and fully diluted (OOO)'s 109,491 100,406 105,281 93,445

Net loss (per share) (0.01 ) (0.01 ) - (0.02 ) (0.02 ) -

Cash and cash equivalents 12,144 3,508 246.1 12,144 3,508 246.1

Highlights of Q2 2019

-

The Company’s commercially contracted client list increased during the first half of 2019, from two clients as at December 31, 2018 to six clients as at June 30, 2019, and now includes one independent pipeline operator, four Fortune 500 companies, and one industry Super-major. These clients collectively operate approximately 51,000 miles of oil and gas pipeline infrastructure for which we anticipate data will be loaded into the Company’s Cognitive Integrity ManagementTM (“ CIM ”) software-as-a-service (“ SaaS ”) solution on a staged timing basis. For historical comparison and context, CIM associated revenue totalled approximately $1.3 million during the ten months ended December 2018 and was primarily derived from only two clients who collectively analyzed approximately 13,000 miles of pipeline data.

-

On April 4, 2019, the Company announced an $8 million Bought Deal Financing (the “ Financing ”), with an over-allotment option for $1.2 million. The Company filed a Preliminary Short Form Prospectus in connection with the Financing on April 9, 2019, followed by a Final Short Form Prospectus on April 17, 2019. The Company closed the fully subscribed $9,200,000 Financing on April 25, 2019 and issued 11,500,000 common shares at $0.80 per share and 600,000 broker share purchase warrants exercisable at $1.00 and expiring April 25, 2020. Institutional investors subscribed for approximately 75% of the Financing.

-

In accordance with the Company’s announced intentions regarding use of proceeds of the April 2019 Financing, management commenced progressing certain technology road-map and development plans, including conducting market research into new CIM companion products and identifying and hiring additional personnel to accelerate new product development sprints.

-

Revenue for the current quarter increased by 142.4% from $292,783 for the 3-month period ended May 31, 2018 to $709,740 for the period ended June 30, 2019. The revenue increase was primarily due to increased usage of the Company’s software solutions by more clients in 2019.

-

Cash at quarter end increased to $12,143,799, from $2,015,428 at December 31, 2018, significantly strengthening the Company’s balance sheet. The Company has no debt.

Subsequent to Quarter-End

-

Subsequent to the quarter end, on July 22, 2019 the Company announced it had teamed up with Worley (formerly WorleyParsons) to conduct a pilot project with a U.S. based Fortune 500 electricity and natural gas supplier, who will trial OneBridge’s CIM software over several months.

-

On July 22 and 23, 2019, the Company and Microsoft held a workshop entitled “Digital Transformation: Making Pipeline Failures a thing of the Past” at the Microsoft Training Center in Houston. The event was very well attended by staff from many pipeline companies and featured a CIM product presentation and demonstration by four clients that are actively using CIM. The workshop generated several sales leads for the Company.

Business Outlook

OneSoft is focused on growing the revenue generated by CIM, its first commercial SaaS solution, and concurrently is pursuing development of new accretive solutions we believe will accelerate future revenue growth. CIM future revenue growth is dependent upon three factors: (a) the pace at which current clients load and process data for their pipelines; (b) customers’ schedules of pipeline inspection, which drives a variable element of revenue and © the pace of adoption of CIM by prospective new clients. We believe the positive user experience and validation of our solutions by our initial clients is now resonating positively within the U.S.A. marketplace, boosting confidence and encouraging wider industry acceptance of our innovative machine learning technologies and processes to replace legacy systems that serve the industry today.

As was disclosed in prior communiques, the Company intended to accelerate its R&D efforts beyond the evolution of CIM functionality, once client interest for participation and appropriate funding resources had been investigated and arranged. Following completion of the Financing in April 2019, the Company is now taking steps to ramp its R&D efforts to grow the revenue potential from current and prospective clients, develop new CIM accretive solutions and strengthen the Company’s machine learning and data sciences technological lead in the marketplace.

Evolution of CIM Solution to CIM Platform

To date, our processing of tens of thousands of miles of pipeline data from many operators and pipeline tool vendors involving more than 30 million features has trained our software with the learnings from it being incorporated as permanent knowledge in multiple iterations of our proprietary machine learning algorithms. We believe this work represents unique and unparalleled analysis capability, that even the largest of pipeline operators and industry inspection tool (“ PIG ”) vendors are not able to replicate as they individually have neither the access to such a diverse amount of data nor the specific data science capabilities to analyze it.

We intend to transform CIM from a solution to a CIM platform to which various new software modules can be integrated to address more functionality requirements of our clients. We believe this will allow us to monetize the ever-increasing cognitive learnings we are deriving from our continued analyses of pipeline data provided by our clients. This initiative may involve development of new probabilistic risk and advanced analytics models, in part designed to operate in accordance with current and future regulatory guidance requirements prescribed by the Pipeline and Hazardous Materials Safety Administration (“ PHMSA ”), the U.S.A regulator of hazardous pipeline operations. Similar to prior product development sprints, we intend to follow “The Lean Start-up” software development model wherein client and prospect feedback drives functionality specifications and development priorities and minimally viable revenue generating products are developed and released to market as soon as is practical. Some of our clients who understand the benefits of transforming CIM to a platform have expressed potential interest in contributing collaborative user input and/or other resources to develop new algorithms and products to be part of the CIM platform.

