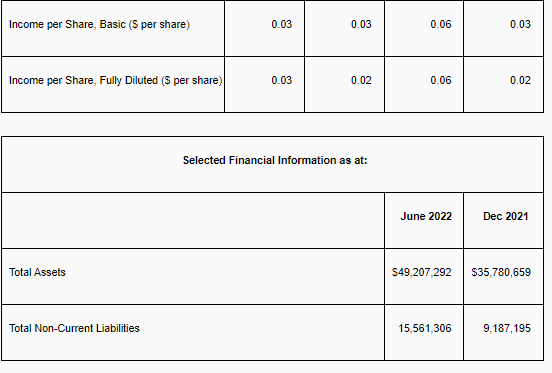

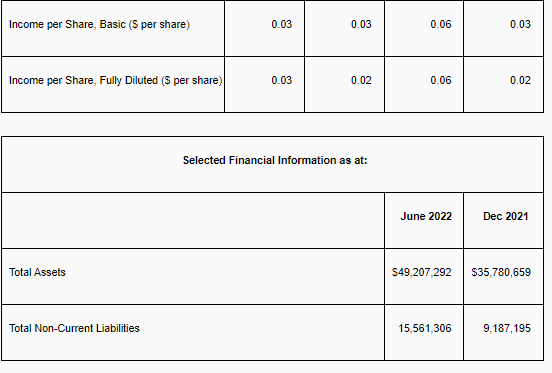

Résultats impressionnants. 0.06$ de BPA pour les premiers 6 mois de 2022 et historiquement les deux derniers trimestres de l’année sont les plus élevés en terme de vente et profitabilité. On se retrouve donc à moins de 4-5x les BPA projetés de 2022.

« Our order book for the remainder of 2022 continues to be strong and we anticipate another year of record results for the Company. »

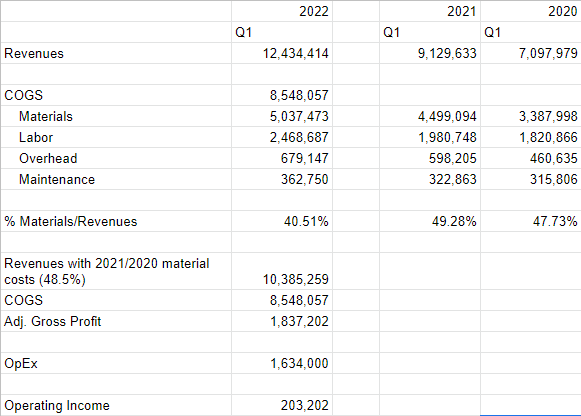

Les marges brutes sont en hausse mais le coût des matériaux les augmentent de façon artificielle…à voir pour le long terme. Reste que dans un marché de pénurie de main d’oeuvre où les employeurs se démènent pour trouver des employés, la compagnie continue de livrer la marchandise (no pun intented)!

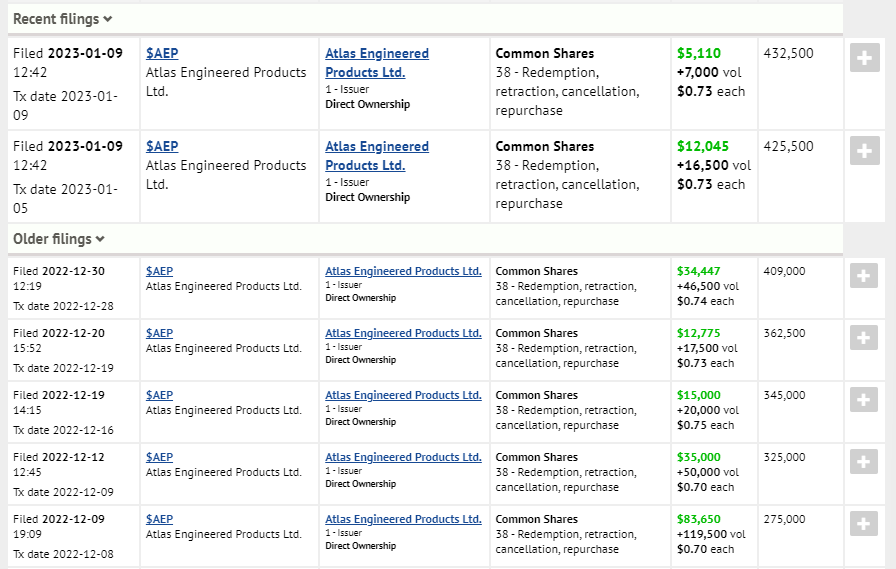

Aussi 1,170,500 d’actions achetées par la compagnie pour cancellation.

