Nouvel article sur le blog: Le Qui, Quoi, Où, Quand et Pourquoi de l’investissement dans les Microcaps – Partie 1

Urbanimmersive annonce la conclusion d’un placement privé d’unités de 1 395 240 $

Bien content pour Urbanimmersive, cela va leur donner la possibilité de continuer sur leur belle lancée!

The Golden Plan From Here

July 18th, 2016

A slow n steady summer will lead into a frantic fall for precious metals. Here’s the plan.

Precious metals are the only option for security and value in our world of ultra-low or negative real interest rates, currency market volatility, and impotent central banks.

More and more investors are reaching this conclusion. That’s why gold is already up almost 30% this year – but it is also why I expect to keep inching up all summer and into the fall.

The gold chart supports my contention. It is developing a clear pattern of higher highs and higher lows. And the price is getting very close to conquering its downtrend line from the 2011 high.

It is roughed in on this chart, but the crosspoint is US$1,377 per oz. A bit of a step up from here and a momentous achievement it would be, but I’m betting it happens before the end of summer.

Also significant: if anything were to have pushed gold down, it would have been a strong US jobs report. And that is precisely what we got nine days ago: payrolls in America increased by 287,000 jobs in June, the largest gain since October. Gold did drop on the news…for 5 minutes. It fell from US$1,360 to US$1,335 per oz. in a matter of minutes and then rebounded completely before settling into the US$1,350-per-oz. range for the day.

The takeaway: for gold, flat is the new down. And that is the mark of a true bull market.

The price has moved steeply enough that another consolidation phase is likely, including pullbacks of a few percent. But remember: while reactions to individual news events – a Fed announcement, a stimulus move from the UK, or whatever – will move the gold price on a daily basis, the lack of other options for yield or returns is the real driving force behind gold’s ascent – and that is here to stay for some time.

Because of all this, I am now of the mentality that gold will end the year between US$1,400 and US$1,500 per oz.

The Plan

What will gold’s continued gains mean for equities?

Good question. And a timely one.

The GDX Gold Miners ETF has multiplied 2.5-fold since the start of the year. The GDXJ, the counterpart junior gold miner ETF, has multiplied 3.9-fold. There is no ETF for development-stage gold companies let alone exploration-stage entities, but the multiples would be interesting to see. I would wager that developers are up somewhere in between senior and junior miners while explorers have enjoyed the smallest multiples so far.

But that will change.

Investors moved first into big and medium miners. Nice gains on those buys are enabling some selling, which releases money for new, riskier buys. It’s the classic trickle-down effect. However, I think the nature of who participated in the rally to date will impact the timing of the trickle.

To those of us involved in this sector, it feels like everyone knows about gold, like everyone has put their chips into play. But that just isn’t the case. Many of the returns enjoyed to date have come largely from inside – sector players betting on themselves and each other at the start of a new gold bull.

The thing is, by the time July rolled around industry insiders were exhausted, physically and financially. They need a vacation from investing and need to take some money off the table to have cash available for the fall. I have literally spoken to dozens of guys who are tapped out – they’ve put all their available investing capital to work and are now waiting until the next stage of the game. This lack of capital and need for a break will mean a quieter period at least through July, as people literally go on vacation.

Then they will come back…and free trading dates will start coming fast and furious.

Think back to the start of the year. Financings had been deadly quiet for almost two years, until gold showed some life. It took a bit before people mustered up some confidence the gains would hold – and then everyone went out and raised money.

The biggest and most confident companies, like Franco Nevada, raised right away in February. Developers and explorers had to wait until the market was more confident, which meant some raised in March, or raised a small amount in March, but many did not close until April or May.

Financings have four-month hold periods. Generally, the share price trades highest three months after the financing close date – or one month before the new shares become free trading. The lowest point happens somewhere in the first two weeks after the new shares come free.

These time frames are upon us for the big companies that raised earliest. For the majority of explorers and developers who raised in April and May, shares will come free trading in August and September.

That’s one timing aspect to consider. The other is the big-picture trickle down effect.

Funds increasingly want to get into gold. The bigger the fund, though:

The more time it takes to prepare for a change in investment rationale, such as a move into gold.

The harder it is to find places to invest big piles of cash.