We believe that the new algorithms, predictive analytical models and other data science capabilities, when completed as envisioned, will increase the potential total addressable market (“ TAM ”) for the Company’s products. We believe that by integrating and correlating pipeline inline inspection (“ILI”) data with other data sets (e.g., cathodic protection, types of pipeline steel, coatings, soil, etc.), we will be able to develop and market innovative new solutions that will use direct assessment analyses, risk management processes and other analytical and predictive functions that operators seek to maintain and improve their operational compliance with PHMSA regulations on a more efficient and effective basis.

Technology Development to Increase Revenue Potential and Competitive Moat

As noted in previous communiques, we believe that revenue from new functionality and solutions will be accretive to current CIM revenues, supporting our expectation that revenue metrics can be increased once new functionality and products are commercialized in the future.

Regarding technology, we believe that OneSoft’s “first mover” advantage in having developed and commercialized the first oil and gas pipeline integrity management solutions based on cloud computing, machine learning and data science has established a highly competitive go-to-market position. Potential competitors who might embark on development of similar CIM type functionality will likely face formidable obstacles to catch up to and displace OneSoft solutions, as such competitors will first need to assemble data science development teams, establish collaborative technology and sales relationships with companies like Microsoft and Worley, undertake significant efforts to get access to pipeline ILI data from pipeline operators, expend millions of dollars to develop their solutions, identify and engage private preview software users and then execute extensive product validation efforts, before their solutions will be purchased by clients.

We believe the enormity of replicating our technology and solutions may dissuade certain current industry vendors who provide legacy products from embarking on such an extensive project due to the very significant development costs and lengthy timeframe which would likely be required to replicate OneSoft’s intellectual property, from initial development to market validation by clients. Providing we continue to pursue cutting-edge R&D initiatives, we believe it will be very challenging for new entrants to catch up to OneSoft and deliver superior solutions, because of our significant head start regarding the technology, client and business advancements we have achieved.

Operational Expectations - Fiscal 2019 and Beyond

We believe that OneSoft is positioned as the machine learning technology leader within our markets today. The April 2019 Financing strengthened our balance sheet and provided the resources necessary to maintain and advance our technological lead. New personnel have been hired to augment the development and sales teams since closing of the April 2019 Financing, and efforts are ongoing to hire additional staff to further increase the Company’s capability to accelerate product development and business growth. Although we are not aware of any competing solutions today that rival CIM’s capabilities, or any potential competitors that are close to releasing a similar machine learning solution, we believe that the industry is becoming well aware of the benefits of these types of solutions and that our efforts to date have positioned the Company to evolve the CIM platform for future opportunities to support revenue growth.

New R&D sprints commenced in Fiscal 2019 are not expected to complete before year end, and recognition of revenue associated with these development sprints, if any, is not likely to occur until at least Fiscal 2020. The Company is well-positioned to pursue accelerated development, marketing and sales initiatives. Whereas the investment in new product development is expected to result in operational losses until such time as new products are commercialized and revenue-generating, we believe the Company’s strategies, business, technology and operational plans will ultimately result in increasing shareholder value through achievement of two key objectives - advancing our technological lead and competitive moat, and increasing market potential and revenues.

https://finance.yahoo.com/news/onesoft-solutions-inc-reports-results-120000458.html

positif je dirai

Beaucoup d’informations très pertinentes dans le MD&A

OneSoft Dig to Repair Ratio White Paper Presented at PPIM 2020 in Houston, Texas Machine Learning Technology Measures Effectiveness and Cost Savings for Pipeline Digging Programs

https://finance.yahoo.com/news/onesoft-dig-repair-ratio-white-120000537.html

“Even a 1% delta in improving Repair Fraction is significant, and we believe our customers may see efficiency gains in the 10 or 20% range, which will greatly improve their risk and financial metrics through use of CIM.”

Two weeks ago, you pre-registered to listen to OneSoft Solutions CEO Dwayne Kushniruk host an investor presentation at the Planet MicroCap Showcase event.

Several investors fielded questions, but due to time constraints Mr. Kushniruk couldn’t answer them all. However, we present these questions and Mr. Kushniruk’s answers following the video presentation and disclaimer below.

If you would like more information or access to any of the past reports we have written on the company or if you would like to receive OneSoft Solutions news and updates, please reply to this email with your first and last name and country of residency (for regulatory compliance).

Thanks.

OneSoft Solutions’ Planet MicroCap Showcase investor presentation.

Disclaimer

The following questions were asked by attendees of the Planet MicroCap Showcase Virtual Investor Conference held on April 22, 2020. Management is providing responses to the questions asked, for which insufficient time during the meeting was allotted to respond.All information discussed herein has been previously disclosed in public filings, including the Management Discussion and Analysis and Financial Statements for the year ended December 31, 2019 and/or in prior publicly disclosed documents filed on SEDAR.

We consider the responses made herein to be reasonable, but caution the reader that these responses include assumptions regarding future events, many of which are beyond our control, and may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect us. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities regulation. Readers are encouraged to review future disclosures on SEDAR and the www.onesoft.ca website to keep updated as to the Company’s progress.

Dwayne KushnirukOneSoft Solutions CEO

Now on to the Q&A.

