IBEX Reports Results for the Third Quarter and the Nine Months Ended April 30, 2020

MONTRÉAL, June 24, 2020 (GLOBE NEWSWIRE) – IBEX Technologies Inc. (“IBEX” or the “Company”) (TSX Venture: IBT) today reported its financial results for the nine months ended April 30, 2020.

“We were pleased to see near record sales in the current quarter as compared to an exceptionally poor quarter year ago. Some of this gain, however, may have been the result of customers advancing orders to secure their supply chain, which may have a negative impact on subsequent quarters”, said Mr. Baehr IBEX President & CEO. “With year-to-date sales up 20% over year ago our financial picture has improved considerably during this fiscal year. Thus far we have not been negatively impacted by the COVID-19 environment”.

Note: All figures are in Canadian dollars unless otherwise stated. The Company’s audited consolidated financial statements for the year ended July 31, 2019 and the accompanying notes and the related management’s discussion and analysis can be found on the Company’s website at www.ibex.ca or under the Company’s profile on SEDAR at www.sedar.com.

FINANCIAL RESULTS FOR THE THIRD QUARTER OF FISCAL 2020

Revenues for the quarter ended April 30, 2020 totaled $1,679,409 and were up $1,010,900 compared to $668,509 in the same period of the prior year. The increase in revenues traces mainly to changes in quarterly purchasing patterns on the part of several of our major customers. It is possible that some customers may have advanced their order due to the COVID-19 situation.

Operating Expenses at $1,052,972 were down $134,237, tracing mainly to the closure of our facility in Iowa.

As a result, the Company recorded EBITDA of positive $769,335 vs. EBITDA of negative $452,119 in same period year ago.

It should be noted that “EBITDA” (Earnings Before Interest, Tax, Depreciation & Amortization) is not a performance measure defined by IFRS, but IBEX, as well as investors and analysts, consider that this performance measure facilitates the evaluation of our ongoing operations and our ability to generate cash flows to fund our cash requirements, including our capital expenditures program. Note that other public companies may use alternative definitions.

EBITDA for the three months ended

April 30, 2020 April 30, 2019

Net earnings (loss) $ 626,437 $ (518,700 )

Depreciation of property, plant, equipment and intangible assets $ 56,862 $ 69,453

Depreciation of right-of-use assets $ 42,561 -

Impairment of property, plant and equipment $ 37,000 -

Interest - Net $ 6,475 $ (2,872 )

Earnings (loss) before interest, taxes, depreciation and amortization $ 769,335 $ (452,119 )

The Company recorded net earnings for the period of $626,437 compared to a net loss of $518,700 for the same period year ago. The positive change of $1,145,137 is related mainly to the increase in revenues and a decrease in expenses as discussed above.

FINANCIAL RESULTS FOR THE NINE MONTHS ENDED APRIL 30, 2020

Revenues for the nine months ended April 30, 2020 of $3,763,010 were up $622,396 as compared to $3,140,614 in the same period of the prior year. The increase in revenues traces to the factor mentioned above.

Operating Expenses at $3,101,113 were down $724,144, tracing mainly to the closure of our facility in Iowa and to a positive inventory adjustment of $140,795 (the difference between goods produced for inventory and the goods sold).

As a result of the above, the Company recorded positive EBITDA of $1,020,922 vs. a negative $478,038 EBITDA in the same period year ago.

The Company recorded net earnings of $661,897 compared to a net loss of $684,643 for the same period year ago. This positive variation can be mainly traced to the decrease in expenses result from to the closure of our Iowa facility and the increase in revenues.

Cash and cash equivalents increased by $263,271 to $2,843,130 during the nine months ended April 30, 2020 as compared to the year ended July 31, 2019. Net working capital increased by $765,151 to $3,603,324 during the nine months ended April 30, 2020 as compared to the year ended July 31, 2019.

Financial Summary for the nine months ended

April 30, 2020 April 30, 2019

Revenues $ 3,763,010 $ 3,140,614

Earnings (loss) before interest, tax, depreciation & amortization (EBITDA) $ 1,020,922 $ (478,038 )

Depreciation of property, plant, equipment and intangible assets $ 174,895 $ 210,522

Depreciation of right-of-use assets $ 126,986 -

Impairment of property, plant and equipment $ 37,000 -

Net earnings (loss) $ 661,897 $ (684,643 )

Earnings (loss) per share $ 0.03 $ (0.03 )

EBITDA for the nine months ended

April 30, 2020 April 30, 2019

Net earnings (loss) $ 661,897 $ (684,643 )

Depreciation of property, plant, equipment and intangible assets $ 174,895 $ 210,522

Depreciation of right-of-use assets $ 126,986 -

Impairment of property, plant and equipment $ 37,000 -

Interest - Net $ 20,144 $ (3,917 )

Earnings (loss) before interest, taxes, depreciation and amortization $ 1,020,922 $ (478,038 )

