Je partage un article publié par Gerry Wimmer aujourd’hui sur son blog. Cette article s’adresse principalement aux investisseurs débutant dans le marché boursier.

Do simple math before you buy a small cap stock

Kraken Announces AquaPix® MINSAS-240 Sensor

03/06/2019 6:00:00 AM

ST. JOHN’S, Newfoundland , March 06, 2019 (GLOBE NEWSWIRE) – Kraken Robotics Inc. (TSX-V: PNG) (OTCQB: KRKNF) (“Kraken” or the “Company”), is pleased to announce that the Company has developed the AquaPix® MINSAS-240 Synthetic Aperture Sonar (SAS).

Karl Kenny, Kraken’s President & CEO said, "For demanding subsea survey missions in mine countermeasures, infrastructure monitoring and oil & gas exploration; time is of the essence. The sensor that gets the job done most effectively is one that combines ultra-high resolution imagery with an extremely high area coverage rate. Kraken’s latest development, the AquaPixâMINSAS-240 sensor, has been designed to advance the state-of-the-art in seabed mapping for both high-speed towed systems and Large Diameter Unmanned Underwater Vehicles (LDUUVs).”

The MINSAS-240 achieves an industry-leading Area Coverage Rate (ACR) of 5.3 km2/h with 3´3 cm image resolution and 6´6 cm bathymetry resolution across the entire swath. The incredibly high pixel density sets a new standard for seabed image quality. Kraken’s embedded real-time processor enables in-stride data analysis for faster decision making as all data is processed at the highest quality setting in real-time. The superior length of the MINSAS-240 receiver array allows for true full-aperture SAS processing even at tow speeds up to 20 knots without switching to a lower resolution imaging mode at high speed. The sensor is rated for operating depths of up to 6,000 metres.

In mine warfare, it is well known that the probability of detecting and classifying a target increases with improving image resolution. A similar principle applies for commercial seabed survey operations, where clear imagery is needed to show the health and integrity of subsea assets. High ACR is therefore only effective when the resolution of the data being collected satisfies the objectives of the mission. At lower resolution settings, multiples passes are required to detect and classify an object with confidence, reducing the effective rate of coverage. With its combination of speed, range, and resolution, Kraken’s MINSAS-240 achieves the world’s highest effective ACR, mapping the seabed in exceptional contrast, clarity and detail when every second counts.

Some applications for the MINSAS-240 Synthetic Aperture Sonar include:

Underwater Defence – MCM, ISR, REA

Hydrographic Survey

Marine Archaeology

Subsea Infrastructure Inspection – Oil and Gas, Offshore Wind, Tidal Energy

Environmental Assessment – Leak and Seep Detection, Offshore Asset Integrity

Seabed Survey – Search and Recovery

AquaPix® MINSAS-240 is now available and ready for integration on a wide variety of unmanned underwater platforms. For more information, please contact sales@krakenrobotics.com.

LD Micro organise une conférence virtuelle demain et mercredi. Il y a plusieurs compagnies intéressantes qui vont présenter (via webinaire).

Si vous cliquez sur l’onglet ‹ ‹ Agenda › › il y a la liste des compagnies avec l’horaire.

Personnellement, les compagnies qui m’intéressent le plus:

- Medexus Pharmaceuticals (MDP.V)

- AltiGen Communications (ATGN)

- Xebec Adsorption (XBC.V)

- Zynex (ZYXI)

- Khiron Life Sciences (KHRN.V)

- OneSoft Solutions (OSS.V)

- Biomerica (BMRA)

@MathieuMartin Je viens de m’inscrire. Si jamais tu en vois d’autres ça m’intéresse. Comme je travaille de soir c’est plus compliqué pour assister à des conférences mais ça c’est parfait pour moi.

Il y a une autre conférence virtuelle cette semaine. Elle a lieu jeudi et les entreprises suivantes vont faire une présentation:

MRI Interventions (MRIC)

Xpel inc. (DAP-U.V)

Sangoma Technologies (STC.V)

Park City Group (PCYG)

Where Food Comes From (WFCF)

Vertex Energy (VTNR)

IOU Financials (IOU.V)

Xebec Adsorbtion Inc (XBC.V)

Generation Next Franchise Brands (VEND)

Quelqu’un suit Verde Agritech (NPK.TO)? Ils possèdent et contrôlent plus de 500 000 acres au Brésil où se trouve un engrais et conditionneur de sol appelé glauconite ou Greensand. Le produit est vendu directement aux fermiers mais aussi sur amazon.