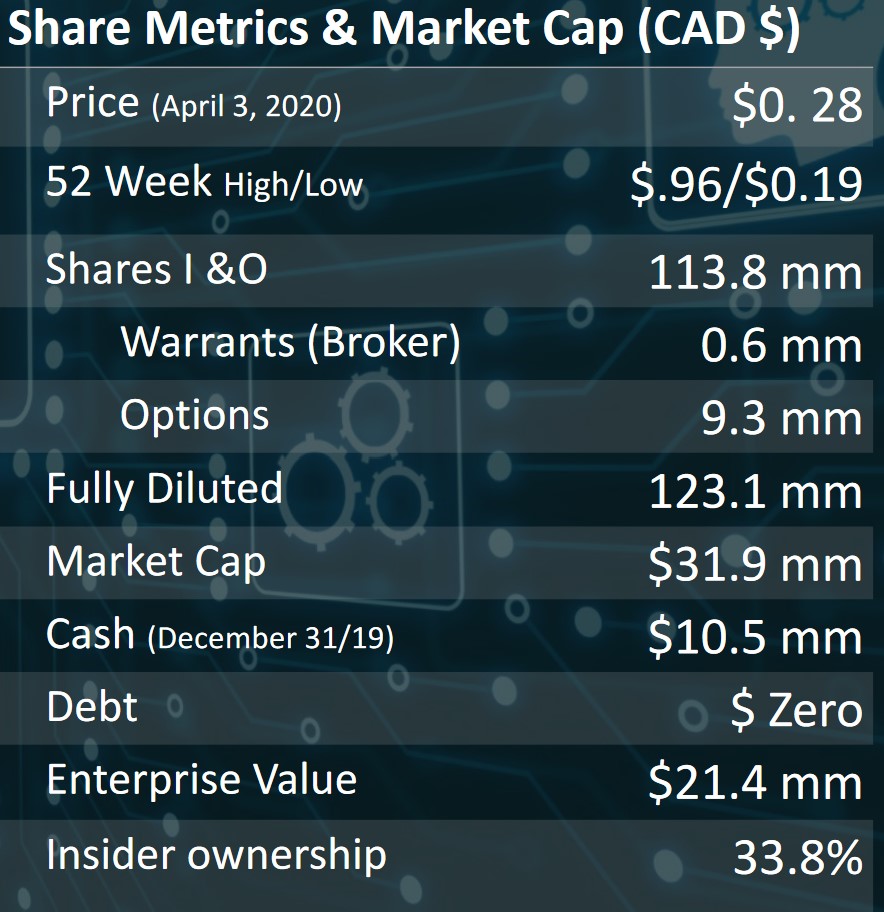

1. Where would you like to be in 3 to 5 years in terms of sales? What is your long-term goal?We expect to double 2019 revenue in 2020 and thereafter hope to continue this pace of revenue growth in the foreseeable future, as we believe that CIM may reach a tipping point for disruption of the legacy systems that are being used today.

2. Your share structure is really getting up there…any comments on a reverse split with a meaningful catalyst to support the new higher price? You don’t want the share price to drift down again.

We’re mindful of our capital structure and review it at every Board meeting. We have 114 million shares issued and outstanding with 9 million options outstanding. A reverse share split to consolidate shares is something that we constantly review, since a smaller share count and higher share price would likely be attractive to U.S. institutions. Note that insiders of our company own a big piece of the company, so we’re focused on building a recurring revenue, high-margin business rather than promoting stock. As we succeed with growing the business, we believe the stock price will take care of itself, and given the uncertainty and volatility in the markets, we believe this is the right approach to creating real value for investors.Broadly speaking, we anticipate that 2020 and 2021 will be strong from a business development perspective – i.e., addition of new clients and industry joint venture projects that are expected to bolster CIM platform use. This could support corporate development initiatives in the future, potentially including the reorganization of share structure and elevating the Company to trade on a major exchange when timing is right.