==================================

Atlas Engineered Products Reports Record Second Quarter Financial and Operating Results

YTD Revenues Increased 24%, Net Income Increased 112%

NANAIMO, BC, Aug. 22, 2022 /CNW/ - Atlas Engineered Products (« AEP » or the « Company ») (TSXV: AEP) (OTC Markets: APEUF) is pleased to announce its financial and operating results for the three and six months ended June 30, 2022. All amounts are presented in Canadian dollars.

« We are pleased with another successful quarter of organic growth, as well as, the contribution from our latest acquisition, Hi-Tec Industries Ltd, » said Hadi Abassi, CEO & President, Founder. « In addition to the ongoing operational improvements and growth of our legacy facilities, we have seen an immediate improvement in both revenues and margins from Hi-Tec. Our order book for the remainder of 2022 continues to be strong and we anticipate another year of record results for the Company. »

Financial Highlights for Q2 2022:

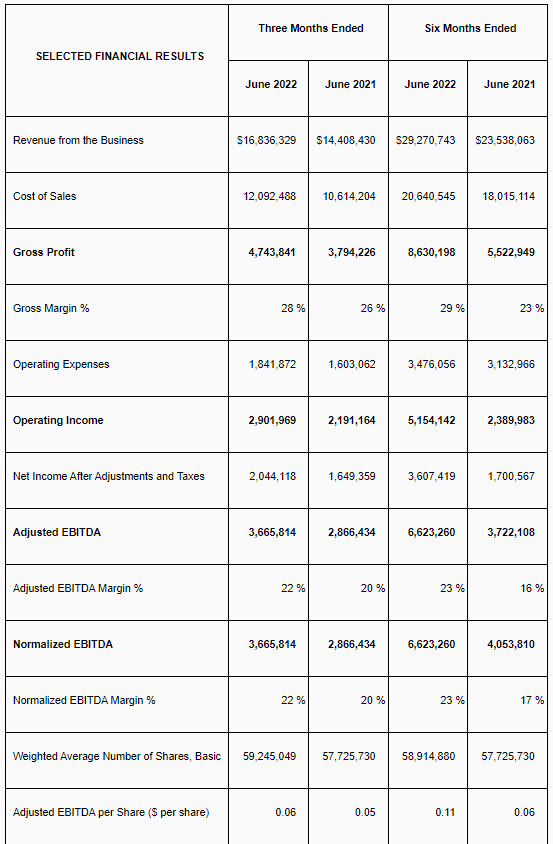

- Revenue increased 17% to $16,836,329 for the three months ended June 30, 2022 from $14,408,430 for the three months ended June 30, 2021. Additionally, revenue increased 24% to $29,270,743 for the six months ended June 30, 2022 from $23,538,063 for the six months ended June 30, 2021. This increase now represents the Company’s best second quarter to date.

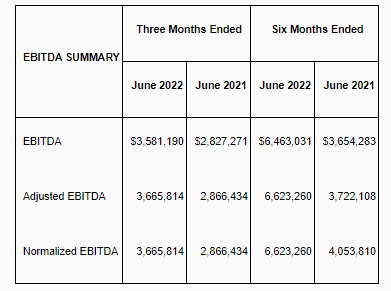

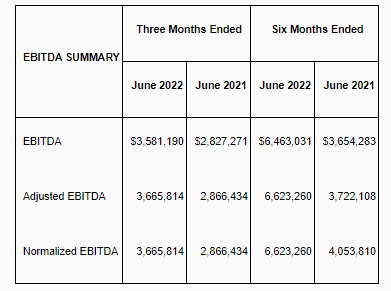

- Non-IFRS EBITDA for the three and six months ended June 30, 2022 was $3,581,190 and $6,463,031, respectively, with an EBITDA margin of 21% and 22%, respectively. EBITDA for the three and six months ended June 30, 2021 was $2,827,271 and $3,654,283, respectively, with an EBITDA margin of 20% and 16%. EBITDA and EBITDA margin for the three and six months ended June 30, 2022 increased compared to the three and six months ended June 30, 2021 due to increased net income for the period resulting from increased sales and improved gross margins.