La compagnie vient de fermer un placement privé dans lequel le CEO a participé pour environ 32%. Le nouveau CFO et un directeur ont aussi participé. Historiquement, la compagnie a très peu dilué les actionnaires ce qui est assez surprenant pour un compagnie d’exploration/production. Environ 50M d’actions sur une base pleinement diluée suite à ce placement.

Placement with Insider Participation

BELO HORIZONTE, Brazil, March 13, 2019 (GLOBE NEWSWIRE) – Verde AgriTech Plc (TSX: NPK) (" Verde ” or the “ Company ”) is pleased to announce that it has closed its previously announced non-brokered private placement financing, issuing 2,820,114 units of securities (a “ Unit ”) at C$0.60 per Unit for total proceeds of C$1,693,067.20 (the “ Placement ”). Each Unit is comprised of one ordinary share of the Company (an “ Ordinary Share ”) and one-half of one Ordinary Share purchase warrant (a “ Warrant ”). Each whole Warrant is exercisable to purchase an Ordinary Share at an exercise price of C$1.00 until March 12, 2021. Verde previously announced that the Placement would be of a maximum of 1,666,666 Units, but increased the size of the Placement as a result of considerable demand.

The Placement included significant participation by a number of Verde’s officers and directors. President & CEO Cristiano Veloso, who already held 5,533,677 Ordinary Shares, purchased 912,416 Units; CFO Felipe Paolucci purchased 166,667 Units; and Director Michael St Aldwyn, who already held 32,340 Ordinary Shares, purchased 83,333 Units.

No commissions or compensation warrants have been paid or issued in connection with the Placement.

Commenting, President & CEO Cristiano Veloso, stated: “Verde will apply the raised funds as working capital to expedite its market growth. We are thankful to our new and existing shareholders for their continued support.”

divulgation : j’ai une petite position spéculative

@SimB j’ai rencontré le CEO au MicroCap Leadership Summit en septembre dernier. Pour être honnête, je n’avais pas été trop impressionné. Sa présentation était difficile à suivre et je n’avais pas trop compris l’opportunité.

Il semble que le Super Greensand procure certains avantages par rapport au potash conventionel, mais le prix est équivalent. Je demande de quoi aura l’air le cycle d’adoption dans l’industrie. J’ai l’impression qu’il faut vraiment que le produit soit supérieur pour qu’un fermier décider de changer ce qui fonctionne déjà pour un produit qui coûte le même prix mais qui promet certains avantages supplémentaires.

Aussi, la présentation aux investisseurs mentionne une opportunité dans le secteur du cannabis. Au Summit, un autre investisseur avait demandé des détails sur cette opportunité, et le CEO avait mentionné que ce n’était pas vraiment un focus mais qu’il l’avait écrit dans la présentation aux investisseurs parce que c’est populaire et que les investisseurs aiment voir ça. J’avais trouvé ça un peu ordinaire lol.

Tout ça pour dire que ce n’est pas nécessairement une mauvaise opportunité, mais pas mon style pour l’instant.

Effectivement ordinaire le truc du cannabis

C’est vrai que c’est un milieu plutôt conservateur et pourquoi changer une formule qui fonctionne déjà. Le cycle d’adoption pourrait être très très long voire ne jamais se matérialiser.

D’un point de vue optimiste, la compagnie a émit un communiqué récemment et les ventes et la demande semble être au rendez-vous. Si ils arrivent à atteindre l’objectif de 200 000 tonnes, ce serait assez significatif. Ce sera définitivement à surveiller :

Delivery of Orders for 2018 and Incoming Orders for 2019

The Company delivered 29,647 tonnes of product in 2018, having had to waive over 17,000 tonnes of orders because the mine and processing plant were closed down early because of the earlier than usual rainy season. Previously, in 2017, total sales approached 5,000 tonnes.

Orders for the 2019 season were opened late 2018 and Verde has already received orders for over 14,170 tonnes, down payment for which has been mostly received. Mining and production will resume after the end of the rainy season in mid-March. The Company is aiming to sell 200,000 tonnes of product throughout 2019.

Compagnie qui se transige à moins de 10x les profits. Le titre est très illiquide!

Est-ce qu’il existe une analyze/étude de la compagnie? Je serai interessé d’en savoir plus mais s’il n’y a rien, je vais me pencher dessus par moi même

La compagnie est profilée sur le MicroCap Club (il faut être membre ou abonné payant pour voir le contenu). À part ça je ne suis pas au courant d’autres endroits où l’entreprise aurait été profilée.