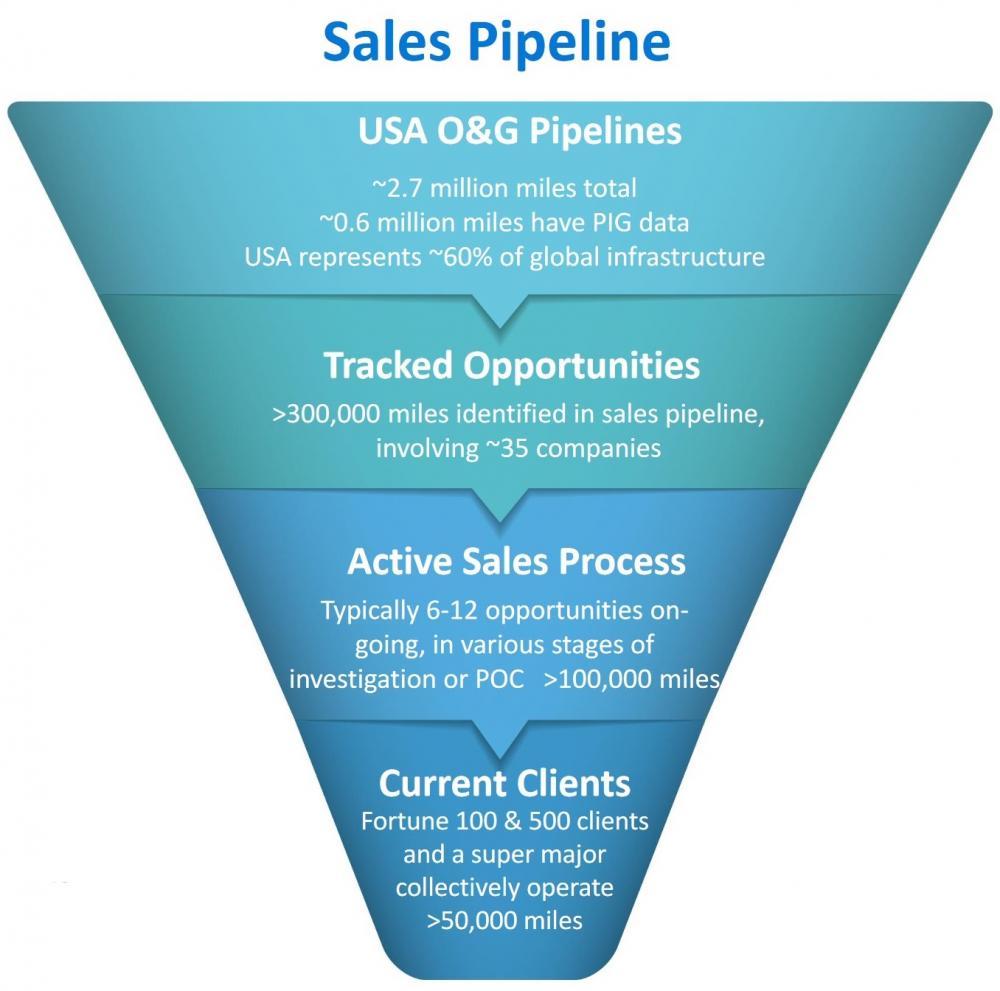

3. When do you expect to have a complete product for the non-piggable part of the market?To recap, a PIG is a device that is inserted into pipelines to collet data as the oil or gas pushes it along. This inline inspection (ILI) data is what our machine learning solution, called Cognitive Integrity Management (or CIM), analyzes to predict pipeline failures. In the U.S., there are about 660,000 miles of piggable and 2.1 million miles of non-piggable pipelines. The latter segment needs to be managed based on various other data sets that exclude ILI data. We raised $9.2 million in April 2019 to accelerate R&D of new software products, including functionality to address the non-piggable market segment. Such development commenced in H2 of 2019 and we continue to work on these projects with expectation to start commercializing components of this new functionality by the end of 2020.

A pipeline inspection gauge (PIG) on display at PPIM 2020 this past February.

4. What seems to be the headwinds why you can’t convert pilot programs to revenue customers? P66 has been with you for quite awhile and thought others would follow.Disruption of processes used for decades represent significant changes for large companies, which requires time and patience to work through. Lengthy sales cycles may continue for a while longer, but we expect them to shorten as our solution gains more validity and traction in the marketplace, and as potential clients gain more insight regarding digital transformation. We are not in control of timing of our clients. We have pivoted our sales approach to experiment with onboarding smaller projects, rather than focusing on company-wide adoption of our solution, which we believe may reduce sales cycles (i.e., our land and expand strategy).

Sales cycles with our current clients have varied between 1 and 3 years. Onboarding clients in 2019, particularly the larger operators, provided great insight regarding the challenges they encounter as they transition to new systems and processes, and how we can streamline processes to scale addition of new clients. One of the biggest issues is that employees involved with implementation of new systems often get pulled away to handle other high priority tasks, which slows the on-boarding process significantly. Secondly, issues regarding finding, organizing and loading of the historic data that has been collected over decades have been consistent challenges amongst our clients. To address these issues, we developed tools during H2 of 2019 to streamline and automate the onboarding process and revamped our role in the onboarding process, so that we can now essentially implement the software without dependence on the client’s participation, other than to have them point us where to find the historic data. Using this new approach, we believe that we can now reduce the onboarding process from months to weeks and streamline the client’s involvement in the process to training only, once CIM is up and running within their organization.

About 60 enterprise level pipeline operators manage the vast majority of the U.S. pipeline infrastructure – this is the group that we have targeted to date, and more specifically, the companies within this group that have proclaimed a digital transformation strategy to move to the cloud. When we started sales efforts in 2017, before digital transformation was embraced by the industry, we found that 6 to 12 months was typically added to the sales cycle, just to explain the advantages of digital transformation and cloud computing. Today, we have sharpened our sales focus to work only with companies that already understand these benefits. Those that don’t are referred to Microsoft, who dispatch their sales teams to convince the IT and C-suite teams from potential customers regarding the benefits of digital transformation, prior to our employees expending sales efforts regarding CIM. For the enterprise level companies that have engaged a digital transformation strategy, our sales team works collaboratively with Microsoft sales personnel, focusing on IT and C-suite executives who are driving digital transformation initiatives within their companies. We anticipate that this pivot in our sales strategy will shorten sales cycles by focusing on the enterprise players who understand and want digital transformation, and who will serve to validate our solutions for the rest of the market players.

The new onboarding tools that we developed are highly important for the other 20% of the U.S. industry, which consists of about 1,800 tier 2 and tier 3 companies. We anticipate that the new onboarding tools will eventually accommodate a self-service SaaS business model, to support self- and consultant-onboarding of CIM, essentially streamlining the sales and implementation processes and creating a platform to expand our technology into other markets (e.g., municipal water and sewer).

5. Is it accurate that pipeline operators have long term contracts so the recent decline in oil prices won’t impact them? How much money will your customers save using your solution vs their current practices?

Yes, this is our understanding. We have not seen any negative impact to our business thus far from reduced oil prices. In fact, we believe that constrained budgets could help our business because of the high value proposition our solution provides by increasing efficiencies and reducing costs , as further explained in our « Repair Fraction » white paper that was published and presented to the industry in February, 2020.

