Dans l’entrevue c’est bien expliqué…Le prix moyen des warrants est entre $0.11 et $0.18, et expirent Aout 2016. Souvent quand les hausses sont rapide beaucoup d’investisseurs prennent des profits. Le prix de l’action va surement remonté d’ici le prochain trimestre.

Ah oops, effectivement

Merci pour l’excellent suivi @midard

Pour ce qui est des mouvements à court terme du titre, je ne suis pas un expert mais il y a de quoi à prendre ses précautions avant de sauter dans le train. Voici quelques points que j’ai soulevé rapidement, je n’ai pas encore poussé la recherche fondamentale mais je crois que c’est intéressant de partager le tout:

-

Le compagnie a beaucoup moins d’actifs à LT et d’inventaire que je croyais, à première vue j’aime ça, il semble que le business model ne soit pas trop capital intensive

-

Les marges brutes (sans faire de calcul précis) me semble autour du 20-25%, qui est intéressant mais il semble y avoir une dépendance avec le volume de vente (comme un point critique disons). Par exemple au 2e et 3e trimestre en 2014 elles semblent être bien en dessous du 10%.

-

Pour ce qui est de la marge opérationnelle, Webb a mentionné qu’ils avaient revu en décembre la structure de l’entreprise pour devenir plus ‘‘lean’’ et pouvoir passer aux travers des cycles baissiers. De son propre aveu, leur business est cyclique, même s’ils reçoivent souvent des commandes répétitives de certains clients satisfaits. Il donne en exemple la ville de Toronto, pour laquelle ils ont déjà fait 12 contrats +. Leur principal clientèle se trouve à être des installations sanitaires municipales (usines de traitement d’eaux par exemple) et des complexes industriels, il estime aussi que le marché annuel mondial est de $250-300M. (Principalement aux É-U pour l’instant, ce qui se reflète par l’importance des USA comme segment de ventes i.e. 60%)

3 b) pour revenir à cette marge opérationnelle, je ne vois pas encore d’économie dans les G&A expenses, du moins entre les 6 premiers mois de 2014 et 2015. Je sais que l’ancien CEO a quitté, il a une clause qui lui permet d’obtenir 12 mois de salaire (possiblement qu’il sera payé tout au long de 2015). Il avait un salaire dans les 6 chiffres avec un petit multiple donc je suppose que ce sera pour 2016 que nous verrons un vrai changement.

- Je ne suis pas certain de comprendre le modèle entièrement mais tout me laisse croire qu’ils fonctionnent comme une petite usine d’assemblage d’équipement et puis qu’ils livrent/installent ensuite la matériel pour le client. Tout ça, en plus d’offrir des services d’inspection, analyses et échantillonnage etc.

4 b) Peut-être externalisent-ils l’assemblement-construction du produit final sur les prémisses du clients? Je ne suis pas certain. Mais qu’ils le fassent ou non, l’estimation des travaux de construction et des projets pourrait expliquer les marge brutes variantes. Ce que je veux dire par là c’est que s’ils se trompaient dans leur estimation d’un gros contrat (quelques millions), cela pourrait se répercuter dans leur marge brute lors de l’exécution. Je crois qu’il serait intéressant de creuser sur l’expertise d’estimation de l’entreprise, le calibre de leurs estimateurs etc. Puisque la compagnie a 25 ans toutefois, je ne crois pas qu’il y ait trop de problèmes à ce niveau mais sait-on jamais.

- Je crois que le marché se berne lui-même s’il poorte son attention sur le fait que l’entreprise a seulement 13M d’actions. Dans les E/F du dernier trimestre (Q2) on voit bien qu’il y a 1.8M de warrants entre 0.11 et 0.18 (comme Webb le mentionne) qui expire dans moins d’un an, soit août 2016. On parle ici d’une dilution d’environ 15%, ce qui n’est pas la fin du monde sur le BPA. Par contre, les débentures convertibles, principalement détenus par l’actionnaire majoritaire (Expansion Capital LP), qui est un fonds de Venture Capital spécialisé dans le Clean Technology et basé à New-York, et aussi par certains dirigeants de l’entreprise, peuvent faire beaucoup plus mal.

