Bon ben je crois que la montée de l’OR se confirme  on est sur le point de passer une résistance clé à 1200$ NUGT est rendu à 50$ ! (17$ il y a à peine 2 semaines )

on est sur le point de passer une résistance clé à 1200$ NUGT est rendu à 50$ ! (17$ il y a à peine 2 semaines )

Et bien la nouvelle qu’on attendait tous pour $GLK.v ! Félicitations à tous les actionnaires, la ride va enfin commencer

Et ca continue pour GLK:

TORONTO, ONTARIO–(Marketwired - Feb. 16, 2016) - Great Lakes Graphite Inc. (“Great Lakes”, “GLK” or the “Company”) (TSX VENTURE:GLK)(OTC PINK:GLKIF)(FRANKFURT:8GL) is pleased to announce it has received two purchase orders from a large, Texas-based industrial company whose initial requirement consists of 40 tonnes of micronized graphite products in total. These purchase orders are the first ever to be received by Great Lakes and originate from a customer who, through this relationship, expects to source a significant volume of micronized graphite on an on-going basis.

Senior Vice President of Sales Mike Coscia commented, “These initial orders represent an important outcome of a process that has been ongoing for several months now. In this case, we worked closely with a customer who is developing a solution with stringent performance requirements. Identifying the right product for their application required an iterative process of testing various products and blends and working collaboratively to find the right solution. We believe this model works well for Great Lakes and enables customers to benefit from our substantial experience with graphite and other industrial minerals.”

Great Lakes CEO Paul Gorman added, “The focused efforts of our team working together with our valued partners have enabled us to achieve this critical milestone. Commissioning of the facility is underway and with our first purchase orders in hand, we are now executing the next phase of our business plan.”

Product Qualification Progress Update

Over the past several months, Great Lakes Graphite has been working with prospective customers to qualify graphite products for a range of applications in specific markets. By working in parallel with a limited number of select prospects, Great Lakes has made significant progress in demonstrating the suitability of GLK’s micronized graphite products and qualifying them for use in the following product areas:

Lubricants - greases and lubricating fluids and sprays

Friction Products - automotive brake pads

Batteries/Energy Storage - anode material for lead-acid batteries and LiOH batteries

Conduction - thermal and electrical conductors for chemical manufacturing

The length of time required and the complexity of the qualification process varies by application. Generally, applications with less stringent performance requirements can often be qualified in a few months. Conversely, applications with demanding requirements for a variety of performance characteristics often require graphite of very high purity and substantially more time to complete qualification, due to the variety and complexity of testing as well as the testing iterations that are typically performed.

Sr. Vice President of Sales Mike Coscia said, "We are in the process of qualifying several products. Our first priority is the micronized graphite products we are preparing to deliver in quantity in the near term and on applications that have relatively shorter qualification periods.

We are complementing that effort with a sampling program for prospects that require high purity micronized graphite. The long qualification times required for the high purity markets require us to begin working with prospective customers now. Feedback obtained during this process will inform decisions we need to make regarding the production of high purity micronized graphite.

Working with a representative sample of our targeted customer base has been enormously helpful and provides insight into what customers are seeking that you simply cannot get any other way. When we collaborate with our customers to solve their challenges, we are providing real value, earning credibility and firmly establishing our brand in the market."

About Great Lakes Graphite: Great Lakes Graphite Inc. is an industrial minerals company focussed on bringing value-added carbon products to a well-defined market.

The Company’s Innovation Division has entered into long-term agreements for use of the Matheson Micronization Facility and for supply of high quality natural graphite concentrate (see news release dated 03/23/15) which are positioning Great Lakes Graphite to become an emerging domestic manufacturer and supplier of micronized products to a growing regional customer base where pricing and demand continue to rise.

Further information regarding Great Lakes can be found on the Company’s website at: www.GreatLakesGraphite.com.

Article sur SeekingAlpha:

http://seekingalpha.com/instablog/6546411-ben-kramer-miller/4817416-great-lakes-graphite-awesome-job

We would like to congratulate Great Lakes Graphite (TSX.v: GLK) (OTCPK:GLKIF) for making its first sales announcement on Tuesday (February 16). It speaks to the work the company has been doing over the past several months, as well as to the appeal of our investment philosophy of finding easy, inexpensive projects being developed by top-notch management teams.

