Ou envoyez votre argent dans le fond microcaps de Rivemont comme ça des professionnels des microcaps s’occupent de votre argent.

C’est pas toi qui le dit c’est moi

Ou envoyez votre argent dans le fond microcaps de Rivemont comme ça des professionnels des microcaps s’occupent de votre argent.

C’est pas toi qui le dit c’est moi

Ça rassure un peu de voir un initié (particulièrement celui qui gère l’entreprise) participer au placement privé. Je m’attends à ce que Paul participe aussi.

Web.com acquires New Zealand domain name registrar

C’est bon de voir qu’il y a toujours de la consolidation dans le secteur.

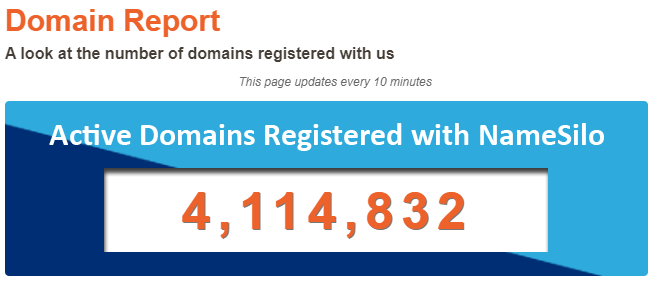

La croissance des domaines sous gestion est aussi de retour :

Je reste confiant qu’au niveau actuel, le titre offre un beau potentiel de rendement et peu de downside.

Intéressant, je pèse le pour et le contre d’ajouter à ma position

Namesilo earns $2.72-million in Q3

C’est encourageant de voir de la croissance ainsi que la marge brute qui s’améliore!

La marge brute était de 17.4% au même trimestre en 2019. Est-ce que quelqu’un sait pourquoi elle varie autant d’un trimestre à l’autre? C’est comme dur de savoir si c’est un progrès des services auxiliaires ou juste le pricing qui change beaucoup d’un trimestre à l’autre. Ce serait bien qu’il fasse un breakdown des revenus!

Je me demande ce que ca donne au global pour la valeur aux actionnaire de URL, des specialistes en chiffres ici?

NameSilo Technologies Corp. Enters into Letter of Intent to Sell NameSilo LLC

(TheNewswire)

VANCOUVER, BRITISH COLUMBIA - TheNewswire – Dec 2, 2020 – NameSilo Technologies Corp. (CSE:URL) (CNSX:URL.CN) PINKSHEETS (OTC:URLOF) (the “Company”) is pleased to announce that it has entered into a non-binding letter of intent (the “Letter of Intent”) with WGH Holdings B.V. (the “Buyer”) whereby the Buyer, subject to the entry into a definitive agreement, will acquire all of the Company’s interest in NameSilo LLC.

The transaction consideration will be approximately US$ 30 Million (the “Consideration”). The total consideration was based on a revenue multiple of 1.2 from the estimated 2020 financial year end. Of the Consideration, US$ 15 Million will be paid on closing and the remaining US $15 Million will be satisfied by three annual deferred payments of US$ 5 Million each (the “Deferred Payments”). As the Company currently owns 81.5% of NameSilo LLC, its gross consideration under the transaction is anticipated to be US $24.45 Million.

The Deferred Payments will also be secured by the units of NameSilo LLC. In the event of default by the Buyer, the membership interest in NameSilo LLC will be returned to the Company.

The Buyer will have 60 days to carry out its financial and legal due diligence of NameSilo LLC and, in consideration of which, NameSilo has granted exclusivity to the Buyer.

NameSilo LLC CEO Kristaps Ronka states: “We believe that this potential transaction is a natural evolution for NameSilo and we want to ensure our loyal clients that our team will continue to manage and drive the NameSilo business post-transaction and will continue to work tirelessly to provide our customers with best in class services and support for the years to come.”

