Merci Phil, c’est très clair!

3 millions d’actions? Swap d’actions?

semblerait que le nouveau board a acheté les actions de ceux qui sont parti

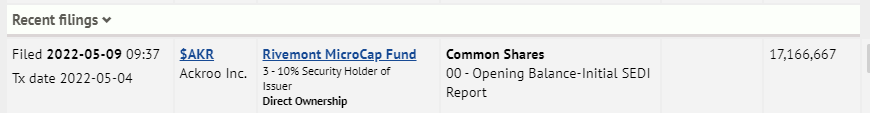

Après avoir participé au rachat des actions des directeurs qui ont quitté, le Fonds Rivemont MicroCap détient maintenant 14,8% des actions en circulation de Ackroo.

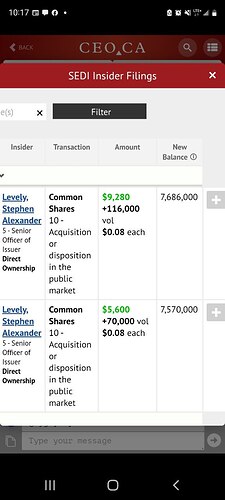

Toutes les positions des directeurs ont été rachetées à 0,10$ par action et 0,02$ par warrant (prix d’exercice de 0,18$ avec échéance en décembre 2023). D’ailleurs, Steve Levely, le PDG de l’entreprise, a acheté pour 300,000$ d’actions et de warrants dans cette transaction, ce qui démontre bien sa confiance envers l’opportunité.

Comme je suis gestionnaire de portefeuille du Fonds Rivemont MicroCap et que le fonds est maintenant un initié d’Ackroo, je vais désormais m’abstenir de faire des commentaires sur l’entreprise sur ce forum. Cependant, il me fait plaisir de discuter de l’opportunité et de ma thèse d’investissement en privé pour ceux que ça intéresse. N’hésitez pas à m’écrire en message privé!

Ackroo Releases Q1 2022 Financial Results

HAMILTON, Ontario, May 27, 2022 (GLOBE NEWSWIRE) – Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the “Company”), a loyalty marketing, payments and point-of-sale technology and services provider, has filed its financial results for the period ended March 31, 2022. The results for the period ended March 31st, 2022 reflect 21% year over year revenue growth, and a 28% increase in subscription revenue over the same period in 2021. The Company also achieved $224,965 of positive adjusted EBITDA during the quarter representing a year over year increase of 2,674% and equates to 14% of total revenues. The Company expects these positive trends to continue as they execute on their renewed plans to consolidate, simplify and improve the merchant marketing, payments and point-of-sale industry.

The complete financial results for Ackroo, along with management’s discussion and analysis for the quarter ended March 31, 2022, are available under the profile for the Company at www.sedar.com. Highlights include:

Q1 2022 vs. 2021:

Q1 2021 TOTALS Q1 2022 TOTALS +/- % Change

Total Revenue $1,284,289 $1,556,495 + 21 %

Subscription Rev $1,054,468 $1,353,486 + 28 %

Gross Margins $1,123,694 (88%) $1,393,636 (90%) + 24% (2%)

Adjusted EBITDA $8,413 $224,965 + 2,674 %

EBITDA % of Rev <1% 14% + 13 %

“I am very pleased with the solid start to the year and how poised we are for growth in 2022,” said Steve Levely, CEO of Ackroo. “Led by the year over year growth in our AckrooPOS business we are very encouraged by both the progress we have had internally as well as seeing our merchant clients’ businesses improving as well. It has been a long 2 years with Covid but we really are seeing light at the end of a long tunnel on a number of fronts. We are winning a greater amount of larger new customers, cross selling more current customers and doing a better job retention wise then we were a year ago. We are migrating more customers from old platforms to our new current ones and have continued our focus on balancing growth with earnings generation as we achieved double digit earnings as a percentage of revenue once again. We continued to make product enhancements and improve product parity from acquired legacy platforms and have some great new product releases coming later in the year to drive bigger organic growth. As the quarter closed off and we made changes at a board level, we also started back up several of our M&A and other strategic discussions so that we are poised for those opportunities in the second half of 2022. In all the company really is on very stable ground and is poised strategically and functionally for our best year yet.”

Ackroo announces additions to their Board of Directors

2022-06-08 08:00 ET - News Release

HAMILTON, Ontario, June 08, 2022 (GLOBE NEWSWIRE) – Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the « Company »), a loyalty marketing, payments and point-of-sale technology and services provider, announces the appointment of Jeremy Jagt, Brad French, Jon Clare, and Philippe Bergeron-Belanger to their Board of Directors. In order to make room for the new board members Wayne O’Connell will step down from the board transitioning his audit committee duties to the new audit committee chairman Jeremy Jagt. A brief bio on each of the new board members can be found below:

Jeremy Jagt - President of Potentia Renewables Inc., a fully integrated developer, owner and operator of renewable energy assets. Prior to joining Potentia, Jeremy had over 20 years’ experience in public accounting with Grant Thornton LLP, with a primary focus on mid-market public and private companies in a variety of industries. At Grant Thornton, Jeremy led the firm’s assurance practice both nationally and in Southern Ontario and was the firm’s lead regulatory partner. Jeremy holds an Honours Bachelor of Commerce degree from McMaster University and currently is a member of CPA Canada and CPA Ontario.