5b) Quand je dis beaucoup plus mal, c’est que la conversion totale des débentures équivaudrait à amener le Nb d’actions à 34M, soit une dilution de près de 160-170%. Bien sûr, on viendrait aussi éliminer la dette à LT, ce qui ne ferait pas de tort et on récolterait de l’argent au passage, mais le strike price moyen est de 15 cent… Toute une pression à la baisse sur le stock dans ce cas.

- Une des débentures n’a pas de composante convertible, elle équivaut à un montant d’environ $1.5M, et elle vient à échéance en Décembre 2015, depuis juin, un montant d’environ $350k doit déjà avoir été remboursé selon l’entente de crédit.

Conclusion: Je ne suis pas sur qu’à court terme, le marché prend compte de 1) l’important déboursé en capital à venir pour la débenture non convertible 2) la dilution possible des warrants + des débentures convertibles (qui sont par ailleurs déjà éligibles) et l’impact sur le BPA 3) la possibilité que la première débenture soit remboursée en action, advenant une entente à ce niveau.

Je crois que l’entreprise évolue dans une niche, avec un certain ‘‘economic moat’’ l’écoute de l’entrevue avec Webb plus haut est un must pour n’importe qui souhaitant y investir. Le balance sheet ne me cause pas de problème en tant que tel mais il me faudrait davantage de compréhension entourant leur pricing, évaluation et earning power et un peu + d’explications sur les économies découlant de la restructuration de Décembre 2014. Cela n’enlève toutefois pas les risques de dilution du BPA si le fonds américain décide de convertir ses titres de dettes vu la profitabilité de l’entreprise.

Bref au niveau actuel, je ne crois pas que l’achat soit intéressant, du moins, pas avant d’avoir plus de clarification sur les intentions du fonds, les impacts de la dilution et sur la fluctuation des résultats de l’entreprise.

Porté à mon attention par mon ami @Accumbens

http://www.marketwatch.com/story/biorem-announces-orders-totalling-24-million-2015-10-05

Biorem designs and makes equipment to eliminate pollution. It uses bacteria to break down the pollutant naturally, and is therefore a pretty green-friendly company.

The company recently installed new management, and has since cut overhead to become profitable. On a trailing-twelve-month basis, the company has generated operating income of $2 million.

Des amateurs de Biorem? Personnellement j’ai ouvert une position sur Biorem il y a 2 semaines et je vais creuser cette microcap pour voir si j’augmente ou je liquide… Je suis ouvert à vos commentaires.

Biorem earns $1.68-million in 2015

2016-04-04 15:38 ET - News Release

Mr. Derek Webb reports

BIOREM REPORTS 58% YEAR OVER YEAR INCREASE IN REVENUE AND $0.13 EPS

Biorem Inc. has released its results for the three-month and 12-month periods ended Dec. 31, 2015. Biorem’s complete fiscal 2015 year-end financial statements and MD&A have been filed on SEDAR (www.sedar.com).

FINANCIAL HIGHLIGHTS:

in '000’s except earnings per share

Three-months ended Twelve-months ended

December 31 December 31

2015 2014 2015 2014

Revenue 3,311 3,968 16,880 10,683

Gross profit 1,300 1,326 5,995 2,231

Operating expenses 1,062 1,191 3,797 3,377

Ebitda* 266 92 2,244 (916)

Net earnings (loss) 125 (69) 1,689 (1,722)

EPS - basic 0.02 0.00 0.13 (0.13)

EPS - fully diluted 0.01 0.00 0.06 (0.13)

- Earnings before interest, taxes and amortizaton, a non IFRS financial measure

TWELVE MONTHS ENDED DECEMBER 31, 2015

For the twelve months ended December 31, 2015 revenue increased 58% to $16.9 million from $10.7 million for the same twelve months in 2014. Net earnings for the year were $1.7 million compared to a net loss of $1.7 million in 2014. Earnings per share for the year were $0.13 basic and $0.06 fully diluted against a $0.13 loss per share reported in 2014.

