Classic de faire sa ? Premiere fois que je vois sa

La seule autre compagnie que je connais qui fait cela est IBH.V, qui dévoile ses volumes de produits vendus à chaque mois.

Ce n’est pas standard mais ça permet aux investisseurs d’avoir une meilleure visibilité sur les revenus et dans le cas de Hempco, de voir la progression des ventes au détails par rapport aux ventes en gros.

@midard ouf!!! les chiffres des futurs revenus de YD.V cité sembles quasiment impossible à atteindre. Cela implique une augmentation des revenu de a peu pres 200% par année j’usque en 2020 qui est fort peu probable. Je detiens le titre mais mes attentes sont plus modeste.

L’action a pris une débarque depuis trois jours, Anonymous vend en grosse quantité pour faire tombé le prix, mon stop loss a été défoncé.

C’est le genre de titre que j’achète en tiers ou quarts de position. En

se fiant aux États Financiers du 30 Juin comme basse d’estimation pour

le BPA de 2016 je m’attends à un BPA de deux a trois cents par action. Alors, YD.V n’est pas très dispendieux soit un P/E estimé de 7 à 10. Je ne sais pas si le prix va continuer a baissé, mais le risk/reward en ce moment si vaut la peine alors j’ai acheté un autre quart de position.

Tout a fait d’accord, j’ai été obliger de prendre position a 0.155 je croit quand c un excellent point d’entré, je me suis renseigné un peut sur la compagnie et beaucoup de croissance pays d’Amérique latine et tout ce qui est des sports il ont beaucoup de porte d’ouverte et de projet en cours coté technologie de publication…hâte de voir leur futur projet!

AcuityAds AT.V a dévoiler ces résultats pour le troisième trimestre de 2016. De très beaux résultats pour la firme. Le Rapport de Gestion et les Etats Finaciers sont disponible sur Sedar.

https://www.acuityads.com/press/acuityads-reports-third-quarter-financial-results/

AcuityAds Reports Third Quarter Financial Results_

TORONTO, ON; NEW YORK, NY, NOVEMBER 8TH, 2016_

AcuityAds Holdings Inc. (TSXV:AT) (“AcuityAds” or “Company”), a technology leader that provides targeted digital media solutions enabling advertisers to connect intelligently with audiences across video, mobile, social and online display campaigns, today announced financial results for the three-month period ended September 30, 2016. “I am pleased to report that Acuity delivered another strong quarter as evidenced by our 62% revenue growth and improving Adjusted EBITDA. Our Adjusted EBITDA for the trailing 12 month period was $935K,” stated Tal Hayek, CEO of AcuityAds. “Contributing to our strong performance were our US and Self-Serve segments as well as our recent acquisition of 140 Proof,Inc., which we closed on September 1, 2016. The amazing team at 140 Proof, Inc. delivered $1.6M of revenue in the month of September.”

Third Quarter Financial Highlights

- Total revenue for Q3 2016 increased 62% to $8,871,289, compared to $5,476,982 in Q3 2015. Total revenue for the nine months ended September 30, 2016 was $21,080,474 compared to $13,101,707 for the same period in 2015, representing growth of 61% year over year. Total revenue includes one month of revenue associated with 140 Proof,Inc.

- AcuityAds grew its Self-Serve partner base by adding 22 new platform partners in Q3 2016.

- Total Partners of the Company’s SaaS-based Self-Service programmatic platform now stands at 125 compared to 60 at the end of Q3 2015.

- SaaS-based Self-Service revenue for Q3 2016 increased 88% to $3,536,431, compared to $1,880,884 in Q3 2015 and represented 40% of overall revenue compared to 34% in the same period last year.

- SaaS-based Self-Service revenue for the nine months ended September 30, 2016 was $9,392,117 compared to $3,541,716 for the same period in 2015, representing growth of 165%.

- US revenue for Q3 2016 increased by 131% to $3,857,976 compared to $1,669,428 in Q3 2015. For the nine months ended September 30, 2016, US revenue totalled $7,536,969 compared to $4,098,701 for the same period in 2015, representing growth of 84%.

- Revenue less media costs (gross margin) remained strong at 50% for Q3 2016 compared to 47% for the three months ended September 30, 2015.

- A key milestone in the quarter was revenue of $226,128 from the Company’s European data center which went live at the end of Q2 2016.

- Operating expenses for the quarter were $4,628,522 compared to $2,974,752 in Q3 2015. Total operating expenses for the nine months ended September 30, 2016 were $11,707,285 compared to $9,010,599 for the same period in 2015. Operating expenses include one month of costs associated with 140 Proof, Inc. which totalled $532,587.

