Nous ne sommes malheureusement pas en mesure de répondre à cette question. Je te conseillerais de contacter l’Autorité des Marchés Financiers pour obtenir plus d’informations à ce sujet.

C’est se que j’ai fait merci. Voici leur réponse simplement par intérêt général. En fait, on m’a expliqué que c’est la responsabilité de la société émettrice de s’assurer que le preneur est un investisseur accrédité et non l’inverse. Dans le cas où le preneur (investisseur) perd tout, il ne peut poursuivre la société en retour.

donc ce n’est pas un gros risque finalement?

Exactement

Le communiqué d’Apivio

Apivio receives $22M takeover bid from Nuri Telecom

2017-01-17 11:29 ET - News Release

Mr. Song Man Cho of Nuri Telecom reports

NURI TELECOM COMPANY LIMITED COMMENCES ALL CASH OFFER FOR ALL OF THE COMMON SHARES OF APIVIO SYSTEMS INC.

Nuri Telecom Company Ltd.'s wholly owned subsidiary, 1101324 B.C. Ltd., has commenced an all-cash offer to the shareholders of Apivio Systems Inc. to acquire all of the issued and outstanding common shares of Apivio.

A Significant Premium and Certainty of Liquidity

The Offeror is offering CDN$0.40 in cash for each Common Share which represents a 51% premium based on the closing price of the Common Shares on the TSX Venture Exchange (“TSXV”) on January 16, 2017 (the last trading day prior to the public announcement by Nuri of its proposal to the Shareholders to acquire Apivio). The Offer also represents a premium of 49% to the volume weighted average trading price of the Common Shares on the TSXV over the 30 trading days ended on January 16, 2017.

Chairman and Chief Executive Officer of Nuri, Song Man Cho expressed, “The Offer represents a compelling opportunity for Shareholders to realize certain value for their Common Shares at an attractive premium. We urge Shareholders to consider the Offer and tender their Common Shares.”

Mr. Cho explained, “Nuri is a publicly traded company listed on the KOSDAQ in Korea with a market capitalization of approximately CDN $127.8 million as at January 16, 2017. The Offer is not subject to any financing conditions and Nuri will fund the Offer from available cash resources.”

Benefits of the Offer

Nuri encourages Shareholders to consider the following factors, among others, when making the decision to accept the Offer.

Significant Premium to Market Price. The Offer represents a significant premium of over 51% based on the closing price of the Common Shares on the TSXV on January 16, 2017. The Offer also represents a significant premium of 49% to the volume weighted average trading price of the Common Shares on the TSXV over the 30 trading days ended on January 16, 2017.

Fair Value for Apivio. The Offer price of $0.40 in cash for each Common Share represents a premium value that fairly reflects the composition and performance of Apivio’s portfolio of assets. The Offer price indicates an enterprise value of approximately $22 million for Apivio, which implies a price-earnings ratio of approximately 42x to Apivio’s earnings per share of $ 0.01, as well as approximately 13x to Apivio’s Adjusted EBITDA, based on Apivio’s most recent publicly filed financial information.

Realize Significant Value. The all cash consideration provides Shareholders with the opportunity to realize significant and certain value for their Common Shares. The Offeror believes the immediate value is even more attractive when viewed against the risks inherent in any long term business plan of Apivio, particularly given its recent stock performance.

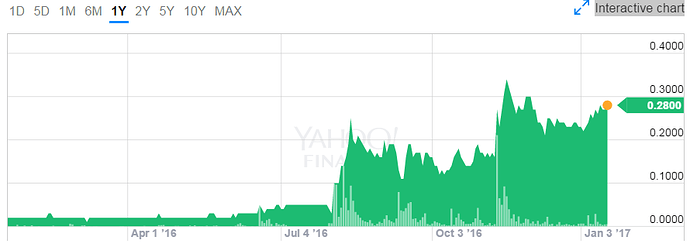

As the chart above shows, the Apivio Board and management team have presided over a share price decline of approximately 39.08% over the one year prior to January 16, 2017, representing a loss of approximately $8.98 million in equity value from its highest point on February 3,2016.

Liquidity. Shareholders currently have limited liquidity based on the trading history of the Common Shares. The aggregate total trading volume for the entire year ended on December 30, 2016 is only 14,538,337 Common Shares, representing less than 28% of the number of issued and outstanding Common Shares. The Offer provides 100% cash consideration at a significant premium for the Common Shares, giving Shareholders certainty of value and immediate liquidity, with the added benefit of the opportunity to sell their Common Shares free of broker commissions and fees for those who deposit their Common Shares directly with the Information Agent and Depositary.