6. Of the 51k miles contracted…what % has been onboarded?

While all 51,000 miles under contract now generates base subscription revenue, operators vary in how quickly they load data for all their pipeline segments. Our experience so far indicates that operators have taken between 6 and 18 months to load all of their data onto CIM and implement their entire pipeline infrastructure. Refer to page 11 of our Fiscal 2019 MD&A for further information about how revenue builds by client.

7. What is your cash burn? Great presentation thank you.As of December 31, 2019, we had about $10.5 million of cash and no debt. Cash burn in 2019 was about $2.5 mm (average $634k per quarter). Based on our sales activity we expect this metric to improve in 2020, and do not have any concern about having sufficient cash to execute our business plans as envisioned during the foreseeable future.

8. I haven’t seen you sign up any new customers in a long time. Why, and when do you expect to announce some new ones?

We expect to announce new clients in 2020, but timing is unknown as this is not in our control.We had a lot of momentum going into PPIM in February 2020, the U.S. pipeline industry’s premier annual event. At that conference services providers, PIG vendors and prospective customers spent time at our booth talking about proof of concept projects and joint-venture initiatives, based on our CIM platform. The end of February was the last time we were able to have in-person meetings. Covid-19 then abruptly ceased progress for the next month or so, as businesses were scrambling to determine how to mitigate the impact to their operations. Activities have since returned to a new « near normal » regarding sales and business development progression through use of on-line rather than face-to-face meetings. So although we’ve encountered some delays, it appears that we are back doing what needs to be done to progress sales activities.

9. How has the transition from working at home been going for your current clients?First, let me discuss OneSoft’s situation with respect to the impact of Covid to our business operations. Even before Covid, and dating back to 2015, all of our employees worked remotely from home offices, except for our CFO and Controller who work from a shared office facility. Many of our corporate meetings and communications before Covid were held through on-line video conferencing, so we haven’t experienced the disruption most other businesses have.

An interesting side observation is that we are one of the few companies that continues to be hiring new employees (we currently are recruiting for 4 open positions), within a personnel environment that has changed dramatically in the past couple of months. The talent pool from which to select new employees has increased in the past couple of months because, we suspect, Covid has caused termination of projects that has freed up talent we are seeking. The pandemic has had minimal disruption to our ability to service our clients and following the month or so of delays we encountered in March we have recently seen a return to more normal sales and business development activities. We believe this is because the people we need to communicate with required some time to organize on-line meeting capability to replace conventional face to face meetings but have now incorporated this change.

The Covid disruption amongst our clients and prospective customers is mixed. Our clients, who already adopted our cloud computing solutions have essentially been able to transition seamlessly from conventional office to home working environments. This contrasts with most of the prospective customers we are engaged with, who have generally encountered more difficulty in transitioning their employees to work from home-based offices. Interestingly, Covid may potentially be a catalyst that helps motivate future sales, because many of our prospective customers now have an abrupt new appreciation for how cloud computing can enable their employees to work effectively from home offices, as a result of having capability to access critical data using any web-connected device.

10. Have you seen greater demand for your platform with the recent decline in crude prices? Would imagine a catalyst right now is process efficiency now more than ever.

Volatility of oil and gas price does not appear to have a direct effect on our business in the same way it affects the upstream and downstream segments of the industry. Transportation of oil and gas (the midstream segment) is still required, irrespective of energy prices, and our clients typically have long term contracts that preserve their revenue streams for transporting products that are not energy-price dependent.

Following the 2008 global economic recession, our understanding is that pipeline operators normally entered into long-term transportation contracts with their own customers – the oil and gas producers – in order to secure stable revenues and cash flows. We also understand that in some cases pipeline operators need to keep product flowing in order to preserve lease rights, which is more crucial than temporarily reducing throughput during periods of low energy prices.

And a highly compelling factor that supports our opportunity within the U.S. is that PHMSA, the U.S. pipeline regulator, mandates that pipeline data must be collected on piggable pipelines every 5 or 7 years at minimum, for liquids and gas lines, respectively. In addition, PHMSA’s new « mega-rule » is scheduled to take effect July 1, 2020, which further bolsters our opportunity, as more pipeline will be required to be operate in accordance with federal regulations that call for enhanced data collection and analyses capability, which CIM addresses. Overall, we believe that our Company is fairly well insulated from the volatility pricing of oil and gas and well-positioned to be the vendor of choice as regulatory operating requirements are enhanced.

11. You have a number of pricing structures in your annual information filings. (a) What seems to be the most popular choice? (b) What is the agreement with Phillips 66 after 10 years? © How are you thinking about all the non piggable pipelines in context of your software development? (d) Do you have interest globally at this stage?

(a) We have developed various pricing structures in response to what clients and prospective customers have asked for. We anticipate that some clients may start with one pricing structure for a small segment of their pipelines and later adopt a different pricing structure, as they onboard more pipeline data. We are focused on increasing initial adoptions of CIM, thus attempt to remove all the barriers to this objective. The various pricing structures assist in doing this, and we have high confidence that clients who commence using CIM for a portion of their pipeline will see value in onboarding all of their pipelines. In short, the different pricing structures support our « sign new logos » and « land and expand » strategies.(b) Clients like Phillips 66 will need to retain some sort of integrity management processes beyond the duration of contracts we have entered into. We have high confidence that with our first mover advantage and committed strategy to continued focus on new product development we will be able to maintain and extend our competitive moat, and thereby extend client relationships. It is neither practical or probable that clients will abandon our advanced machine learning/data science technology and return to using legacy processes and systems that do not deliver CIM-type capability. In short, we believe that our clients will remain with us, providing we continue to advance our solutions.