Balance Sheet Summary as at

April 30, 2020 April 30, 2019

Cash and cash equivalents $ 2,843,130 $ 2,980,584

Net working capital $ 3,603,324 $ 3,068,584

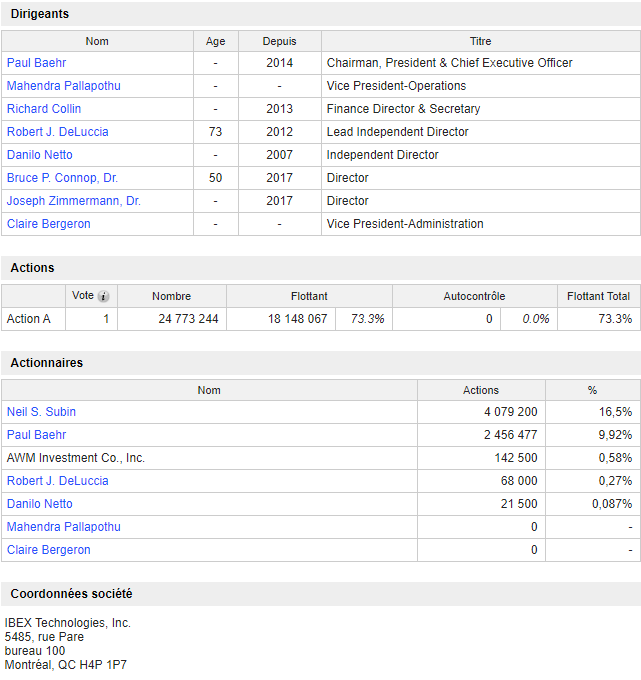

Outstanding shares at report date (common shares) 24,773,244 24,773,244

SALE OF BRP’S ASSETS

The Company closed operations at its North Liberty, Iowa production facility on July 31, 2019 and the facility was put up for sale. During the third quarter, the Company accepted an offer from a third party to purchase the land, buildings and equipment owned by the Company’s Bio-Research Products subsidiary in Iowa. The transaction closed on June 19, 2020.

Therefore, as at April 30, 2020, criteria for their classification as assets held for sale has been met. The assets have been stated at the lower of carrying value and fair value less costs to sell. The Company has taken a non-cash impairment of approximately $37,000 related to the land, buildings and equipment.

The sale will have a small positive cash impact after transaction fees and paying off the $723,527 USD mortgage.

From an operational point of view, the Company expects the sale of the site will reduce annual expenses by approximately $170,000 USD per annum.

As previously reported, the production of all major products which IBEX acquired during the purchase of BRP have been moved to Montréal and represent an important augmentation to the IBEX product portfolio.

COVID-19

As an “Essential Service” (producing reagents and components for critical care diagnostic tests), IBEX has remained operational, albeit with significant changes in the way we operate (administrative staff work mainly from home and production and lab staff are on site on an as-needed basis) and COVID-19 has not thus far impacted our ability to produce and sell.

Our financial picture has actually improved over the last quarter, as customers have increased their purchases of our products (which mainly end up in diagnostics used in hospitals), however like many companies in the medical environment we do not have a clear picture of how COVID-19 will impact future sales.

The COVID-19 situation has had an impact on some of our developmental programs which rely heavily on external suppliers, some of which have been closed down as a result of the pandemic. We expect some of these programs to resume in the fourth quarter.

LOOKING FORWARD

As always, the future financial results of the Company are difficult to predict as the Company’s customers have significant variations in their purchasing patterns, as can has been illustrated in the current year’s quarterly results.

Based on what we see at this time, we expect Fiscal 2020 revenues to be somewhat higher than last year, and with the reduction in expenses resulting from the closure of the Iowa production facility, we expect to be net earnings positive for the year.

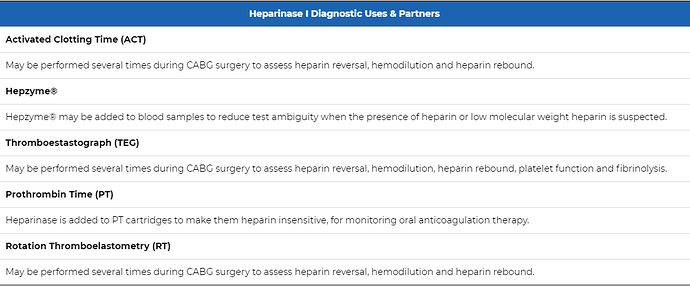

The Company continues to work on a number of new heparinase-containing clinical device projects with its key customers, some of which may result in additional revenues in Fiscal 2021 and beyond; however, as with all developmental projects, we cannot give any assurances that any of these customer-driven projects will come to market and produce significant revenues.

ABOUT IBEX

IBEX manufactures and markets proteins for biomedical use through its wholly owned subsidiaries IBEX Pharmaceuticals Inc. (Montréal, QC). IBEX Pharmaceuticals also manufactures and markets a series of arthritis assays which are widely used in osteoarthritis research.

For more information, please visit the Company’s website at www.ibex.ca.