An Overview of Great Lakes Graphite

There’s nothing new in this section, so if you are familiar with the company feel free to skip it.

Great Lakes Graphite’s approach is different from the other major graphite players. The latter are looking to first mine graphite and then sell it. We think this is a risky proposition given the relative cost of developing a mine when compared with refurbishing a graphite micronization facility, which is what Great Lakes Graphite has done.

Things didn’t start this way. Initial conversations with management focused on the Lochaber Project, which is an early-stage exploration project in Ontario with a small inferred resource with easily accessible graphite skewed towards large/jumbo flakes that command a market premium. Great Lakes, like its peers, was going to mine graphite and then process it, and its selling point was that its mine would be considerably smaller than its peers’, and that its initial capital costs would consequently be lower by comparison. Despite this “advantage,” before Great Lakes could build its mine it would need to drill out a resource, upgrade it to a reserve, carry out environmental tests, file for a mining permit and have it accepted, and procure project financing. That’s a lot of work, and we feel that financing such a scenario leads to a “chicken-egg” dilemma in which Great Lakes would need to convince financiers to give it money in order to build a mine and to start building a customer base, but in which the financier might not move on the deal without Great Lakes proving it can sell its graphite to a pre-determined customer. The “produce it and they will buy it” approach that most commodity producers adhere to simply doesn’t work in graphite, which is why we think mining graphite is a risky proposition.

However, on February 26th, 2015 the company announced that it is going to be leasing a micronization facility-Matheson in Ontario- from Northfil Resources.

(Source: Great Lakes Graphite)

(click to enlarge)

(Source: Ibid)

This micronization plant was virtually unused, contained equipment that Great Lakes can (and is) use for graphite micronization, and required just over a million dollars to refurbish. Since signing the facility use agreement the company has refurbished the plant and added the necessary equipment. It set everything up, received its permits, and all the while it had been manufacturing small samples of micronized graphite designed for potential customers, one of which is now an actual customer.

Micronized graphite is flake graphite that has been ground into smaller particles. It can also be manufactured using synthetic graphite, and we see this as a viable expansion opportunity for Great Lakes in the intermediate term. These particles have to meet specific customer requirements, and in fact Great Lakes Graphite intends to produce several custom-made products. Micronized graphite is used in many kinds of products such as lubricants, as friction products in brake pads, in drilling fluids in the oil industry, as an additive to paint…etc. It can also be further processed into the anode material used in lithium ion batteries-the market that has generated a lot of the recent interest in graphite.

For now Great Lakes is focused on simpler products, that is, the more “traditional” products that don’t have the allure of the lithium-ion battery market. But these products are much easier to have qualified by prospective customers, meaning it is much easier for Great Lakes to create a satisfactory product for a paint company than for Tesla. So long as it can make a profit doing the former it is intent on starting there. This is, in fact, one of the things that several investors don’t like about Great Lakes, namely that it is not immediately intent on getting into the battery market. But since battery-grade graphite is much more difficult to produce, and since products that lead up to battery-grade graphite (e.g. micronized graphite) are marketable, Great Lakes is intent on selling the latter, thereby reducing its technical burden while generating the cash-flow needed to research anode material without diluting shareholders.

So Great Lakes is leasing the Matheson facility in order to micronize graphite. It will be buying this graphite from DNI Metals (CSE: DNI, DMNKF), which will be procuring graphite out of Brazil. DNI is required to supply Great Lakes with a graphite that meets certain quality standards so that the latter company can ensure that it can process the raw graphite into a marketable product profitably. As a result Great Lakes is probably paying a small premium to the market price. We aren’t told exactly what it is paying for its graphite, but we’re guessing $1,000-$1,100/t, the higher figure is used in our valuation estimate. In return it gets price stability and product assurance, and this allows management to focus on generating a profit through one value-add step at first, namely micronization. It is the fact that management has honed in on one value-add step that has enabled it to slash its capital costs, its timeline risk, and its operational risk to the point that it has transformed from “just another graphite mining company” to a viable start-up business that can morph to include other value-adds as opportunities present themselves. This is why Great Lakes is the graphite stock we’re betting on, and why we’re having trouble finding any justification for owning its peers at this point in time.