- Gross margin for the three and six months ended June 30, 2022 was 28% and 29%, which was up from a gross margin of 26% and 23% for the three and six months ended June 30, 2021. Gross margins increased due to pricing assessments and updates being completed at all locations due to the fluctuating costs of raw materials and labour. The Company has also focused on improving efficiencies on new product lines and acquisitions.

- Net income after taxes was $2,044,118 and $3,607,419 for the three and six months ended June 30, 2022 compared to net income after taxes of $1,649,359 and $1,700,567 for the three and six months ended June 30, 2021. This increase was primarily due to the increase in revenues, improvements in gross margin, and the new acquisition of Hi-Tec Industries Ltd. (« Hi-Tec »).

Expansion for 2022:

On February 28, 2022, the Company acquired Hi-Tec (« Hi-Tec Acquisition »), located in Lantzville, BC on Vancouver Island. The shares of Hi-Tec were acquired for $5.8 million in cash, with a working capital adjustment of $454,981 that was finalized subsequent to the three months ended March 31, 2022. The land and buildings of Hi-Tec were also acquired by the Company for the appraised value of $3.25 million in cash. The Company financed the Hi-Tec Acquisition with a term loan for $5.8 million and a mortgage for $2,437,500. During its last fiscal year ended August 31, 2021, Hi-Tec earned unaudited revenues of just over $5.0 million, net income before taxes of just over $1.0 million, and a normalized EBITDA of $1.25 million, resulting in a normalized EBITDA margin of 25%. (Financial information for Hi-Tec for the year ended August 31, 2021 was unaudited and unreviewed.)

Since purchasing Hi-Tec Industries on February 28, 2022, this operation contributed $2,227,555 in revenues and approximately $667,827 in EBITDA for the three months ended June 30, 2022 and $2,855,014 in revenues and approximately $839,496 in EBITDA for the six months ended June 30, 2022.

Normal Course Issuer Bid (« NCIB ») Update:

From the commencement of the NCIB on November 3, 2021, the Company has acquired 1,170,500 shares for cancellation. Once all shares are cancelled that have been acquired the number of shares outstanding would be 58,713,049. The NCIB is ongoing until November 3, 2022 and the Company may purchase up to 2,886,286 common shares of the Company. All purchases of common shares will be made on the open market through the facilities of the TSXV and will be purchased for cancellation.

AEP’s board of directors continues to believe that the current market price for the Company’s common shares do not currently reflect the underlying value of the Company. As a result, depending on the future price movements and other factors, AEP’s board of directors believes that the purchase of the shares is an appropriate use of AEP’s funds and in the best interests of AEP’s shareholders.

Non-GAAP / Non-IFRS Financial Measures

Certain financial measures in this news release do not have any standardized meaning under IFRS and, therefore are considered non-IFRS or non-GAAP measures. These non-IFRS measures are used by management to facilitate the analysis and comparison of period-to-period operating results for AEP and to assess whether AEP’s operations are generating sufficient operating cash flow to fund working capital needs and to fund capital expenditures. As these non-IFRS measures do not have any standardized meaning under IFRS, these measures may not be comparable to similar measures presented by other issuers. The non-IFRS measures used in this news release may include « EBITDA », « EBITDA margin », « adjusted EBITDA », « adjusted EBITDA margin », « normalized EBITDA » and « normalized EBITDA margin ». For a description of the composition of these measures, please refer to AEP’s Management’s Discussion and Analysis for the period ended March 31, 2022 under « Non-IFRS / Non-GAAP Financial Measures », available on AEP’s website at www.atlasengineeredproducts.com or on SEDAR at www.sedar.com.