TSU.to nouveau sommet à 30 $ aujourd’hui. Secteur ennuyant mais Trisura est profitable et en forte croissance.

J’ai débuté le sujet sur Corner Berkshire & Fairfax … si vous voulez contribuer du nouveau contenu, vous êtes plus que bienvenue!

http://www.cornerofberkshireandfairfax.ca/forum/investment-ideas/tsu-trisura/

Salut! Pouvez-vous m’aider à me faire une tête sur ces deux questions svp?

-

Est-ce qu’il y a des investisseurs institutionnels qui investissent sous les 100M$ de capitalisation boursière? Autrement dit, si je regarde XBC, à 1,75$ elle attirerait l’attention d’institutions. Est-ce que ce sweet spot est une illusion?

-

Comment évaluez-vous une entreprise avec un très petit market cap, sachant que le vrai argent (d’investisseurs) viendra beaucoup plus tard, ou jamais? Est-ce que « Can attract institutions? » est un de vos critères?

Si vous avez d’autres idées à partager en périphérie à ces questions, je suis toute ouïe !

Très bonnes questions je suis curieux aussi. J’ajouterais p-e le prix de l’action comme “catalyst” potentiel, par exemple je crois que certains brokers acceptent les titres achetés sur marge à partir de 2$, d’autres 3$ et 5$ (marge réduite).

Par exemple, j’ai l’impression que XPEL dans le coin de 5$ et moins récemment étaient probablement des margin calls couplés aux pertes de fin d’années…probablement une excellente opportunité d’acheter à ce moment là.

1- 1.00$ ou 100M$ de market cap

2- Une microcap doit avoir le potentiel de multiplier plusieurs fois sa valeur pour atteindre 1.00$ ou 100M$ de market cap. Autrement it’s a value trap!

- Est-ce qu’il y a des investisseurs institutionnels qui investissent sous les 100M$ de capitalisation boursière? Autrement dit, si je regarde XBC, à 1,75$ elle attirerait l’attention d’institutions. Est-ce que ce sweet spot est une illusion?

Pour les institutions je te dirais que le plus gros catalyseur est lorsqu’un courtier qu’ils ont comme vendeur se met à couvrir un titre, il faut souvent soit que la compagnie ait besoin d’argent ou qu’elle ait fait une montée fulgurante en bourse pour attirer leur attention (les courtiers veulent souvent être les premiers à couvrir un titre au potentiel de devenir un bon market cap pour avoir le plus de contrats avec la compagnie).

Perso, je crois que le volume (en $) journalier d’un titre est aussi important sinon plus que le market cap, car les institutions ont une vue court terme sur leurs investissements en général (je parle des fonds mutuels, pas des caisses de retraite) et veulent savoir qu’ils peuvent sortir d’un titre assez rapidement si ça ne fonctionne pas comme ils veulent. Certains titres de 500 M$ sont très peu liquides comparés à des titres à 75 M$

En gros, 100M$ de market cap est un sweet spot, mais ce n’est pas le seul sweet spot et tu pourrais manquer de bonnes opportunités si tu attend trop ce point

- Comment évaluez-vous une entreprise avec un très petit market cap, sachant que le vrai argent (d’investisseurs) viendra beaucoup plus tard, ou jamais? Est-ce que « Can attract institutions? » est un de vos critères?

Je n’utilise pas ce critère, ca peut prendre beaucoup de temps avant qu’un titre dégage de l’intérêt des institutions et ce n’est pas nécessaire pour avoir de bons rendements (Xpel est un bon exemple que j’ai manqué  ) Il y a plein d’institutions avec des stratégies small cap et elles peuvent faire bouger des titres en bas de 100 M$ de market cap assez rapidement. Je me concentre sur des compagnies de qualité qui ont une bonne marge de sécurité quant à leur valeur et leurs risques et ensuite il n’y a plus qu’à attendre et suivre la situation. Il faut dire que j’ai un horizon de 5 ans

) Il y a plein d’institutions avec des stratégies small cap et elles peuvent faire bouger des titres en bas de 100 M$ de market cap assez rapidement. Je me concentre sur des compagnies de qualité qui ont une bonne marge de sécurité quant à leur valeur et leurs risques et ensuite il n’y a plus qu’à attendre et suivre la situation. Il faut dire que j’ai un horizon de 5 ans

Est-ce que quelqu’un connait/suit la compagnie BEE.v ( Bee Vectoring Technologies International Inc)? J’en suis à mes balbutiements dans mes recherches, mais c’est une compagnie que je trouve intéressante qui utilise les abeilles pour disperser des biopesticides et réduire leur utilisation en faisant une utilisation ciblée. Des producteurs de fraises de la Floride sont déjà clients, mais beaucoup reste a faire. Ils seraient en train de changer l’orientation de la compagnie de recherche vers la vente… alors c’est a partir de maintenant que les revenus risquent de rentrer!