- The Company posted Adjusted EBITDA of $559,164 in Q3 2016 compared to an Adjusted EBITDA loss of $254,609 in Q3 2015. Adjusted EBITDA for the nine months ended September 30, 2016 was $673,534 compared to an Adjusted EBITDA loss of $1,704,176 for the same period in 2015.

- Net loss for Q3 2016 was $479,172 compared to a net loss of $586,377 in Q3 2015. Net loss for the nine months ended September 30, 2016 was $1,435,014 compared to $3,127,909 for the same period in 2015. Included in the Q3 2016 net loss was a charge of $374,004 relating to acquisition costs associated with the purchase of 140 Proof, Inc.

- As at September 30, 2016, the Company’s cash and restricted cash balance was $2,478,067 compared to $3,049,172 at the end of Q2 2016. In the quarter, the Company paid cash consideration and acquisition costs of $1,709,052 relating to the acquisition of 140 Proof, Inc. and also increased its term loan by $1,000,000.

Une nouvelle apparue aujourd’hui au Brésil sur Ydreams par rapport à l’ouverture de l’aquarium de Rio de Janeiro YDreams Global signs AquaRio technology Je pense que le titre à descendu à cause de la vente des warrants a $0.15, il faudra vérifier.

J’ai également initié une position dans YD.V à .14

APV.V Apivio a donné des résultats positif ce matin, Apivio Systems earns $284,000 in Q3 2016 le résultat aurait été meilleur n’eut été de la perte de couverture de 331k

La nouvelle attendu pour AMY.V

American Manganese Inc. Reports: Phase 3 Successful Completion of Proof of Concept for Upcycling and Recycling EV Lithium- Ion Battery Cathode Material

Accesswire

13 hours ago

VANCOUVER, BC / ACCESSWIRE / November 10, 2016 / Larry W. Reaugh, President and Chief Executive Officer of American Manganese Inc. (“American Manganese” or “AMI” or the “Company”), (TSX.V: AMY; Pink Sheets: AMYZF; Frankfurt: 2AM), is pleased to announce that Phase 3 testing conducted by Kemetco Research Inc. (“Kemetco”) confirms that rechargeable lithium-ion battery coin cells can be successfully produced from lithium-cobalt cathode material regenerated using AMI’s proprietary process.

The resulting lithium-ion button cell battery produced from AMI’s proprietary process was charged to a maximum of 4.2 volts and then discharged to a minimum of 2 volts. This charge-and-discharge test was repeated 10 times without the battery losing its chargeability.

Norm Chow, President of Kemetco says, “Based on these preliminary results, it can be concluded that the American Manganese upcycling technology can transform spent lithium-ion battery cathode material into high-purity intermediate products (e.g., lithium carbonate and cobalt carbonate) as well as into lithium-ion cathode material suitable for the fabrication of new batteries.”

“These results validate the AMI process,” said Mr. Reaugh. “With this final phase test work, we’ve taken lithium-ion battery cathode material from the recovered component metals through reconstitution of the cathode materials to produce working chargeable cells.”

Battery Fabrication and Assembly

During Phase 3 testing the lithium cobalt dioxide (Li2CoO2), which was generated from experiment SCL6S and identified with 100% purity by X-Ray Diffraction (XRD) (please see the Oct 14, 2016 press release for further details), was used in the lithium ion cathode material formulation for button cell fabrication.

The cathode material was then prepared by combining a solid mixture of 90% (by weight) Li2CoO2, 6% Carbon Black, and 4% PVDF (polyvinylidene fluoride) with NMP (N-methyl-2-pyrrolidone). This cathode material mixture was subsequently coated onto aluminum foil and dried for 2 hours at 120 °C in a vacuum oven to form the lithium-ion battery cathode.

The button cell batteries were assembled as follows: top cell case, cathode, separator, anode, spacer, ring-shaped spring, and bottom cell case. The anode was made from purchased graphite. The ring-shaped spring was placed between the negative casing and the spacer to ensure adequate pressure was applied to the cell components. Both the spring and the spacer are made from stainless steel. A thin layer of polyolefin was used as the separator. The Company will report on the next R&D program in a future release.

Une autre bonne nouvelle pour YDreams :

VANCOUVER, BC / ACCESSWIRE / November 11, 2016 / YDreams Global (YD.V) (APY.F) (“YDreams” or the “Company”) is proud to announce that has once again teamed up with Qualcomm Inc (Nasdaq:QCOM) at Futurecom, the largest Latin American telecommunications fair, hosted by São Paulo this year. With impactful design and a dynamic lighting system that changes colours as an interactive response to visitors, Qualcomm´s display reached media highlights for the second year in a row.