© We have aggregated more data than anyone else we are aware of at this point, which provides opportunity to leverage learnings from this data that can be applied to all pipelines, including those for which inline inspection data has not been gathered. We are already working on new solutions for the 2.1 million miles of pipeline that falls under « Direct Assessment » U.S. regulatory mandates, which we anticipate will start to roll out as commercial solutions in 2020.

(d) We are already involved in sales activities outside of the U.S. Two of our current clients have plans to implement CIM in their subsidiaries within other countries, and we are actively pursuing potential sales in various countries including Argentina, Brazil, Australia and Middle East regions, both directly, and collaboratively with Microsoft international sales teams and other O&G industry vendors.

12. Where do you see our business in the next 10 years? Will oil & gas still be viable at that point? Or will it be replaced by other clean energy? If so, what will you do to navigate our company to avoid that judgement day?

Most pundits agree that oil and gas energy will still be required for the next 30 years at minimum, irrespective that new energy sources are being developed. During this time pipeline infrastructure globally, which is ever-aging, will need to be maintained to ensure reliability and in accordance with regional regulatory requirements that apply. In some jurisdictions such as the U.S. these are becoming more stringent. Our belief is that we expect to be busy with the O&G pipeline market for decades.

We also believe that our technology can be adapted for municipal water & sewer, and potentially railroad/rail transit industries. We have recently commenced investigation of the municipal water market, which closely resembles the O&G pipeline market (i.e., steel pipes that corrode, and inspection tools are used to collect snapshots of data).

13. Can you disclose who are the other pipeline operator customers beyond Phillips?

We are prevented from disclosing our client names because of confidentiality terms we agreed to when contracting these clients.

While we can’t make these disclosures, I would note that potential customers, particularly within the U.S. and Canada, are generally quite well aware of the companies that have adopted CIM, as this information is often shared at various industry conferences and meetings. During the past year, we haven’t had need to include history/background of our Company in sales meetings, as prospective customers we are now meeting with understand who we are and what we do, as a result of peer to peer discussions about our company and technology.

14. How many miles of pipeline in total is the company managing? (b) And at which point will the company turn a profit?(a) We currently have 51,000 miles under multi-year contracts, and more than 100,000 miles in our sales pipeline.

(b) We did post a small profit for the period ended December 31, 2018, but decided to raise more capital to fund acceleration of R&D and new product development in April 2019 to increase our competitive moat, rather than focus on bottom line profits. We believe that we can create higher value for shareholders by advancing our first mover advantage, signing new logos and increasing recurring revenues, which is the metric that generally governs SaaS company valuations. We believe that new client additions are key to future opportunities, as it is highly probable that they will ultimately onboard our solutions for all of their pipeline segments once they experience the value proposition of using CIM. This justifies the relatively low introductory pricing models and incurrence of onboarding costs for new clients. While these strategies contribute to increased costs in the short term, they set the stage for greater recurring, profitable business in the longer term.

15. What is the Philips 66 royalty rate, what is the cap and when do you anticipate having paid it off?

This information is confidential, as required to comply with our agreement and for competitive reasons. The royalty is capped, which provides us the option of retiring the obligation whenever we choose to. We do not consider royalty expense to be material, relative to revenues that we expect to occur over time.

16. Is there seasonality in recurring revenues? Why was the Q4 quarter down on the Q2 quarter in 2019?

We anticipate quarterly revenues to continue to be somewhat lumpy over the next year as one of the major revenue components, associated with loading of inline inspection data sets onto CIM, is dependent on clients’ timing. I suggest that you review the Fiscal 2019 year-end MD&A published on SEDAR to understand the revenue components and revenue recognition factors discussed in the document. One of the important factors to monitor is the « Deferred revenue » recorded on our balance sheet, which typically represents pre-paid consumption of CIM by clients, as expected to unfold during the ensuing year. We anticipate that timing to load inline inspection data sets onto CIM will continue to vary by client, thus revenue recognition will vary accordingly.

17. Do you have enough cash to continue operations for the next 12 months? Is there any plan to raise additional capital and/or cause even further shareholder dilution?

Cash burn in 2019 was ~$2.5 million, and we expect this to improve in 2020. With $10.5 million in cash, and no debt, we believe we have sufficient cash to execute our business plans as currently envisioned, without requirement to raise additional capital.

Une réponse qui démontre que la société est maintenant reconnue dans l’industrie : During the past year, we haven’t had need to include history/background of our Company in sales meetings, as prospective customers we are now meeting with understand who we are and what we do, as a result of peer to peer discussions about our company and technology.

OneSoft Solutions Inc. Reports Q1 2020 Results

183% Quarter-over-Quarter Revenue Increase, Positive Adjusted EBITDA, Positive Net Income, Strong Balance Sheet

EDMONTON, AB / ACCESSWIRE / May 19 , 2 020 / OneSoft Solutions Inc. (the « Company » or « OneSoft ») (TSX-V:OSS)(OTCQB:OSSIF) , a North American developer of cloud-based business solutions, is pleased to announce results for the financial quarter ended March 31, 2020 (Q1 of Fiscal 2020). Please refer to the interim unaudited condensed Consolidated Financial Statements and Management’s Discussion and Analysis (" MD&A ") for the three months ended March 31, 2020 filed on SEDAR at www.sedar.com for more information.