Fully Funded Cash Offer. The Offer is not subject to a financing condition. The Offeror will fund the entire Offer from available cash resources.

Low Likelihood of a Competing Offer. The Offeror believes that Apivio is unlikely to receive a competing offer at a premium to the price being offered by the Offeror.

Avoid Uncertainty of Continued Investment in Apivio. Apivio faces significant challenges that represent a substantial risk for Shareholders going forward, including:

Apivio Dependent on Moimstone. Apivio’s financial health is dependent on its wholly-owned Korean subsidiary, Moimstone, which represents approximately 95% of Apivio’s overall revenues for the 2014 and 2015 fiscal years. Apivio’s performance in North America, independent of Moimstone, has been flat, with its major sales to date consisting of a $2.6 million contract for the UT880 Monet series VoIP phone and a $0.2 million contract for the Wi-Fi Liberty series, Liberty L1 product in 2015. To put these numbers in perspective, Apivio spent roughly the equivalent amount in North America on research and development and marketing expenses.

Moimstone Faces Stagnating Market in Korea. While Apivio depends on Moimstone for the bulk of its revenues, Moimstone’s own future growth prospects face significant headwinds and appear limited. Moimstone operates in the relatively mature market of Korea’s VoIP telephony industry where it already enjoys a 95% market share. In this context, the Offeror and Nuri believe any further growth for Moimstone will necessarily involve significant market and execution risks.

Thin Market for High End Products. As a cornerstone of its business plans, Apivio’s management team has devoted substantial resources to developing high-end products such as the UT880 Monet series VoIP phone for NEC America and the Wi-Fi Liberty series units for the North American market. However, the market for high-end products in the VoIP telephony market is relatively thin and can quickly saturate. The Offeror and Nuri believe there are significant risks to the high-end product line strategy currently being pursued by Apivo’s management team.

Potential for Downward Impact to Common Share Price if Offer Not Accepted. The Offer represents a significant premium to the market price of the Common Shares prior to the public announcement by the Offeror of its Offer to the Shareholders to acquire Apivio. If the Offer is not successful, and no other offer is made for Apivio, the Offeror believes it is likely the Common Share price will decline significantly below the Offer price.

Lock-Up Agreements

The Offeror has also entered into lock-up agreements (the “Lock-Up Agreements”) with various shareholders of Apivio (the “Locked-Up Shareholders”), including the founder and former CEO of Moimstone, and former board member of Apivio, C.W. Lee. The total number of Common Shares subject to the Lock-Up Agreements represent approximately 10.69% of the issued and outstanding Common Shares. Under the Lock-Up Agreements, each of the Locked-Up Shareholders has agreed, subject to certain exceptions, to accept the Offer by depositing the Common Shares presently owned or controlled by the Locked-Up Shareholder in accordance with the terms and conditions of the Offer.

Filing and Mailing of Offer and Takeover Bid Circular

Nuri has filed the Offer and take-over bid circular and related documents (collectively, the “Offer Documents”) with the applicable Canadian securities regulatory authorities on SEDAR. The Offeror is also mailing the Offer Documents to Shareholders.

Full Details of the Offer are contained in the Offer Documents and Nuri encourages Shareholders to carefully review the Offer Documents and to consider the important information set out therein, including detailed instructions on how to tender their Common Shares to the Offer. Copies of the Offer Documents may be retrieved on the website for the Offer at www.ApivioOffer.com or under Apivio’s profile at www.sedar.com. Shareholders may also obtain copies of the Offer Documents free of charge upon request made to the Offeror’s Information Agent and Depositary, Laurel Hill Advisory Group at 1-877-452-7184 (North American Toll Free), or by email at assistance@laurelhill.com.

THE OFFER WILL BE OPEN FOR ACCEPTANCE UNTIL 11:59 P.M. (TORONTO TIME) ON MAY 2, 2017, UNLESS THE OFFER IS EXTENDED, ACCELERATED OR WITHDRAWN BY THE OFFEROR IN ACCORDANCE WITH ITS TERMS.

Shareholder Questions

If you have any questions regarding the Offer or require assistance with tendering your Common Shares, please call the Information Agent and Depositary for the Offer, Laurel Hill Advisory Group, toll free in North America at 1-877-452-7184 (+1-416-304-0211 outside North America), or by email at assistance@laurelhill.com.

