Salut à tous, voici mon dossier original. L’action a bougé beaucoup et j’ai pas eu le temps de creuser plus ou de traduire en français. Je vous partage le tout quand même.

Propel Holdings (PRL.TO)

General info (2023-11-28)

Ticker : PRL.TO

Price : 11.00 CAD

Fully diluted shares : 36,835,242

Market CAP : 378 M.

Total Loan : 299 M

Provision loan default: 67M

Company Description

Prospel Holdings is a top 500 fast growing company in North America in 2023. The company operates as an AI-driven consumer lending platform that evaluates consumers in a more comprehensive way than traditional credit scores. This broadens access to credit for underserved consumers while creating sustainable and profitable growth. The company operates as Fora CreditTM in Canada (since November 2022), CreditFreshTM and MoneyKey TM in the US (since 2021 now in 38 states) and recently launched (June 2023) a Lending-as-a-Service (LaaS) product line with a first partner (Pathward) and third party financial institution diversifying the portfolio (Prospel offering a white label service integrating Pathward customer and financial institutions providing credit to Pathward customers).

Market Opportunity

Current interest rate raises and macro-economic perspectives including high inflation and economic slowdown results in regular banking system tightening their credit requirements. This pushes more customers to alternative financing. Propel through its products offers loan and advance balances (similar to credit card) to those customers and is developing new products to facilitate the transition for those customers from regular banking to Propel. The trend has accelerated and there is a strong demand and credit performance for those customers is higher than the traditional base of Propel customers. Loan and Advance balances at the end of Q3 raised 44% from Q3 2022 and see the trend continuing in Q4 and further into 2024. Q4 is usually the highest quarter in term of loans and revenues with Christmas month being the highest revenue generator for the company. We expect the Q4 loan and advance balance to be close to 360M (45% from Q4 2022) generating higher revenues.

Many opportunity lies ahead : expanding in all states, expanding in Canada, offering new products to good paying customers, getting more white label partners, etc. The current growth rate seems accelerating and not slowing. This should attract investors and get the current valuation to a growth valuation instead of a micro-cap valuation. Further more, if the company valuation grows 50% it will surpass the 500M mark and bigger funds will be interested, driving the price even higher. Main competitor Upstart (UPST) is driving twice the sales and valuated at 5.19 sales. Applying the same multiple to PRL would result in a 443% gain at the current sales volume.

Share Structure

Only 1 share class is issued and no special option or purchase rights exists.

Competition

Lots of competition in this raising market : Upstart, SoFI, LendingPoint, Opgrade, LightStream, HappyMoney. Most of the fintech companies requires good credit scores but major exceptions are Upstart and Propel.

Management

48.39% insider ownership aligns investors with management. Michael Stein (Co-Founder & President) is currently the company’s largest shareholder with 19% of shares outstanding. Clive Kinross (Co-founder and CEO) is the second-largest shareholder at 17%. Both are not on their first company, and they sold the previous ones. They are well aligned with investors.

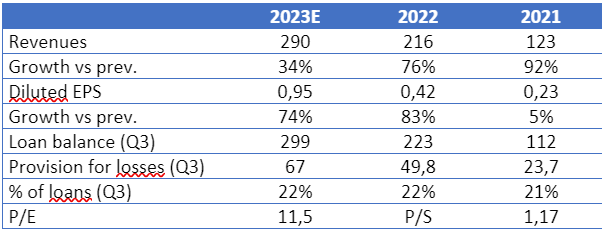

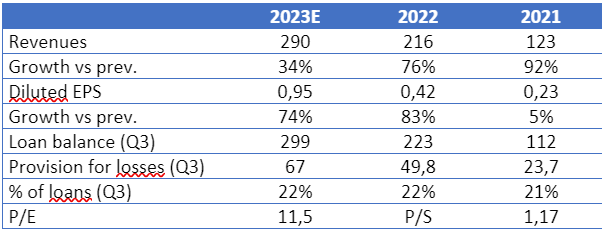

Financial ratios

Financing Risk

The biggest financial risk for this company is loan default. Almost 50% of the revenues are allocated against loan defaults provision and write-offs. Almost all of this cost is incurred, and provision stands currently at around 22% of the loan portfolio.

Catalysts

The market is expending and Propel is taking a good share of this market (estimated market value at 1Trillion).

Company will cross the 500M market. A lot of big investors may dive in driving the price higher.

The current majority owners sold their previous company and are aligned with shareholders.

Risks

Canadian regulation lowering the maximum interest rate.

Higher default in loans (currently between 12% and 14% with provision standing at 22%).

Future Expectations (e.g. new contracts, future revenue, earnings, etc.)

Q4 is usually the biggest quarter of the year with the Christmas season generating high short-term loan and margin volume. I estimate around 30% of the year in volume in Q4. With the record volume of loans already originated, I expect record revenues in Q4 continuing the growth and profitability.