FINANCIAL SUMMARY FOR Q1 ENDED MARCH 31, 2020

The following table summarizes the first quarter ended March 31, 2020, compared to March 31, 2019:

Three months ended

(in C$,000, per share in C$) March 31,

2020 March 31,

2019 Increase / (Decrease)

$ $ $ %

Revenue 1,675 592 1,083 182.9

Gross profit 1,334 512 822 160.3

Net income (loss) 27 (914 ) 941 (102.9 )

Exchange loss on translation of foreign operation (16 ) (53 ) 37 36.9

Comprehensive income (loss) 11 (967 ) 978 (101.1 )

Weighted average common shares

outstanding - basic and fully diluted (000)'s 113,111 101,025

Per share:

Net income (loss) - (0.01 ) -

Adjusted EBITDA 250 (670 ) 920 (137.4 )

Q1 2020 FINANCIAL Highlights

- Total revenue for the quarter ended March 31, 2020 (" Q1 2020 « ) was $1,675,486, a 183% increase over revenue of $592,302 in the comparative quarter of the prior year. Revenue consisted of $1,616,267 of annual recurring revenue ( » ARR ") and $59,219 of Other Revenue, representing increases of 180% and 284%, respectively, over the comparative quarter.

- Comprehensive income was $10,609 versus a Comprehensive loss of $967,391 for the comparable period in the prior year.

- Adjusted positive EBITDA was $250,478 compared to negative EBITDA of $669,729 for the comparable period in the prior year.

- On March 31, 2020, cash and short-term investments were $9.7 million ($10.5 million on December 31, 2019), working capital was $8.6 million ($8.2 million on December 31, 2019) and the Company has no debt.

- OneSoft tracks revenues in three categories and various buckets, as was described on pages 9-10 of the Company’s Management Discussion and Analysis (« MD&A ») for the fiscal year ended December 31, 2019:

- ARR includes revenue from SaaS Subscription, ILI Log Ingestion, Microsoft Azure and Specialized Functionality Module fees associated with the Company’s Cognitive Integrity Management TM (" CIM ") SaaS solution.

- Other Revenue includes Proof of Concept (" POC ") and services revenue that typically is non-recurring.

- There was no Software development project revenue in the current or comparative quarters.

The following chart summarizes some of the key financial revenue metrics followed by Management, with comparisons to prior periods, as described in the December 31, 2019 MD&A referenced above.

OneSoft SaaS Metrics Q1 2020 Q1 2019 YE Dec 31/19 PE Dec 31/18

Revenue as reported in the Financial Statements $ 1,675,488 $ 592,302 $ 2,711,768 $ 4,327,845

Revenue categorization:

Annual Recurring Revenue (« ARR ») $ 1,616,267 $ 576,879 $ 2,460,330 $ 1,093,690

Other Revenue $ 59,219 $ 15,422 $ 251,438 $ 214,665

Software development project revenue $ - $ - $ - $ 3,019,500

Total Revenue $ 1,675,486 $ 592,301 $ 2,711,768 $ 4,327,855

Direct Costs $ 341,542 $ 79,865 $ 701,739 $ 185,183

Direct Costs as % of ARR and Other Revenue 20 % 13 % 26 % 14 %

Gross profit as % of ARR and Other Revenue 80 % 87 % 74 % 86 %

ARR as % of Total Revenue 96 % 97 % 91 % 25 %

ARR Growth (Qtr / Qtr, Year / Year) 180 % 174 % 125 % 21 %

OPERATIONAL HIGHLIGHTS FOR Q1 ENDED MARCH 31, 2020

Highlights for Q1 include the following:

- On February 13, 2020, the Company announced its Innovation Lab to collaborate with Microsoft [NASDAQ:MSFT], oil and gas (" O&G « ) pipeline operators and select industry vendors. Innovation Lab, which is separate from the Company’s core operations, seeks to fast-track the creation and scaling of new ideas to advance digital transformation agendas through the Company’s revolutionary machine learning and data science technology using Microsoft’s Azure cloud computing platform and services. We are now investigating various potential business development alternatives with certain clients, prospective customers and industry experts and vendors, which may result in future joint initiatives that broaden the Company’s CIM functionality, intellectual property ( » IP « ) and total addressable market ( » TAM ") potential.

- On February 18, 2020, the Company announced the appointment of a senior O&G industry veteran as its new VP Sales, who will lead sales and marketing activities focused on senior personnel of our clients who typically drive digital transformation initiatives within their organizations.

- On February 24, 2020, the Company attended PPIM 2020, the industry’s primary annual forum devoted exclusively to pigging for maintenance and inspection, pipeline integrity evaluation and repair, and presented (see video) a white paper profiling Statistical Analysis of Dig Operations to pipeline industry professionals. This white paper documents the high value proposition of utilizing CIM to improve Repair Fraction effectiveness by optimizing dig selection criteria as part of integrity management processes.

- The Company essentially completed the on-boarding processes in Q1 2020 for the new clients who adopted CIM in 2019, which contributed $0.709 million of revenue and reduced deferred revenue by the same amount.

