Le site Bullmarketrun.com fait un suivi sur Biorem, voici le résumé,

Biorem Inc. (BRM, TSX-V) Update

Is there value on the Venture right now?…absolutely, though follow the 80/20 rule – only 20% of the companies are really worth considering, the other 80% are junk…within that 20%, you can narrow things down even more to the very best opportunities…

Our last update on Biorem was August 7 when it was trading around 30 cents…this morning the company reported its Q2 financial results, showing net earnings for the quarter of $718,000 or 5 per share (undiluted)…this brings net earnings for the 1st half of the fiscal year (January 1 to June 30) to $1.25 million or 9 cents per share (vs. a net loss of $1.36 million for the 1st 6 months of 2014)…

Biorem’s revenues for Q2 were $4.7 million, a 91% increase over the $2.2 million in revenue recorded during the same period last year and consistent with the $4.7 million recorded in Q1…year-to-date revenue has totaled $9.4 million, a $5 million or 112% jump in revenue over the 1st half of 2014…the revenue increase came from each of the geographic markets in which Biorem operates…

Biorem, which has only 13 million shares outstanding, is an environmental biotechnology company that designs, manufactures and distributes a comprehensive line of high-efficiency air emissions control systems used to eliminate odors, volatile organic compounds and hazardous air pollutants…

“The company is well positioned to deliver consistent results for the second half of the year,” said Derek S. Webb, President and CEO. “Overall booking activity in the near term is expected to be consistent with the previous two quarters. We expect continued growth in our overseas markets as new regulatory structures are implemented to curb the release of greenhouse gas emissions and communities demand a higher quality of life free of nuisance conditions.”

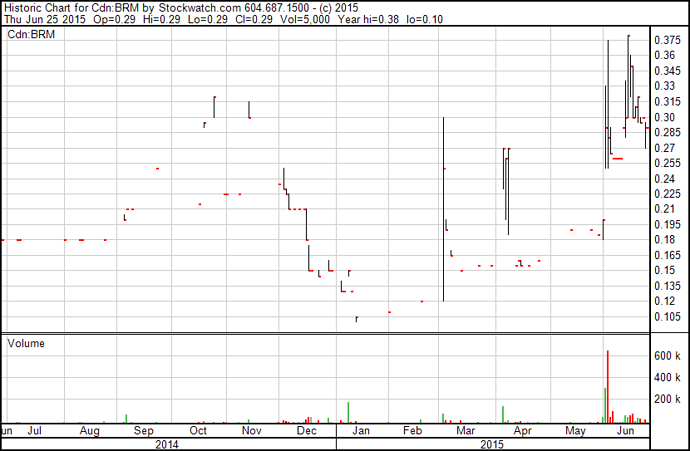

Technically, what’s interesting about BRM is the fact that it’s very close to confirming a breakout above a downtrend line that has been in place for several years as shown in this 10-year monthly chart…all aspects of this chart are encouraging…this company is making money, and that’s a rarity on the Venture…