Since we first recommended the shares in early July they have maybe risen 20-30%. On the one hand this is in the context of a lousy stock market, especially for junior miners. But it really isn’t much considering that stocks like Great Lakes Graphite can easily move this much in a day. So we’re not taking a victory lap on this front yet. However, we remain confident in the price action, which has been positive, and which has taken the shares higher than many of the warrant/option strike prices, and higher than the prices of the secondary offerings made by the company. That means that all but a handful of the equity owners are in the money.

However we didn’t recommend Great Lakes Graphite because we were looking for a 3-cent increase in the shares. We didn’t come up with a final tabulation of the company’s value in our last assessment; but we did estimate that-using very conservative numbers, that the Matheson Project is worth ~US$48 million before taxes. Here is our recent spreadsheet.

Very roughly, in CAD terms that gets us to C$0.66/share, giving us a 6-bagger. Investors will note that this is a VERY conservative estimate, but that it is well within reach. We note points at which this is a conservative estimate:

We underestimate the amount of graphite the company will produce in early years with respect to the company’s expectations. This is not due to any disagreement, but rather it is a result of the fact that from an investment standpoint we want to be as conservative as possible when valuing companies.

We underestimate the amount of graphite the company will produce in later years because we deny it growth at 10,000 tpa. That may be the capacity of the Matheson facility, but this capacity can be expanded using internally generated cash-flow. The company can also buy other facilities and incorporate other value-add steps into its portfolio of capabilities (e.g. purification and everybody’s favorites: spheronization and coating for Li-B anode use).

We underestimate the price the company will likely realize for its graphite. Discussions with the company and some external research has revealed that micronized graphite can sell for up to $4,000/t, and rarely sells for less than $2,500/t. We cap prices at the lower end of this range.

A “full” valuation estimate of the company has to take these into consideration, and it also has to take into consideration that there is no reason why production has to stop in 2030, and that the best approach to valuing the company might be by assigning it a multiple to the cash-flow it will generate in its “mature” years, assuming these aren’t too far off. With that being the case we can easily envision $1/share, although we note that circumstances will change sufficiently along the way that making such a prediction based on current circumstances is unreasonable.

40 Tonnes-Who Cares?

Those who scoffed at the news because it announces only 40 tonnes worth of sales will note that in our 6-bagger scenario we estimate that Great Lakes will only sell 1,000 tonnes in 2016. We did this because selling graphite is difficult, and anybody starting a new graphite company will likely have to build a customer base over time. In fact we’re skeptical of any company that states it can sell its full mine production right at the start, even if it plans to start with a small mine and scale it up.

1,000 tonnes doesn’t seem so far-fetched at this point, especially if the company can get its customers to return.

Other companies have very lofty sales estimates that dwarf Great Lakes’ 40 tonnes, and investors infer that Great Lakes is an inferior company or that the 40 tonne sales is meaningless. We think there are two misunderstandings here.

A: Estimated Sales vs. Actual Sales

Companies with graphite mines like to put out fancy reports saying that they will produce such-and-such amount of graphite, and then using some methodology they determine the graphite’s “value,” and investors just assume that the company will be able to sell the graphite it produces at that value. Of course all of this is hypothetical. Yet investors believe it to be true without questioning it because management or a “qualified person” signed off on the information. In an industry as minuscule as graphite investors, regulators, and “qualified persons” may not be sufficiently knowledgeable to question this information. For instance we pointed out that while Syrah Resources (ASX: SYR) (OTCPK:SYAAF) has a lot of high grade graphite it will have a very difficult time selling the amount of graphite it says it will-more than half the market. This isn’t like a copper company coming in with a huge mine that produces copper at $0.25/lb., thereby shifting the market price that equilibrates supply with demand. It will need to attract customers, and this is not simple. We think it is impossible on the scale that Syrah wants to do it, and risky on the scale that a company such as Mason (TSX.V: LLG) (OTCQX:MGPHF) wants to do it-~50,000 tpa. But these companies’ formal documents say they can do it without factoring in our concerns. Thus estimated sales don’t make for a good basis for determining value without taking several qualifying factors into consideration.

Thus, 40 tonnes may appear small compared with the thousands, or tens of thousands of tonnes that other companies estimate they will sell, but this 40 tonnes is greater than what these companies have actually sold, which is nothing. Great Lakes has gotten its foot in the door, and this is a serious development that de-risks the shares. Meanwhile, the 40 tonnes is hardly indicative of how much Great Lakes is really selling to this customer, which we suspect will be a recurring customer given the nature of the graphite market. This means the full quantifiable value of Tuesday’s PR cannot be known without the information required to determine how much graphite this customer is buying per unit of time.