Gross profit was $5,995,000 for the year, a 169% increase from gross profit of $2,231,000 for the year-ended December 31, 2014.

Total operating expenses for the year were $3,797,000 compared to $3,377,000 for the year ended December 31, 2014. The increase in operating expenses was attributable to higher sales and marketing costs, particularly commissions, on increased revenues.

Operating activities for the year provided $2.1 million of cash compared to $445,000 used by operating activities in 2014. A reduction in restricted cash and accounts receivable provided $605,000 of cash. A decrease in prepaid expenses and accounts payable contributed a further $409,000 in cash from operating activities. These operating sources of cash were offset by cash used to fund an increase in unbilled revenue of $698,000, and a decrease in unearned revenue of $240,000.

In January of 2016 the Company negotiated an amendment to its 12.75% debenture agreement amending the repayment terms and extending the maturity date to December 31, 2016. Under the amended payment terms, principal payments of $75,000 are due at the end of each month until the principal is repaid in November 2016. $770,000 of principal was repaid in 2015.

The Company received $164,000 during the year from the exercise of share purchase warrants and stock options.

“2015 was a turning point for BIOREM as we restructured the company to create value for shareholders and our customers,” said Derek S. Webb, President and CEO. “This strategy resulted in a significant amount of new orders across a wide variety of applications and geographical markets. Year-end backlog was at $16.7 million as compared with $14 million at December 31, 2014, which represents a 19.3% increase year over year.”

“Our focus on organizational efficiency and new product development has enabled us to stay one step ahead of the competition in a number of our key market segments. In 2015, we saw growth across both our domestic and international markets and expect this trend to continue into 2016. Demand for air emissions abatement is robust across a diverse geographical territory and BIOREM continues to be well positioned for meeting this demand with our range of engineered biological solutions.”

Three Months ended December 31, 2015

Revenue for the three month period ended December 31, 2015 was down 20.6% from the previous quarter to $3,311,000 and 16.6% or $657,000 million below revenues reported in the same period in the prior year.

Gross profit in Q4 was $1,300,000, a $208,000, or 13.8%, decrease from the $1,508,000 recorded in the third quarter of 2015 and $26,000 below the gross profit of the 4th quarter of 2014. Total operating expenses (net of other income) for the quarter were $1,062,000 a 10.8% decrease from the operating expenses of $1,191,000 incurred during the fourth quarter of 2014.

Ebitda for the quarter was $266,000 compared to an ebitda of $92,000 for the fourth quarter of 2014.

Net earnings for the quarter were $125,000 compared to a net loss of $69,000 in the fourth quarter of 2014.

Biorem receives $4.8M of orders for emission control

2016-11-24 16:18 ET - News Release

Mr. Derek Webb reports

BIOREM ANNOUNCES ORDERS TOTALLING $4.8 MILLION

Biorem Inc. has received several new orders totalling $4.8-million. The orders are for air emission abatement projects in North America, the Middle East and Asia.

“These recent orders are a reflection of our customer’s desires for reliability and the ability to achieve stringent performance targets while minimizing operational costs,” said Derek Webb, president and chief executive officer. “These orders follow a comprehensive market outreach program in key geographical areas and are in large part due to the strong strategic relationships we have formed with distributors, consultants and suppliers. This addition to our backlog provides a stable foundation for the 2017 fiscal year, and we are excited at executing these high-profile contracts.”