Brad French - Owner of Alliance Communications and Security, and a thriving commercial real estate business, Brad has a keen interest in emerging technologies and has been an active investor in several successful start-ups. Brad has first-hand experience with mergers and acquisitions, he sits on the board of SportsHeadz, a privately-owned software company, and has served on numerous other boards, including the Youth Diversion Program, the Community Foundation of Kingston and Area, and is Past Chair of the Canadian Association of Message Exchange. Brad graduated from Wilfrid Laurier University with an Honours BA and earned his MBA from the University of Liverpool.

Jon Clare - CEO of FuneralTech, an international death care SaaS company based out of Kingston, specializing in management, website, memorialization and marketing solutions. Jon has been involved in many successful software acquisitions and exits over the past 12+ years. Jon brings practical experience integrating teams, systems and strategies to allow companies to manage and scale their businesses more efficiently and effectively. He holds a Bachelor’s degree in Business from The University of Western Ontario.

Philippe Bergeron-Belanger - CFO of Good Protein, a vegan protein and superfoods company based in Montreal, is a trusted investor and business strategist who has helped several private and public companies with M&A, capital markets and investor relations for the past 8 year. He holds a Bachelor of Science in Business Administration and Finance from the University of Sherbrooke and is a shareholder in Rivemont Microcap Fund, one of Ackroo’s largest shareholders.

« We are very fortunate to be adding each of Jeremy, Brad, Jon and Philippe to our board, » said Steve Levely, CEO of Ackroo. « Reconstituting our board was important as we enter this next chapter for Ackroo where each of these individuals bring great skills and experience to the team. We gain strong financial, M&A, sales and marketing, capital markets and general business experience, most importantly from organizations our size and within the SaaS industry that we work in. The new team is committed to actively helping the business grow and so I couldn’t be more excited about what’s next for Ackroo. In order to make room for these additions Wayne O’Connell is stepping down where I would like to thank him for all of his help and support over the past few years. He played an important role in helping to support Ackroo through us going from losses to profitability and helping to support and transition the CFO’s at Ackroo, so I really do wish him the best of luck with his other endeavors. »

Ackroo has also granted incentive stock options to purchase 1,000,000 common shares to certain directors and employees of the Company exercisable at a price of $0.085, for a period of 3 years. The option grant remains subject to the approval of the TSX Venture Exchange.

Impressionnant ! Félicitations

Félicitations @pbergeronbelanger !

D’un 5 @ 7 en 2014 ou 2015 avec Steve jusqu’à un siège sur le conseil d’administration en 2022. Ça fait drôle d’avoir suivi ça depuis le début.

Bon, c’est malheureusement pas Ackroo qui a permis de réussir le défi du 1M$ en CÉLI mais il n’est jamais trop tard pour créer de la valeur!

Félicitations Phil!

ACKROO LAUNCHES MARKETINGHUB FOR THEIR ACKROOMKTG CLIENTS

October 19th, 2022|Ackroo News, Press Releases

Ackroo expands loyalty offering with enhanced communication and analytics tool

HAMILTON, Ontario, Oct. 19, 2022 (GLOBE NEWSWIRE) — Ackroo Inc. (TSX-V: AKR, OTC: AKRFF) (“Ackroo” or the “Company”), a loyalty marketing, payments and point-of-sale technology and services provider, announces the launch of its latest advancement to the Ackroo Anywhere platform with the beta of the MarketingHub. This development will provide current and prospective AckrooMKTG customers the ability to communicate with custom segments of their customer base via email, text message, and push notifications to users of Ackroo’s mobile app offering. Clients will be able to target customers via loyalty transaction behaviours, and reactions to past communication campaigns. Clients will also be able to automate communications and loyalty offers based upon consumer behaviour. These actions will then generate clear and concise reporting for merchants allowing them to better strategize and execute successful loyalty programs.

The Marketing Hub platform is built to easily accommodate additions to segmentation, automation and reporting over time, based upon client feedback. It is being rolled out in beta phases this quarter to existing clients for testing and feedback. The initial release will allow for email communication and segmentation based upon a preselected list of options. Month-over-month, Ackroo will add additional communication methods of text messages and push notifications as well as adding reporting features and automation. Later phases will also include the ability to import other 3 rd party email and phone lists into the MarketingHub. Wide release of the product is scheduled for the first quarter of 2023.