B: Recurring Customers, Not Off-Take Agreements, Will Be the Key To Success

This notion of a recurring customer is critical to understanding the importance of Tuesday’s PR and reason why we think Great Lakes is on a real, albeit an arduous, path towards success. Naturally we are going to place much more value on recurring customers over one-time customers, but graphite investors misunderstand the notion. They take this to mean that graphite companies should look for long-term off-take agreements. We’ve discussed why this approach won’t work. Instead you should think about this notion in the same way that you think about every-day consumers being return customers. Just like you return to stores, brands, and restaurants you like so will customers of successful graphite companies return to their suppliers. But the relationship is a bit more intertwined, as graphite companies often custom-produce products for individual customers. So long as the customer continues to have the need for a custom product, the supplier will have its business. The customization process is a cooperative effort on the part of both the graphite producer and the customer, making it very difficult for the customer to switch suppliers.

The 40 tonnes of graphite that Great Lakes has sold is the culmination of such a process. If Great Lakes only sells this 40-tonnes, then the transaction is a failure even if the company generated an operating margin. This is because it takes a lot of work to get to the point at which the customer decides to buy. Fortunately, the customer has put in work as well, and there is now a reasonable chance that this sale will be recurring, if variable depending on the customer’s specific demand. If the customer decides to move ahead without Great Lakes, it has a lot of work ahead of it: it must repeat the same multi-month product qualification process if it chooses to continue to manufacture the relevant product(s).

The Bottom Line

Great Lakes Graphite has its foot in the door. It certainly has its work cut out for it, as one 40-tonne sale cannot be the basis of a business. Nor can one repeat customer, even if we don’t know its current demand But this news is unquestionably a step in the right direction, and evidence that what we’ve been saying over the past several months is legitimate. As a result, despite the fact that shares are trading higher today than they did in July, we are more bullish of Great Lakes Graphite. The above $48 million NPV estimate compares with a $9 million valuation, indicating that there is substantial upside. But as we said before this estimate is conservative in many respects, and that it might be more appropriate to value the company relative to its mature cash-flow potential, which is >$10 million per year pre-tax. Depending on what sort of multiple investors are willing to assign to this cash-flow (and this can vary widely) investors might be willing to pay as little as, say, $50 million for the company or as much as $150 million. This doesn’t incorporate the growth opportunities, nor does it acknowledge the competitive advantage that Great Lakes has as a proven producer and seller of micronized graphite products. This good-will is unparalleled, although the market largely ignores it.

Since investors are so intent on owning resources in the ground Great Lakes has been largely overlooked. But this is going to change. We’re already seeing bullish price action: here’s a 1-year chart:

GLK Chart

Shares may pull back, but we think that investors are going to come around to this name as they realize that Great Lakes has unparalleled advantages among the graphite juniors, who are still largely in fantasy-land. We also suspect money will continue to bleed out of more typical names that have undeveloped resources that are going nowhere fast. Some of it will find its way into Great Lakes shares.

We’re hesitant to put a price target on Great Lakes given that so many things remain up in the air. Roughly, if we give the company credit for 2/3 of its NPV (to roughly account for taxes) in the above 10% discount rate scenario the valuation is $32 million, meaning that there is more than 3X upside. We don’t think this is far-fetched even in the near-term, especially if the company can announce more deals. Even so, if that valuation is reached we may have reason to believe that shares have additional upside at that time given how conservative our estimates were, and given the expansion opportunities for which we didn’t give Great Lakes any credit.

This article was originally published at miningWEALTH.com on February 18, 2016.

Disclosure: I am/we are long GLKIF.

J’aimerais surtout attirer votre attention à ce passage

J’espère que vous avez tous vos actions de GLK.v

PDAC arrive à grands pas et je m’attends à de grosses annonces

Great Lakes Graphite appoints Devaney as sales VP

Great Lakes Graphite Inc (C:GLK)

Shares Issued 101,227,645

Last Close 2/26/2016 $0.105

Monday February 29 2016 - News Release

Mr. Paul Ferguson reports

GREAT LAKES GRAPHITE ADDS INDUSTRY VETERAN ALAN DEVANEY TO SALES TEAM

Alan Devaney has joined Great Lakes Graphite Inc. as vice-president of sales. Alan has been working with the Company for the past few months as a consultant and is now prepared to transition into a leadership role within the sales organization.