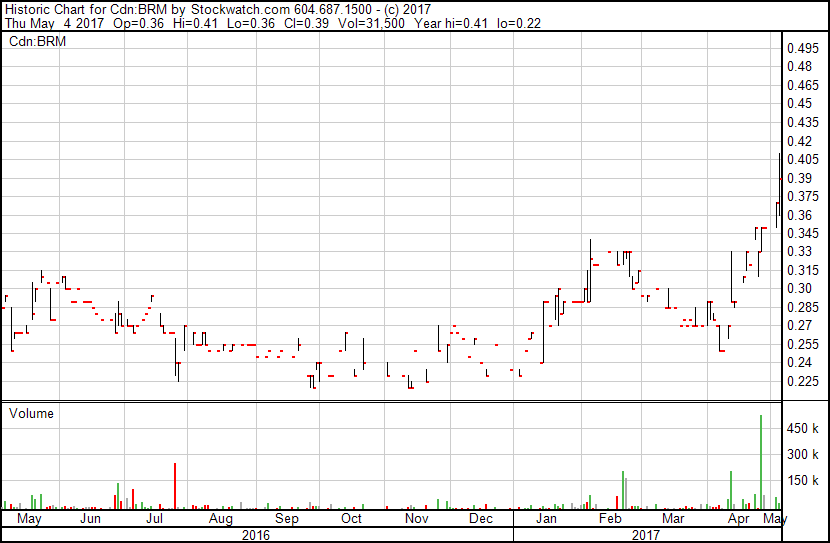

On surveille Biorem, important décollage aujourd’hui, il n’y a pas eu de nouvelles mais lors d’une récente entrevue Derek Webb a mentionné que le coté asiatique était très actif.

Biorem receives $3.1-million in new orders

2017-04-25 17:10 ET - News Release

Mr. Derek Webb reports

BIOREM ANNOUNCES $3.1 MILLION IN NEW ORDERS FOR THE COMPANY’S AIR EMISSIONS CONTROL SYSTEMS

Biorem Inc. has received new orders totalling $3.1-million.

The new orders came from Canada and the United States and a variety of industrial sectors. The bulk of the orders are expected to be delivered in the next 12 months. The Company has booked a total of $6.6 million in new orders to-date in 2017.

“We are very pleased with the Company’s order booking rate in the first few months of 2017”, said Derek S. Webb, President and CEO. “These new orders for projects across North America represent the successful execution of sales initiatives targeting customers in a variety of States and Provinces. They also reflect the needs of municipalities and industry to select technologies and companies that are reliable over the long-term life of their projects”

"Our order backlog has increased to $21 million which provides revenue visibility for the next 4-5 quarters. This combined with our lack of debt, enables us to focus resources on growing our business in China with our new strategic investor. We have launched several initiatives in the world’s largest market for environmental services and feel confident that with the foundation of our core business and the resources we have available, our business development activities over the coming months will produce some very interesting results."

About BIOREM Inc.

BIOREM is a leading clean technology company that designs, manufactures and distributes a comprehensive line of high-efficiency air emissions control systems used to eliminate odors, volatile organic compounds (VOCs), and hazardous air pollutants (HAPs). With sales and manufacturing offices across the continent, a dedicated research facility, a worldwide sales representative network and more than 1000 installed systems worldwide, BIOREM offers state-of-the-art technology-based products and peace of mind for municipalities, industrial companies and their surrounding communities. Additional information on Biorem is available on our website at www.biorem.biz.

Biorem semble vouloir décollé, il n’y a pas assez de volume pour signaler un break out mais il y a plus d’acheteur en ce moment.

Biorem receives $5.4M of new orders

2017-06-05 09:10 ET - News Release

Mr. Derek Webb reports

BIOREM ANNOUNCES ORDERS TOTALLING $5.4 MILLION AND ORDER BACKLOG OF $24 MILLION

Biorem Inc. has received several new orders totalling $5.4-million. The orders are for air emission abatement projects in North America.

