en français

La pression sélective opère comme prévue.

Il est temps de savoir si les résultats d’IPA sont à la hauteur de nos attentes! On est dû

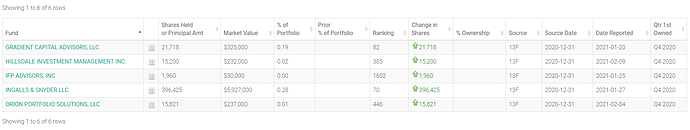

De nouveaux fonds actionnaires de IPA : LIEN

La liste devrait s’agrandir lorsque les fonds qui ont participé au placement vont déclarer leurs transactions.

2021-02-10 19:05 ET - News Release

Mr. Frederic Chabot reports

IPA ANNOUNCES CLOSING OF OVER-ALLOTMENT OPTION ASSOCIATED WITH THE RECENTLY COMPLETED BOUGHT DEAL OFFERING OF COMMON SHARES

The overallotment option granted in connection with Immunoprecise Antibodies Ltd.'s previously announced bought deal offering of 1,616,293 common shares in the capital of the company has been fully exercised. H.C. Wainwright & Co. has purchased additional 242,443 shares of the Company (the « Additional Shares ») at the public offering price of $13.45 per Additional Share for additional aggregate gross proceeds to the Company of approximately $3.3 million, less underwriting discounts and commissions.

H.C. Wainwright & Co. acted as sole book-running manager for the Offering.

The Company intends to use the net proceeds from the Offering and the issuance and sale of the Additional Shares for (i) pursuing the Company’s objective of expanding its operations into Good Laboratory Practice and Good Manufacturing Practice-certified; (ii) the development and commercialization of Talem Therapeutics, LLC’s, a wholly owned subsidiary of the Company, internal and partnered therapeutic discovery programs; (iii) investments in employees, partnerships, cloud computing, data curation and analysis to enable further work toward the development of custom algorithms, cloud computing, large-scale sequence data analysis, and expanded access to next-generation sequencing technologies; (iv) the development of its PolyTopeTM approach to the development of innovative therapeutics and vaccines against the COVID-19; and (v) general corporate and working capital purposes.

In connection with the Offering, the Company filed with the securities regulatory authorities in each of the provinces of Canada (except Quebec), a short form base shelf prospectus dated December 11, 2020. The short form base shelf prospectus was filed on Form F-10 with the U.S. Securities and Exchange Commission (« SEC »). The Company also filed a preliminary prospectus supplement to the short form base shelf prospectus with the securities regulatory authority in the Province of British Columbia as well as with the SEC as part of a registration statement on Form F-10 under the U.S.-Canada multijurisdictional disclosure system (« MJDS »). The Common Shares were only offered and sold in the United States either directly or through duly registered U.S. broker dealers. No Common Shares were offered or sold to Canadian purchasers.

The Offering was made in the United States only by means of the registration statement, including the base shelf prospectus and applicable prospectus supplement. Such documents contain important information about the Offering. A short form base shelf prospectus and accompanying preliminary prospectus supplement have been filed with the SEC and are available for free on the SEC’s website at www.sec.gov and on the SEDAR website at www.sedar.com. Copies of the short form base shelf prospectus and accompanying final prospectus supplement have been filed with the SEC and are available for free on the SEC’s website at www.sec.gov and on the SEDAR website at www.sedar.com. Electronic copies of the final prospectus supplement and registration statement may also be obtained from H.C. Wainwright & Co., LLC, 430 Park Avenue 3rd Floor, New York, NY 10022, or by calling (646) 975-6996 or by emailing placements@hcwco.com.

Il semble que HCW soit pressé d’exercer ses options bien avant le délai de 30 jours…

Ils avaient l’option de vendre plus d’actions à 13,45$ à leurs clients (aux investisseurs). En tant que courtier sur le financement, ils ont tout intérêt à les vendre le plus vite possible pour toucher leur commission si la demande est là!

Announcing its financial results for 2020 on Thursday, AstraZeneca said: “In collaboration with the University of Oxford, AstraZeneca is focused on adapting C19VAZ [its vaccine] to new disease strains if required and hopes to reduce the time needed to reach production at scale to between six to nine months, by utilising existing clinical data and optimising its established supply chain.”

Frederick, peux-tu nous donner un peu d’information concernant le délai de la publication des résultats de l’étude pré-clinique ?

non désolé

Hi Frederick,

First time poster here. Glad that you are here and available to answer any questions and concerns.

I have a simple one.

Given the fact that many feel the clinical results are somewhat delayed in many investors eyes, (and this may not be the case) Are you currently feeling  or

or

Bonjour Faxzz_Yt,

Espace MicroCaps est le seul forum de langue Française en Amérique. Svp respectez ces lecteurs en posant votre question dans la langue commune.

Merci

Je suis désolé

Ça va etre un beau weekend!!!

C’est un bon départ! J’ai hâte à l’annonce du début de la phase 1 et d’un possible deal avec une grosse pharma maintenant! Go IPA

L’analyste chez Industrielle Alliance m’a envoyé ça:

‹ ‹ Another NASDAQ listed company yesterday Immunome (IMNM.O) was up 138% following similar news release - their antibody cocktail (IMM-BCP-001) has identified antibodies that neutralize multiple SARS-CoV-2 variants. › ›

Je ne connais pas la compagnie ni leur programme. En regardant rapidement, il semble que la capitalisation boursière a augmenté d’environ $200M sur la nouvelle.