- Regarding product development, the Company continued to advance its SaaS products, IP and competitive moat during the quarter, including development of functionality that is considered foundational for future new products that we anticipate will address the segments of O&G pipeline infrastructure that are managed using Direct Assessment processes (rather than through collection of ILI data).

- The Company continued to engage in various POCs with potential new clients in Q1 2020, which were in various stages of progress but not completed at the quarter end. The Company’s sales funnel is increasing and remains robust, with sales activities currently underway involving prospective new clients that collectively operate more than 100,000 miles of pipeline infrastructure.

BUSINESS OUTLOOK

Business Disruption Due to Covid-19

While the extent of future potential business disruption due to Covid-19 cannot be known with any degree of certainty Management anticipates that business will be disrupted for at least part of 2020, but not overly threatening to the Company’s longer-term business and outlook. We believe that OneSoft is well-positioned to deal with this unusual business disruption as most of our clients and prospective customers have by now implemented procedures using on-line and video conferencing tools to minimize negative impacts caused by travel restrictions and lack of usual access to people, data and other resources they require to operate their businesses. We do not anticipate slow-down of product development or inability to service our clients, as our cloud-computing environment insulates us from the quarantine and disruptive work scenarios that have hampered businesses that depend on on-premise computing platforms and conventional office environments.

Our sales and business development activities started to return to a new « near normal » in mid-April, after prospective customers transitioned their business activities to on-line. We believe that Covid-19 may be a catalyst for future sales because some of our prospective customers now have a new appreciation for cloud computing and digital strategies that empower their employees to access critical data on-line using any web-connected device, especially while working remotely. Although we have encountered some delays in signing new clients, we anticipate that sales activities proceeding under the « new normal » conditions will ultimately be successful. Although timing and recognition of the revenue is unknown and not in our control, we expect to complete new sales in 2020.

Regulatory Influence on OneSoft Future Sales is Positive

The global O&G pipeline infrastructure continues to age, and regulatory compliance for U.S. operators in particular, where OneSoft is currently focusing sales efforts, is becoming more stringent as mandated by the U.S. regulator, the Pipeline and Hazardous Materials Administration (" PHMSA "). We believe that existing regulatory and revised compliance requirements that will apply in the future are becoming more opportunistic for OneSoft. The new " Mega Rule " was scheduled to take effect on July 1, 2020 but some requirements were relaxed to December 31, 2020 in response to Covid-19 disruptions. The Mega Rule mandates, amongst other requirements, that pipeline operators adopt more sophisticated ILI data management and analyses capability, which is squarely in CIM’s sweet spot to address. More pipeline infrastructure will need to be operated within federal compliance standards in the future, including requirements to adopt ILI data analyses for these pipelines. Additionally, certain pipeline inspection and maintenance standards and operating guidelines pertaining to ILI data management and analysis that were only recommended practices in the past will become mandatory to maintain regulatory operational compliance in the future.

Pursuit of New Visions and Opportunities Through OneBridge Innovation Lab

The Company announced establishment of its Innovation Lab in February 2020, to collaborate with clients, prospective customers and industry experts and vendors in pursuit of new visions and opportunities. We are investigating projects with several third parties with the objective of advancing them to a proof of concept stage, and potentially to full product development and commercialization. These projects have the potential to increase the Company’s total addressable market and generate incremental revenue by adding new functionality to the CIM platform and by launching CIM technology into new industries.

Sales and Revenue

Our highest priority in 2020 is to sign new clients using our « land and expand » growth strategy to expand our foundation and opportunity to increase future revenues. Management anticipates that ARR will double in 2020 over 2019, as a result of some current clients increasing use of our solutions by on boarding their regional affiliate operations, and through addition of new clients. Management’s key objective is to focus on growing annual recurring revenue, as we believe this metric is a key factor used in determining the value of SaaS companies.

Corporate Development and Outlook

Management will continue to focus on increasing shareholder value, by advancing the Company’s intellectual property and by addressing the multiple factors that we believe enhance value for shareholders of SaaS companies . We will continue to improve awareness of our Company and investment opportunity by increasing our participation in various on-line investor and industry conferences, road show events (when those become practical to resume) and other initiatives that target Canadian and U.S. investors, particularly with those who have specific interest in microcap companies that focus on artificial intelligence, machine learning, SaaS, and environmental, social and governance themes.

Given the Company’s strong balance sheet with $9.7 million of cash and short-term investments, no debt, current cash burn rate and strong sales pipeline, we believe the Company is well-funded to pursue our business and strategies, with no requirement to raise additional capital.

Je ne sais pas qui est le client mais ça me dit que les pipelines cibles sont sur le permafrost. Si c’est le cas, le client a probablement été ébranlé par la débandade qui s’est produit en Russie. Si c’est le cas, ça pourrait ouvrir un marché intéressant pour OSS.

Oui il semble effectivement s’agir de pipeline posés sur le permafrost et la rumeur veut qu’il s’agisse de Trans Alaska. Si c’est le cas c’est probablement un contrat parmi les plus petits à date mais il est intéressant parce qu’il est possible que le processus soit différent puisqu’il s’agit de pipelines surélevés. Possible que ça puisse attirer de nouveaux clients si cela démontre la faisabilité du processus au cas où ça bloquait des clients potentiels.

À suivre mais au moins c’est un pas en avant après une longue traversée du désert d’un an et demi. La dernière fois les signatures d’ententes avaient déboulées par la suite. On verra bien s’ils peuvent recréer un nouveau momentum.