Mais se serait pas faite en une transaction à un prix fixe per share?

oui à travers le marché

Achat de $IO.v Inca One, superbe graphique en mode renversement. Avec des warrants à 0.15$, je le vois revenir à 0.20$ pour une 'course de warrants

Encore plus de warrants qui s’en viennent…Inca One arranges $2-million private placement

INCA ONE GOLD PROVIDES REVIEW OF CALENDAR 2017

Inca One Gold Corp. has provided an update on the milestones achieved in 2017 and its primary goal of profitability in 2018.

The year 2017 was a turnaround year for Inca One, with significant milestones accomplished as it continued toward its pursuit of profitability and its vision of becoming a leading commercial gold processor in Peru. In its third year of commercial operations, it focused on operating cost reductions, infrastructure upgrades and internal controls.

During 2017, the Chala One plant operated at an average throughput of 65 tonnes per day. Deliveries to Chala One were 22,921 tonnes, up from 15,447 tonnes in 2016, an increase of 48 per cent. Chala processed 23,708 tonnes of material in this year, up from 14,447 tonnes in 2016, an increase of 64 per cent. Gold production for the year was 9,927 ounces, up from 6,682 ounces produced in 2016, representing a 49-per-cent increase. Gross sales were approximately $13-million (U.S.), up from $9.0-million (U.S.) in 2016, an increase of 44-per-cent year over year. The increase in production can be attributed to the company’s skilled operators and having sufficient working capital to purchase ore and pay miners in a timely manner. This working capital was lacking in 2016 due to IGV (value-added tax) audits.

The year’s first milestone occurred in early January, 2017, with the receipt of a beneficial permit, making Chala One one of the few companies in Peru to complete the formalization process. The receipt of the beneficial permit allowed for the successful permitting of the company’s first major infrastructure project: the construction of an electrical power line. The power line was completed in July, and Chala One was connected to Peru’s national power grid in August. As a result, electrical and power cost savings to Chala One are approximately $18,000 (U.S.) per month with this conversion.

Another key infrastructure component was the expansion and upgrading of tailing facilities to increase capacity by approximately 90,000 cubic metres. The capital cost was approximately $313,000 (U.S.) and, at current throughput levels, tailing capacity will last approximately five years. Future expansion may be required sooner as throughput rates increase.

Additionally, to ensure a consistent supply of quality mineral to the processing plant, it was necessary to develop a comprehensive infrastructure of mineral buyers in each gold-rich area of Peru. Inca One’s network of mineral buyers had been using a fleet of leased vehicles to service existing zones and for exploring new zones to determine the viability of mineral supply. During the fourth quarter of 2017, the company negotiated the purchase of a fleet of well-maintained used vehicles for its team on the ground, reducing monthly lease costs by approximately $22,000 (U.S.), contributing to improved cost savings.

While infrastructure was a focus last year, the company also had a noteworthy improvement in production on a year-over-year basis. Ore purchasing, ore processing and gold production were consistent throughout the year and ore-purchasing margins were maintained over comparable periods on a year-over-year basis. Inca One was able to improve production despite an extraordinary rainy season in February, March and April due to the impact of El Nino.

Due to investment in infrastructure, the company’s business cycle has now been reduced from the 45-day turnaround in its first year to the current 21-day operating cycle of ore delivery to gold export. This represents a significant improvement as working capital will no longer be tied up for extended periods of time. Additionally, the back office in Peru is to be congratulated as they have been able to keep monthly IGV submissions and refunds current.

Looking ahead to 2018, the company anticipates further production growth and cost reductions. It has emerged from recent improvements and investments, following three years of consecutive commercial production, right-sized and with a fully integrated gold ore processing plant. Inca One is optimistic about its future and trusts that its foundation is strong and ready for growth.

Results of 2018 annual general meeting

On Dec. 13, 2017, the company held its annual general meeting in Vancouver, B.C. All resolutions were passed by the requisite majority. Grant Thornton LLP, chartered professional accountants, was reappointed as auditor of the company for the ensuing year and shareholders confirmed the company’s stock option plan.

Shareholders voted in favour of setting the number of directors at four and the following incumbent directors were re-elected: Edward Kelly, Bruce Bragagnolo, Rodney Stevens and Adrian Morger.

About Inca One Gold Corp.

Inca One is a Canadian-based mineral processing company. The company’s activities consist of the production of gold and silver from the processing of purchased minerals located in Peru. Peru is the sixth-largest producer of gold in the world and the Peruvian government estimates the small-scale mining sector accounts for a significant portion of all Peruvian gold production, estimated to be valued approximately $3-billion (U.S.) annually. The company purchases its minerals from government registered small-scale mining producers from various regions and processes it at its Chala One milling facility located in Chala, southern Peru.

We seek Safe Harbor.

http://incaone.com/_resources/presentations/IO_Corporate_Presentation_January_2018.pdf

Excellente présentation de la compagnie

Décollage ce matin, c’est pas tous les jours qu’on trouve des producteurs d’or à 5M$ de MarketCap et sur le point d’être profitable

$IO.v continue sa montée tranquillement…si on brise 0.095$ la prochaine résistance se trouve à 0.13$ ensuite la voie sera libre.

L’OR et l’Argent montrent des signes de breakout incroyables, nous sommes à la veille d’un bull market des métaux précieux. Pour le moment les stocks n’ont pas encore réagit autant mais ca ne va pas tarder. Plusieurs aubaines présentement et plusieurs producteurs vont faire du cash comme de l’eau. Les majors sont à un bon prix comme G et ABX

$NTM.c à surveiller dans le lithium. JV avec XMG.c

Les initiés détiennent 40% des actions, très petit float. Je le vois aller à 0.30$ assez vite !

Petit in dans $GRAT.c à 0.165$ pour rebond technique.

J’ai pris ma perte à 0.15$

Un stock à surveiller de près est RB.H

Russell Breweries, une ancienne microbrasserie qui a vendue ses actifs. Présentement inactive avec 3M$ en cash. Hugh Notman ( un investisseur bien connu dans le milieu ) vient d’y investir, on dirait un reverse merger qui se trâme…pourrait être très intéressant. Il se transige présentement à 0.035$ soit la valeur en cash.

Transaction de Hugh Notman

https://screenshotscdn.firefoxusercontent.com/images/fa0971b9-d45d-432c-a442-b03ee132b1f6.png

Quelques infos sur Hugh Notman:

Je viens de prendre position à 0.035$. Je crois que le gamble est très intéressant. Au pire la compagnie se liquide et fait une distribution en cash et je récupère mon investissement. Au mieux, une transaction intéressante qui finie par me donner un 10 bagger +

Je pense que d’un point de vue TRÈS spéculatif, ça peut être un bon ‘‘play’’ pour un RTO éventuel. Par contre, le 3M d’encaisse a été versé aux anciens actionnaires le 26 janvier dernier. Reste à savoir pourquoi Norman a pris une position aussi important du 5 au 7 février, étant donné que la compagnie ne vaut ‘‘techniquement’’ absolument rien en ce moment.

étrangement ils n’en parlent nul part dans les états financiers. Cela devrait être inclus dans la section: événements subséquents normalement.

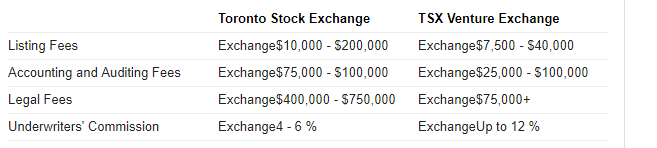

C’est exactement le bet que j’ai pris sur cette compagnie. Aussi beaucoup plus rapide que de procéder par IPO.