Paul Andreola, CEO of NameSilo Tech states: “Since purchasing the company in August of 2018, we have seen significant development in NameSilo including more than a doubling of user count and revenues, and should this transaction close successfully in Q1 2021, we feel that this is a good opportunity to realize a significant return on equity from our original investment.”

Closing of the transaction will be subject to customary conditions to be included in the Definitive Agreement, financing of the Buyer and approval of the Canadian Securities Exchange.

NameSilo Technologies Corp.

Paul Andreola

31.64M$ CAD, dont la moitié au close et l’autre moitié en 3 paiements séparés.

Je suis capable de lire la nouvelle, mais au net que devient la valeur de URL au livre si on considère les investissement qu’il reste dans la compagnie, etc… ?

Une fois tous les paiements reçus et compte tenu de la dilution des options et warrants, j’estime une valeur par action d’environ 0,36$.

Cependant, il faut considérer que ça prendra trois ans pour recevoir tous les paiements. Si j’applique un taux d’actualisation ( ‹ ‹ discount rate › › ) de 10% par année sur les paiements à recevoir, j’arrive à environ 0,33$-0,34$ par action comme valeur actuelle.

Après ça, URL sera simplement une entité publique avec de l’encaisse au bilan et un portefeuille d’investissement. Il y aura un ‹ ‹ burn rate › › corporatif pour maintenir l’entité publique en attendant de voir ce que Paul va faire comme prochaine transaction. Je pense donc qu’on doit attribuer un certain escompte à la valeur comptable.

Bref, selon moi ça devrait se transiger à 0,27$-0,30$ pour l’instant, donc je pense que le marché a bien évalué la nouvelle à l’ouverture ce matin.

est-ce que ton calcul est seulement pour la valeur de vente de NAmeSilo ou ca contient aussi les investissement qui restent dans URL ?

Ça inclut les investissements et la dette.

Les derniers états financiers datent du 30 septembre et mes calculs sont approximatifs. J’ai fait ça rapidement pour évaluer la nouvelle avant l’ouverture du marché.

Ne vous fiez pas sur mes chiffres pour prendre des décisions d’investissement!

Et probabilité que la transaction ne se concrétise pas.

Une excellente année. Qu’en pensez-vous ?

Namesilo Technologies pays off some debt, adds director

2021-05-13 17:38 ET - News Release

Mr. Paul Andreola reports

NAMESILO ANNOUNCES FURTHER REDUCTION IN DEBT OUTSTANDING AND THE APPOINTMENT OF PAUL KOZAK TO THE BOARD

Namesilo Technologies Corp., due to continued strong cash flow from operations, has paid down approximately $604,500 of debt. Year-to-date the company has been able to reduce debt outstanding by approximately $1.54-million from internally generated cash. The current debt outstanding has been reduced to approximately $4.1-million.

The company also wishes to announce that it has appointed Paul Kozak to the board of directors to replace outgoing director Daniel Nanson. The company wishes to thank Mr. Nanson for his contributions as a director of the company.

Mr. Kozak brings to the company over two decades of experience as a financial professional. As an investment adviser at BMO Nesbitt Burns, Mr. Kozak advised individuals, families and companies with a variety of investment and financial instruments. Prior to this, Mr. Kozak trained as a pharmacist and owned and operated a number of Shopper’s Drug Marts, combining his business acumen with his passion for health sciences.

« We are delighted to have Paul join the team, » said Paul Andreola, president and chief executive officer of the company. « His experience within the investment industry, with financial instruments and structuring, and business operations will add another dimension to the skill sets of our board. »

About Namesilo Technologies Corp. and Namesilo LLC

Namesilo Technologies Corp. invests its capital in companies and opportunities which management believes are undervalued and have potential for significant appreciation. The company’s flagship subsidiary, Namesilo LLC, is a low-cost provider of domain name registration and management services. As an accredited ICANN registrar, Namesilo is one of the fastest growing domain registrars in the world with over 2.5 million active domains under management, and over 240,000 customers from approximately 160 countries.