“Our business development and sales initiatives continue to bear fruit as we approach the mid point of 2017” said Derek S. Webb, President and Chief Executive Officer. “We have focused our attention on providing technical and engineering services to our existing clients in an effort to expand the scope of supply for high profile projects. This approach is resonating with consultants and municipalities who need to have a reliable long term solution. With these latest orders, the Company’s order backlog stands at approximately $24 million, providing great revenue visibility for the next four to six quarters.”

The Company’s 2017 order bookings to date total $12.5 million compared to $7.6 million of orders booked in the first half of 2016 and the order backlog of $24 million is $6.9 million or 40% greater than the order backlog of $17.1 million on June 30, 2016.

Biorem est un titre à surveiller prochainement, au dernier trimestre il y avait 22M en backlog, heureusement que j’ai accumulé dans les $0.34

Nouvelle aujourd’hui BIOREM ANNOUNCES ORDERS TOTALLING $12.2 MILLION - INCLUDING $4 MILLION IN CHINA

Bonsoir Midard, je vois que tu a suivi le titre depuis le début. Vu la récente montée du titre,est ce que tu trouves que Biorem est toujours une bonne opportunité d’investissement ?Au risque de me répondre moi-même, le backlog est toujours élevé et les bénéfices par action à 12 cents du dernier trimestre sont convaincants.Merci de me donner ton avis.

BIOREM Reports 8% Increase in Revenue, Earnings of $4.7

million and EPS of $0.12

GUELPH, ON, March 18, 2019 /CNW/ - BIOREM Inc. (TSX-V: BRM) (“BIOREM” or “the Company”) today announced its results for the

three and twelve-month periods ended December 31, 2018. BIOREM’s complete fiscal 2018 year-end financial statements and MD&A

have been filed on SEDAR (www.sedar.com).

FINANCIAL HIGHLIGHTS:

in '000’s except earnings per share

Three-months ended Twelve-months ended

December 31 December 31

2018 2017 2018 2017

Revenue 10,871 8,538 24,333 22,558

Gross profit 3,393 2,409 6,378 6,270

Operating expenses 2,103 1,250 4,662 4,742

Ebitda* 1,412 1,047 1,764 1,694

Net earnings 4,334 1,051 4,666 1,530

EPS- basic 0.11 0.03 0.12 0.04

EPS- fully diluted 0.11 0.03 0.12 0.04

- Earnings before interest, taxes and amortizaton, a non IFRSfinancial measure

TWELVE MONTHS ENDED DECEMBER 31, 2018

For the twelve months ended December 31, 2018 revenue totaled $24.3 million compared to $22.6 million for the same twelve months in

- Net earnings for the year were $4.7 million compared to net earnings of $1.5 million in 2017. Earnings in 2018 were positively

impacted by a $3.0 million recognition of previously unrecognized deferred tax assets. Earnings per share for the year were $0.12 basic

and $0.12 fully diluted against $0.04 basic and $0.04 fully diluted per share reported in 2017.

Revenues of $24.3 million for the year represented an 8% increase over revenues reported the previous year. Gross profit was

$6,378,000 for the year, a 2% increase from gross profit of $6,270,000 million recorded for the year-ended December 31, 2017.

Total operating expenses for the year were $4,662,000 compared to $4,742,000 for the year ended December 31, 2017.

On December 31, 2018 the Company had cash on hand of $4.0 million and working capital of $9.7 million.

The Company has no long term debt.

Total order bookings for the year were $ 25.5 million and the Company’s order backlog stood at $21.8 million on December 31, 2018.

“2018 fiscal results are a continuation of the strong order bookings and increase in revenues BIOREM has achieved in both 2016 and

2017” said Derek S. Webb, President & CEO. "Of particular note in the 2018 operating results is a $2.8 million increase in revenues in

China over the previous year. The Company is in a strong financial position at the end of 2018 and expects to build on this strength in - The Company’s current order backlog combined with a strong sales pipeline is expected to result in sustained revenue and ebitda

again in 2019."