Alan Devaney brings a wealth of industrial minerals experience to the Company. Alan was an integral part of the sales team that built an 80 million dollar operation at HC Starck, a leading premium supplier of advanced, strategic metals. Alan brings a combination of technical depth and people skills that suit him exceptionally well when working with the types of customers who purchase graphite. The value GLK seeks to provide goes well beyond simply offering a new source for high quality industrial minerals. GLK works closely with customers to understand issues they are working to solve. In depth industry knowledge and engineering expertise helps GLK customers identify the right solution for their particular situation.

In addition to H.C. Starck Inc., where Alan served as Marketing and Sales Manager, he was most recently Executive Vice President at Orchard Material Technology in North Andover, Massachusetts where, among other things, he was responsible for project management in Global Refractory Metals.

Great Lakes Graphite CEO Paul Gorman said, “The ability for Great Lakes Graphite to successfully execute our business plan depends on our ability to attract the highest quality professionals in all aspects of our operation. Alan has a level of knowledge, experience and credibility that instills confidence and brings tremendous value to customers.”

Alan also served for several years as Product Manager for Materion Advanced Chemicals where he had responsibility for specialty inorganic chemicals and played a key role in the inorganic chemicals business in the battery and LED markets. Materion is one of the world’s premier advanced materials solutions providers that is committed to developing, manufacturing and marketing highly engineered advanced materials for global customers across a wide range of markets, including consumer electronics, defense and science, industrial and aerospace, automotive electronics, telecommunications infrastructure, appliances, medical and energy.

Il y a eu un beau signal aujourd’hui sur LND-V , inspira financial qui a une valeur au livre de $0.80 par action est entrain d’entreprendre une remonté. Inspira a fait une consolidation d’actions dernièrement pour un total de 37,292,743 d’actions en circulations. Voici leur dernier résultat financier

A surveiller les résultats trimestrielles la semaine prochaine de TCN-T Tricon capital, les analystes ont un prix cible d’environ $12. J’ai pris position a $7.80 cette semaine

FMS.v Focus Graphite

Compagnie avec un projet Quebecois dans le Graphite est passée de 0.065$ à 0.30$ en quelques jours.

Le bull market des ressources continue à se confirmer

Focus Graphite est la pire compagnie qui existe dans le secteur. Le deposit est intéressant mais les dirigeants sont des vrais magouilleurs. Si quelqu’un est in la dedans, c’est pas mal le temps de sortir avant que la balloune dégonfle.

Je pourrais développer sur le sujet si certains osent investir dans cette compagnie.

Quand des scraps de même montent autant sans news, c’est signe que le marché est suracheté tant qu’a moi…

Un autre post sans fondement. Je suggère à tous de faire vos propres recherches:

Nemaska Lithium, de toute beauté. Parti de son bas 52sem à 0.15$ on est rendu à 0.61$

Toi mon champion la, avant de dire que c’est non fondée, informe toi un peu a place de regarder les titres qui sont les plus actifs et ceux qui ont les plus gros gains pis de les prendre pour venir peter de la broue ici.

Cet article c’est pas de moi mais ca couvre une partie de ce qu’est Focus Graphite:

http://seekingalpha.com/article/3509086-focus-graphite-get-fooled

Sinon si vous avez du temps a perdre, fouillez les états financiers et regarder les dépenses prépayées de Focus envers d’autres compagnies et à qui ces compagnies appartiennent.

Regardez aussi le lien entre Grafoid et Focus, les transfert d’argent entre les 2 compagnies et la valeur comptable des actions de Grafoid versus la valeur gonflée que Gary Economo donne en entrevue (actions desquels ils essaient de se départir d’à peu pres 15% de ce qu’il possèdent depuis de nombreux mois, sans en être capable).

Regarder le fameux offtake agreement entre les 2 compagnies sans aucun chiffre ou tous les agreements sont à la discretion de Grafoid.

Gary avait aussi mentionné en entrevue que "Grafoid will have sales for 2015 of 100million ", entrevue réalisée après le Q2 ou Q3 (je ne me souviens plus) de Grafoid ou la compagnie ne déclarait que seulement 500k de revenus.