“We are very excited to formally announce the beta release of the new Ackroo MarketingHub service to our growing loyalty marketing merchant base,” said Steve Levely, CEO at Ackroo. “The ability to offer integrated and intuitive communication tools right from our program console is a big step forward for our platform. We began offering communication solutions as a marketing service several years ago as clients who operate loyalty programs naturally have a need to manage communications with their clients. We also now have a growing digital gift card customer base that are capturing buyer and recipient email addresses in which they would like to market to those customers so the demand for communication tools have grown. As a product first, services second business it was important for us to build technology that would provide this solution to our customers versus provide it as a service and so in March of 2020 we strategically acquired WinWin Marketing, who had a loyalty marketing technology that provided this integrated solution. We have spent the last 2 years building a tool within our core Ackroo Anywhere platform that is even more intuitive and powerful than WinWin’s, which we are excited to roll out in the coming months. Access to the enhancement will be included in our loyalty platform base offering, with a small additional monthly cost for distribution of the messages, making it even more appealing for Ackroo gift card only merchants to want to upgrade to our loyalty plan. In all this is a big win for Ackroo and for our AckrooMKTG customer base.”

Intéressant de voir qu’ils vont émettre des actions à 0.12$ pour procéder à l’acquisition. Je pensais que le marché allait peut-être réagir un peu mais crickets.

Je me demande comment la compagnie va payer 750k$US au closing? L’encaisse était de 325k$ avec 527k$ de compte à recevoir au 30 septembre…ça me semble tight. Les warrants restants qui expiraient en novembre étaient à 0.18$ et ça serait surprenant que les détenteurs aient exercé alors que le prix de l’action est à 0.07$. À moins que le prix aurait été modifié mais pour ça il aurait fallu faire une demande au TSXV il me semble?

Edit : marge inutilisée de 1.6M$ (merci Phil)

==================================================

Ackroo to Acquire Simpliconnect

Ackroo signs definitive agreement to acquire all of the assets of US loyalty provider Simpliconnect

Ackroo Inc., a loyalty marketing, payments and point-of-sale technology and services provider, is pleased to announce that it has signed a definitive asset purchase agreement, dated December 9, 2022, with Simpliconnect, Inc. (“Simpliconnect”). Simpliconnect is a US based SaaS provider focused on driving client engagement for small to medium sized convenience store and petroleum chains, specifically focused on chains with 2-100 sites/locations. Simpliconnect currently has more than 60 clients across over 350 locations generating approximately $1,000,000 USD in annual revenues. The transaction represents Ackroo’s twelfth acquisition to date and is expected to close on January 1st, 2023.

Marketing Technology News: Making the Most of a Security Breach

“We are thrilled to be adding Simpliconnect’s customers, technology and team to Ackroo,” commented Steve Levely, CEO of Ackroo. “As we continue to focus on consolidating our industry further expansion into our AckrooMKTG business, especially in markets like the United States, are key parts of our strategic plans. Their focus on 2 – 100 locations merchants in segments like convenience and petroleum are sweet spots for Ackroo making it a great client match for us. Their platform being strong in areas like mobile, their rules engine and various integrations will help advance Ackroo’s technology while Ackroo’s self-serve program console, reporting engine and feature set including gift card and promo’s will be a great enhancement for Simpliconnect merchants. We will also be adding talent through the acquisition as the owner Brent will be joining Ackroo to lead our US sales efforts while other key staff will integrate and help advance Ackroo in other areas. Simpliconnect also leverages outsourced engineering teams to help advance their technology which is one of the strategic plans for Ackroo to explore in 2023. It is for all of these reasons and more that I am really excited to integrate and expand our business together.”

Total consideration for the acquisition will be (US)$2,000,000, which will be satisfied through the issuance of 5,625,000 common shares, issuable at a deemed price of C$0.12 per share, along with a cash payment of (US)$750,000 on closing and a further six monthly cash payments of (US)$125,000 commencing on July 1, 2023. The Company is at arms-length from Simpliconnect, and no finders’ fees or commissions will be paid in connection with completion of the acquisition. All common shares issued to Simpliconnect will be subject to statutory resale restrictions in accordance with applicable securities laws. Completion of the acquisition remains subject to the satisfaction of customary closing conditions, including the approval of the TSX Venture Exchange.

Ackroo achète GGGolf oct. 2020 : 1.8M

Ackroo cède GGGolf févirer 2023 (moins de 3 ans plus tard) pour se « recentrer » : 1.6M

Ackroo Announces Sale of GGGolf to Quebec based investment (globenewswire.com)

Perte de 200k sans compter les efforts et temps pour l’acquisition et l’intégration…

ouch.

Ackroo décide finalement de re-vendre GGGolf.

Raisons invoquées: difficultés d’intégrations , possibilités limitées de ventes croisées.

On se rappelle que l’achat était survenu à l’époque ou il y avait un certain enthousiasme pour les terrains de golf et ce en pleine pandémie.

Bref ça semble avoir été un flop.

Par contre au lieu de s’obstiner c’est bien de reconnaître qu’on c’est trompé et passer à autre chose.

Est-ce que cela va être compensé par une autre acquistion ? Je le souhaite.

Vraiment hâte qu’Ackroo atteigne une certaine masse critique (mettons 8-10M ARR)

Je n’avais pas vu le message précédent désolé pour la redite !

Je ne suis pas un accro de Ackroo mais il est temps de passer à autre chose comme tu le dis.