YDreams’ key goal was to increase Qualcomm´s visibility at the event through interactive experiences. This year the visitors were able to obtain information and knowledge of Qualcomm´s 5G technology. The interaction took place through a kiosk integrated into the structure of the booth, that used LED lights to direct the visitors’ eyes to look at a large screen where the related content was being exhibited in colours that changed according to the visitors’ choice. “We designed the space so that these features could be seen from any spot of the event”, says Daniel Japiassu, CEO for YDreams Global.

Allan Gianrossi, Qualcomm marketing executive for Latin America, praised the partnership with YDreams Global for the successful participation of the company in the last two years at FutureCom. “In addition to their competence, YDreams understands our business and was able to use the best technology to achieve our key goals in this event that is of strategic importance to us. We are very happy with the results delivered in these two years working together”, says Gianrossi.

Japiassu explained that the bold design YDreams created for Qualcomm delivered in the FutureCom editions and the interactive experiences developed by YDreams Global have helped the company to present their new products to the new world connected by the Internet of Things.

Est-ce que quelqu’un connait Immunotec Inc (IMM)?

Ça semble intéressant. Votre avis?

J’ai déjà analysé sommairement la compagnie il y a plusieurs mois. Sur une base purement financière, le titre est intéressant en effet. Cependant, les investisseurs ne semblent pas aimer le modèle d’affaires de l’entreprise (marketing de réseau) et j’aurais tendance à croire que pour cette raison, le titre n’a pas le potentiel d’être ‘‘bien évalué’’ ou même surévalué.

Je cherche à investir dans des titres qui sont mal évalués pour une raison qui peut être corrigée (turnaround de l’entreprise, changement de direction, pas assez de communication avec les investisseurs, etc.). Dans le cas présent, je ne crois pas que l’entreprise changera son modèle d’affaires et c’est ce qui a fait en sorte que j’ai choisi de passer mon tour.

Quelqu’un a publier cette article sur Stockhouse concernant Ydreams, Microchips made of paper ce qui expliquerais la croissance relié au rapport de recherche publier en Allemagne.

Un autre article sur Ydreams YDreams Global Launches The SKUP Product Line – Retail Experience For Your Store

Au sujet d’Apivio, aujourd’hui la firme Haywood a grugé le ask, si la tendance se maintien le titre va se transiger a $0.285 en fin de journée.

Hempco Food symbol change

2016-11-16 19:23 ET - Symbol Change

Also Symbol Change (C-HEMP) Hempco Food and Fiber Inc

Effective at the opening, Thursday, Nov. 17, 2016, the trading symbol for Hempco Food and Fiber Inc. will change from HFF to HEMP. There is no change in the company’s name, no change in its Cusip number and no consolidation of capital. The company is classified as an industrial company.

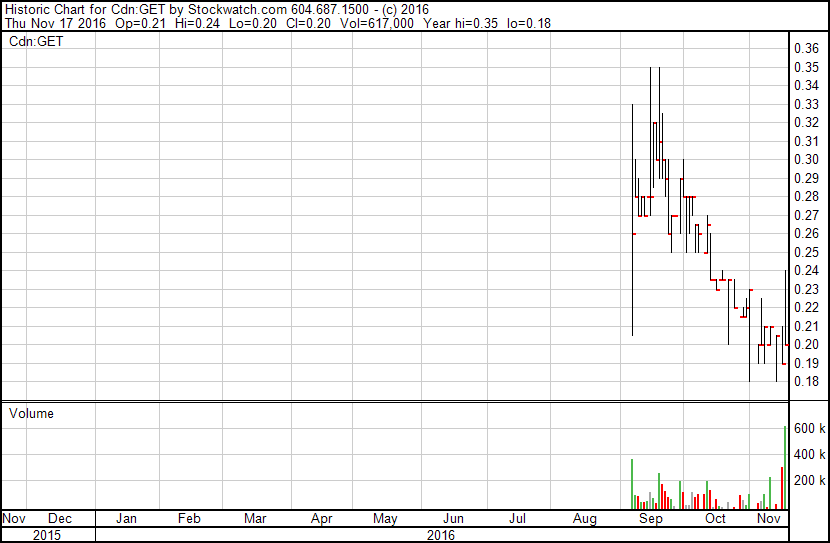

GET-C Glance technologie a capté mon attention cette semaine, compagnie avec revenue récurent dans le payment mobile, il est peut-être tôt pour prendre position mais je le met dans la watchlist.

Glance Pay app has $55,000 payment volume in a week

Glance Pay has 232% volume increases in first 12 weeks