NameSilo Technologies Corp. Announces Q1 2021 Results

VANCOUVER, BRITISH COLUMBIA – TheNewswire June 1, 2021 – NameSilo Technologies Corp. (CSE:URL) (CNSX:URL.CN) (OTC:URLOF) (the “Company”), one of the fastest growing domain registrars in the world, is pleased to announce the financial results for the quarter ending March 31, 2021. The financial statements and related management’s discussion and analysis (“MD&A”) can be viewed on SEDAR at www.sedar.com.

Financial Highlights of the Company:

The Company experienced financial results in fiscal Q1 2021 as set forth below:

NameSilo has grown to be the 12th Largest Domain Registrar in the world (according to RegistrarOwl.com) with over 3.99 million active domains under management and customers in approximately 160 countries.

Since acquiring Namesilo LLC in August 2018 the new management team has grown revenues from full year 2017 revenues of approximately $10.6 million to over $31.05 million in 2020. Domains under management have grown from 1.85 million to over 3.99 million today. The Company has also invested significant resources to launch a number of new products and services which are expected to significantly increase future revenues and improve gross margins. Along with a new and more functional website the Company has launched hosting services, email products, a free logo maker, security products, several new domain services and more all while maintaining some of the lowest prices in the industry. NameSilo now accepts over 150 payment methods including most major credit cards, Web money payments such as Apple Pay, Venmo, Alipay and more. The Company was also one of the first companies in the industry to accept bitcoin. In 2020 the Company launched new marketing initiatives to build brand awareness and drive future revenue growth.

NameSilo LLC CEO Kristaps Ronka states, “Q1 2021 was another quarter of solid operations. We have spent the last several quarters investing in new products, services, and people in anticipation of continued growth. We launched new marketing initiatives which have helped lead to sustainable revenue growth including this past March where we reached over US$3 million in monthly bookings for the first time in the Company’s history. NameSilo is now well positioned to take advantage of our team’s hard work and further grow our company. We look forward to continuing to offer our customers new and best in class products and services at the best possible prices, all while maintaining world class customer service”

As per the press release issued on Dec. 2, 2020, the Company announced that it had entered into a non-binding letter of intent with WGH Holdings BV whereby the buyer, subject to the entry into a definitive agreement, will acquire all of the Company’s interest in Namesilo LLC. Both parties continue to work toward meeting the conditions to enter into a definitive agreement. More details will be announced when available.

Subsequent to the quarter ending March 2021 NameSilo Technologies has paid down an additional $636,000 in outstanding loans. The Company currently has approximately $4.1 million in debt outstanding. In the 5 months since the end 2020 NameSilo LLC has grown its domain names under management by approximately 480,000 domains or by 13.7%. Management anticipates continued strong growth for the remainder of the year.

NameSilo LLC will focus on adding value-added products to offer customers a one-stop source for essential services related to their domains. The Company believes that these new products will further increase core revenues and margin growth for NameSilo, improve customer retention and improve the value proposition to the customer base.

C’est long avant que les services auxiliaires fassent effet.

Gross Margins

Q1-19 11.7%

Q1-20 11.7%

Q1-21 12%

Je ne suis pas convaincu que ça va lever. J’ai 40 domaines chez Namesilo, mon hébergement est chez Dreamhost et AWS, nos emails sont chez Microsoft et Gmail.

L’interface est tellement technique qu’un néophyte ne va forcément pas les utiliser (vs Squarespace, Wix, Webflow… qui sont simples), et les plus experts ont des besoins assez spécifiques pour avoir du « multi-homing ».

La lettre d’intention est expirée depuis un bout. Selon Paul Andreola, la compagnie est toujours à vendre mais il n’y a pas d’offre d’achat sur la table actuellement.

Le point positif est que les domaines sont en croissance continue depuis les derniers mois :

20 novembre 2020

28 juin 2021