Three Months ended December 31, 2018

Revenue for the three month period ended December 31, 2018 was up 60% from the previous quarter to $10,871,000 and 27% or $2.3

million above revenues reported in the same period in the prior year.

Gross profit in Q4 was $3,393,000, a 41% increase over the $2,409,000 of gross profit recorded in the 4

th quarter of 2017 and 223%

increase over the gross profit achieved in the previous quarter. Total operating expenses (net of other income) for the quarter were

$2,103,000 a 68% increase from the operating expenses of $1,250,000 incurred during the fourth quarter of 2017.

Ebitda for the quarter was $1.4 million compared to ebitda of $1.0 million in the fourth quarter of 2017.

Net earnings for the quarter were $4.3 million compared to net earnings of $1.1 million in the fourth quarter of 2017. Net earnings in the

quarter before the recognition of previously unrecognized deferred tax assets were $1.7 million.

Total bookings for the quarter were $2.8 million.

About BIOREM Inc.

BIOREM is a leading clean technology company that designs, manufactures and distributes a comprehensive line of high-efficiency air

emissions control systems used to eliminate odors, volatile organic compounds (VOCs), and hazardous air pollutants (HAPs). With sales

and manufacturing offices across the continent, a worldwide sales representative network and more than 1,300 installed systems

worldwide, BIOREM offers state-of-the-art technology-based products and peace of mind for municipalities, industrial companies and their

surrounding communities. Additional information on BIOREM is available on our website at www.biorem.biz.

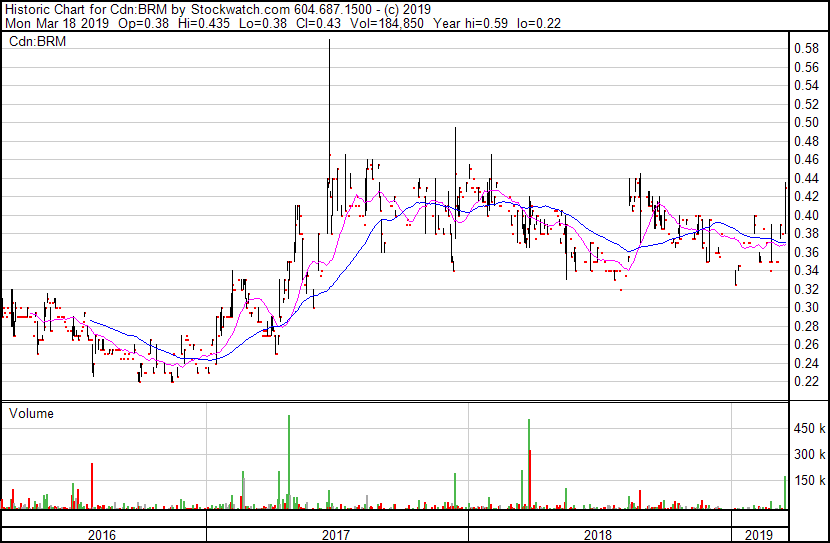

Bonjour David,

J’aime ce titre, un titre greentech dont le bilan c’est améliorer aux cours des années. Le carnet de commandes est convainquant cependant le titre demeure illiquide pour une raison que je ne connais pas. Peut-être causé par le manque de communication avec les investisseurs. Si tu vas sur le site web, il n’y a aucune présentation aux investisseurs.

Du coté technique, le titre à beaucoup de difficulté à passer le $0.45, les derniers trimestre la firme TD à mis beaucoup de volonté à maintenir le titre à ce niveau. Si Biorem touche le $0.50 cette semaine, cela serait un signal positif du marché et le titre pourrait atteindre de nouveau haut.

Bon à savoir et merci pour le chart.Merci aussi à Sly pour m’avoir parlé du titre!