Les producteurs agricoles font déjà souvent affaire avec des ruches pollinisatrices, alors combiner contrôle des pathogènes et pollinisation sauve une étape!

Merci.

J’ai rencontré le management il y a environ 2 ans dans une conférence. À l’époque ils étaient sur le point de débuter les ventes aussi il me semble haha.

L’opportunité me semblait trop ‘‘early’’ et je n’ai pas vraiment suivi l’entreprise depuis, alors je n’ai pas d’opinion en ce moment. Tout ce que je peux te dire c’est que leur modèle d’affaires semblait intéressant et le besoin semblait assez clair. J’avais eu une bonne impression par rapport au PDG également.

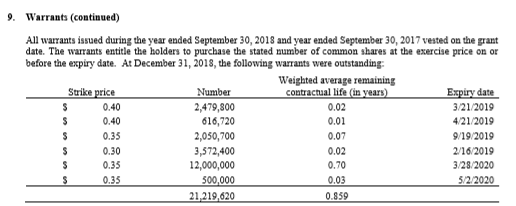

La compagnie est très intéressante cependant il y à beaucoup de warrants dans la structure d’actions soit 21M et la compagnie tarde à avoir des revenues. Ici j’ai la même opinion que Mathieu, c’est trop tôt.

journal les Affaires

À partir de la semaine prochaine, la Bourse américaine pourrait se buter à deux petits obstacles qui freineront son appréciation à court terme.

La semaine prochaine s’amorce en effet la période de blocage de cinq semaines qui précède le dévoilement des résultats du premier trimestre, en avril.

Pendant cette période, les entreprises ne peuvent racheter de leurs actions. Les initiés aussi sont tenus de suspendre toute transaction, car ils bénéficient d’informations privilégiées dont ils pourraient tirer profit.

Au minimum, cette règle minimise l’apparence de conflit d’intérêts.

Pendant cette période de cinq semaines, la Bourse américaine est privée d’importants acheteurs réguliers d’actions, l’un des facteurs déterminants derrière l’avance des actions américains ces dernières années, soutient Martin Roberge, de Canaccord Genuity.

Par ailleurs, les actions américaines font historiquement meilleure figure que les autres Bourses du monde lorsque le billet vert s’apprécie, car les deux vont de pair.

Or, le stratège quantitatif croit justement que les conditions sont mûres pour que le dollar américain recule à nouveau parce que l’élan de l’économie américaine brille un peu moins fort par rapport à celui des autres économies, sur une base relative.

Les conditions sont mûres pour un nouveau recul du dollar américain, croit Martin Roberge. (Source: Canaccord Genuity)

Les taux de deux ans aux États-Unis ont aussi cessé de creuser leur avantage par rapport à ceux des pays du G7.

M. Roberge a tenté de chiffrer ces observations. Voici ce que les épisodes passés révèlent.

Pendant les périodes de blocage, les actions américaines tirent un peu de l’arrière sur celles des marchés étrangers. En moyenne, l’appréciation de 1,2% des actions américaines se compare à celle de 1,8% pour l’indice mondial sans les États-Unis.

Dit autrement, les probabilités que la Bourse américaine performe mieux que les autres tombe à 43%, pendant les cinq semaines de blocage.

Cela se compare aux chances de 60% d’une performance supérieure des actions américaines pendant toutes les autres périodes.

Le rôle du dollar

En ajoutant le dollar américain à l’équation, les données ont fasciné M. Roberge.

Lorsque le dollar américain s’apprécie, il neutralise l’effet de l’absence d’acheteurs pendant la période de blocage.

Quand le billet vert gagne en valeur, les chances d’une performance supérieure des actions américaines grimpent à 82%, lorsque les entreprises et les initiés ne sont pas bloqués.

Et lorsque le dollar recule pendant la période de blocage, les probabilités que la Bourse américaine fasse mieux que les autres tombent à 32%, précise M. Roberge.

Il conclut en disant qu’il ne serait pas surpris que les actions étrangères prennent l’avance jusqu’à la fin d’avril.