Est-ce que certains suivent le titre d’American Manganese (AMY.V)? Ils ont développé un procédé pour récupérer le Lithium, Cobalt et autres produits des batteries de véhicules électriques. Un potentiel énorme dans les prochaines années avec la quantité de batteries de véhicules électriques à la fin de leur vie utile.

http://www.americanmanganeseinc.com/wp-content/uploads/2016/11/Amy_FactSheet_20161.pdf

Nouvelle ce matin pour AMY

http://finance.yahoo.com/news/cycling-spent-electric-vehicle-batteries-110000633.html

Bon vieux AMY.v, dire que j’ai déjà était actionnaire quand ca valait 0.02$ il y belle lurette

Wow, merci beaucoup d’avoir partagé la reponse JPA, tres apprécié!

Donc, un investisseur accrédité pourrait poursuivre une compagnie s’il perd tout? En cas de fraude flagrante j’imagine ?

En tout cas, merci de l’info!

Non c’est le contraire. Un investisseur accrédité est réputé comme quelqu’un qui comprend bien les risques et il ne peut pas poursuivre la compagnie.

Au fond, cette règle cherche à protéger les petits investisseurs qui seraient susceptibles de se faire avoir par des promoteurs malhonnêtes. L’investisseur non-accrédité pourrait poursuivre la compagnie s’il perd son argent. C’est donc la responsabilité de l’entreprise de s’assurer que tous les investisseurs qui participent à un placement privé sont accrédités et ce, dans le but d’éviter des poursuites potentielles.

Et comment ses sociétés font-elles pour s’assurer que vous êtes un investisseur accrédité? On vous demandera simplement si vous en êtes un ou non sans demander de preuves. Dans tous les cas, il vous sera impossible de poursuivre la société même si vous n’êtes pas honnête.

Dans un autre ordre d’idée, le film GOLD qui sera bientôt a l’affiche est inspiré du scandale BRE-X qui a eu lieu dans les années 1990 qui a été une des plus grosse escroquerie boursière au Canada Gold: The movie about the Bre-X mining scandal that ‘isn’t about Bre-X’

Rendu + 300% depuis le premier post @ 3,83$.

Bonne leçon. Et moi qui a privilégié PKT à la place haha

NPA.V Alphinat vient de déposer son premier trimestre, comme je l’avais mentionner ce titre va surement rebondir, vraiment sous-évaluer a $0.04 Alphinat earns $259,243 in Q1

Structure des actions

Common Shares: 50,213,220

Insider Holdings: 23,447,985 or 47%

Aucun warrants en circulation

Mon gros point d’interrogation avec NPA et présentement l’encaisse et les dettes. L’entreprise semble toutefois sur la bonne voie.

+125% ce matin

@midard

Est ce ton post qui a trigger la hausse d’aujourd’hui?

Je pense que oui haha.

Comme @simonfisc le dit, le gros problème est les liquidités à court terme en date du 30 novembre. Beaucoup de gros payables à faire avec des gros comptes clients non encaissés. Mais nous sommes 3 mois plus tard.

Aussi, comme risque important il y a la concentration des clients.

@pbergeronbelanger @MathieuMartin Est ce que ça se fait sollicité une business pour un placement privé? Ils ont l’air en besoin de cash pour continuer de grossir.

Non je ne crois pas que ces moi, le titre a été aussi mentionné par Scott Fetsenthal dans le MicroCap club celui-ci en a fait une thèse d’investissement. Malgré les problèmes de liquidité tel que mentionné Alphinat a fini l’année dernière avec un petit cash flow positif. Il semble avoir une augmentation des ventes. Les trimestres semblent aussi irrégulier, il est préférable selon moi de le regarder sur une base annuelle. J’avais une petite position sur le titre à $.04, j’en ai vendu une partie aujourd’hui sur un ordre de vente qui à été déclenché $0.10

Oui ça se fait, cependant je préfère généralement investir dans un placement privé qui permet à l’entreprise d’investir dans sa croissance plutôt que de rembourser des vieilles dettes.

Alphinat est intéressant mais le bilan est trop risqué pour moi à l’heure actuelle.

D’accord avec toi.

Le deal que je proposerais dans le cadre d’un investissement privé inclurait que les détenteurs debentures convertissent leurs dettes en actions.

Cette compagnie sans dette avec 500M -1000M de cash pourrait avoir un potentiel de croissance interessant