Tant qu’à moi, la chose qui peut sauver Focus c’est soit un changement complet des dirigeants (voir Gary et Jeffrey, mais bon c’est pas mal tout ceux qui restent depuis les derniers congédiement/départs) ou que notre cher gouvernement leur donne les 170 millions qu’ils ont besoin pour essayer de faire une mine.

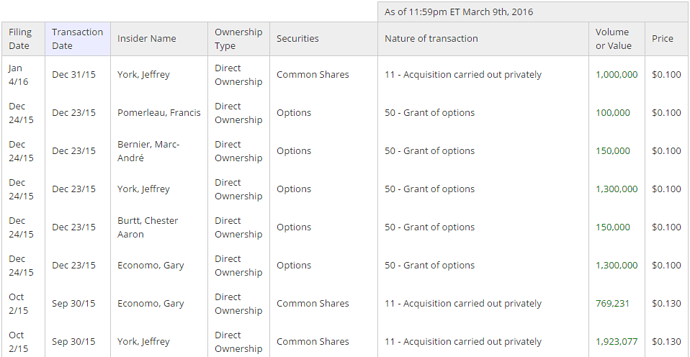

Je ne vois que des achats d’actions et des octrois d’options dans les derniers mois, aucune vente d’initiés malgré la remontée du titre:

Ok et ce beau screenshot de canadian insider, ca change quoi au fait que la compagnie est gérée tout croche et que les conflits d’intérets louches sont omniprésents?

Des octrois d’options a un prix dérisoire ca coute rien a personne, a part de la dillution pour les actionnaires. Pis c’est pas des achats d’initiés sur le marché mais une participation a des placements privés qui permettent de faire rouler la compagnies pour encore quelques mois.

A quand remonte la dernière nouvelle qui concerne vraiment leurs projets? Ces participations aux placements privé leur reviennent en grande partie dans leurs poches en salaires (qui sont ridiculement élevés pour une compagnie d’exploration minière comme la leur).

Le placement a 10 cents, c’est des flow-through en plus, donc c’est presque rendu rentable pour eux, ils investissent a 10 cent, le gouvernement leur en redonne une partie et l’autre partie leur revient dans les poches en salaire…

Le placement a 13 cents, ils voulaient lever 2 millions et ils n’ont été capable que de lever 500 000$ (qui vient presque juste de Jeffrey et Gary).

Pendant ce temps la, ces 2 peddlers se déplacent en Jet Privé (appartenant a une compagnie leur appartenant) sur le bras des actionnaires (donc ils injectent le peu d’argent de la compagnie à une compagnie qui leur appartient et qui ne fait en aucun cas avancé le projet Lac Knife).

T’en voulais du contenu en voila, retourne pomper tes merdes ailleurs!

Wow wow wow on est pas sur le forum de la clique du plateau svp un peu de retenue. Luc a raison sur plusieur point… Ils sont dans la meme gaming des anciens de cambior. Plusieur compagnie en soustraitance qui sont a eux bcp de plug au gouvenement… Trafiquer les chiffre pour faire accroire que le cout d’exploitation est faible… Et je passe sur plusieurs autre point. Mais qui sais parfois ça marche mais au finle ca retombe toujours.

A surveiller CVX-V Cematrix corporation, ce titre pourrait tirer profit du programme d’infrastructures du gouvernement Canadien. 34 million d’actions en circulation, la compagnie est déjà profitable.

Cematrix earns $1.56-million in 2015 Le titre a un beau mouvement de coté et pourrait faire un breakout bientôt.

Je rajoute un vidéo de la présentation des investisseurs pour ceux qui désirent en connaître plus sur cette compagnie.

Le GOLD continue sa montée  NUGT rendu à 75$, parti de 17$ à la mi-Janvier ! JNUG rendu à 87$, parti de 20$. Pas pire rendement en 2 mois.

NUGT rendu à 75$, parti de 17$ à la mi-Janvier ! JNUG rendu à 87$, parti de 20$. Pas pire rendement en 2 mois.

Quelques titres orifères qui performent:

HRT.to Harte Gold qui végétait autour de 0.09$ jusqu’à la semaine dernière vient de toucher 0.27$.

ORX, encore une fois dans l’OR, végétait à 0.01$ la semaine dernière, a touché 0.075$ cette semaine