A friend used a good analogy for this: imagine these funds like massive ocean-going freighters. For a freighter like that to change course takes time. Once it has faced itself the right direction, it takes more time again to establish some forward momentum.

Funds are figuring out those shifts now and are seeking places to invest. That is the next stage of the bull market, wherein fuel comes not just from engaged retail investors and small, nimble fund managers, but from the mega-money managers driving these freighters.

So what’s the plan?

Look at every stock you own and see when they financed. If a free-trading date is approaching, create a plan.

If you want to add to your position, the time to buy is shortly after the shares come free. If you want to cash in a gain, look to sell approximately a month before the free trading date.

More generally, I think junior gold companies will see slow but sustained gains between now and Labour Day, excepting the ups and downs around free trading dates. Once September hits I think the freighters will be ready to move and industry participants, refreshed from a summer break and with some cash in hand from locking in gains, will be ready to play again.

And things will really heat up. So take advantage of this pause to make a plan.

Pour ceux que ce intéressent, Canopy Growth CGC.V anciennement Tweed, la compagnie la plus sérieuse dans le domaine du cannabise médical au Canada vien de signer une entente avec des pharmacies Allemande pour de la distribution dans leurs points de vente.

De plus la compagnie va quitter le venture et va passer au TSX

http://web.tmxmoney.com/article.php?newsid=8398438901742605&qm_symbol=CGC&mobile=false

Bref le titre à monté de 14,5% aujourd’hui

Yup, le canabis va s’échauffer en vue de la légalisation l’an prochain

Deuxième partie de notre dernier article: Le Qui, Quoi, Où, Quand et Pourquoi de l’investissement dans les Microcaps – Partie 2

Les contrats s’accumulent chez Luxor LRL.V

Luxor unit receives $2M (U.S.) framing contract

2016-08-03 08:05 ET - News Release

Mr. Terry Lashman reports

LUXOR’S MILL FRAME LLC AWARDED A $2 MILLION TURNKEY FRAMING CONTRACT FOR THE ALEXAN 100 PROJECT IN SEATTLE, WASHINGTON BY VENTURE GENERAL CONTRACTING

Luxor Industrial Corp.'s U.S. subsidiary, Mill Frame LLC, has been awarded a turnkey framing contract for the Alexan 100 project in Seattle, Wash., by Venture General Contracting. The contract valued at approximately $2-million (U.S.) is expected to commence in March, 2017. The Alexan 100 contract is the second awarded by Venture to Mill Frame LLC for 2017 with each contract valued at approximately $2-million (U.S.).

Luxor’s 2017 U.S. framing contracts now total approximately $4-million (U.S.) or $5-million. Luxor’s 2016 U.S. framing contracts total approximately $19-million (U.S.) or $25-million. Mill Frame LLC continues to quote on 2017 projects as well as additional business for 2016.

We seek Safe Harbor.

Encore un autre contrat pour Luxor LRL.V

Luxor wins $650,000 (U.S.) framing contract with PHC

2016-08-04 10:09 ET - News Release

Mr. Terry Lashman reports

LUXOR’S MILL FRAME LLC AWARDED A TURNKEY FRAMING CONTRACT IN BAINBRIDGE ISLAND, WASHINGTON BY PHC CONSTRUCTION

Luxor Industrial Corp.'s U.S. subsidiary, Mill Frame LLC, has been awarded a turnkey framing contract in Bainbridge Island, Wash., by PHC Construction. The company has commenced installation for this project, which is valued at approximately $650,000 (U.S.). Mill Frame Inc., Luxor’s Canadian subsidiary, management has known PHC for over 20 years and has done previous projects with PHC. Mill Frame LLC has been encouraged by PHC to bid on future projects.

The PHC contract demonstrates Luxor’s ability to quote on and secure projects on short-term notice. Since Luxor entered into the turnkey framing business at the beginning of 2016, it has secured framing contracts in excess of $30-million in the United States and Canada.

Wow, énorme dilution. On va plus que doubler les O/S si les warrants sont exercés.

«__In connection with the private placement, the company paid cash finders’ fees to certain finders in the amount of 10 per cent of gross proceeds raised._»

Par curiosité, c’est standard un 10% de finders fee? Est-ce que quelqu’un sait qui détermine ce pourcentage là?

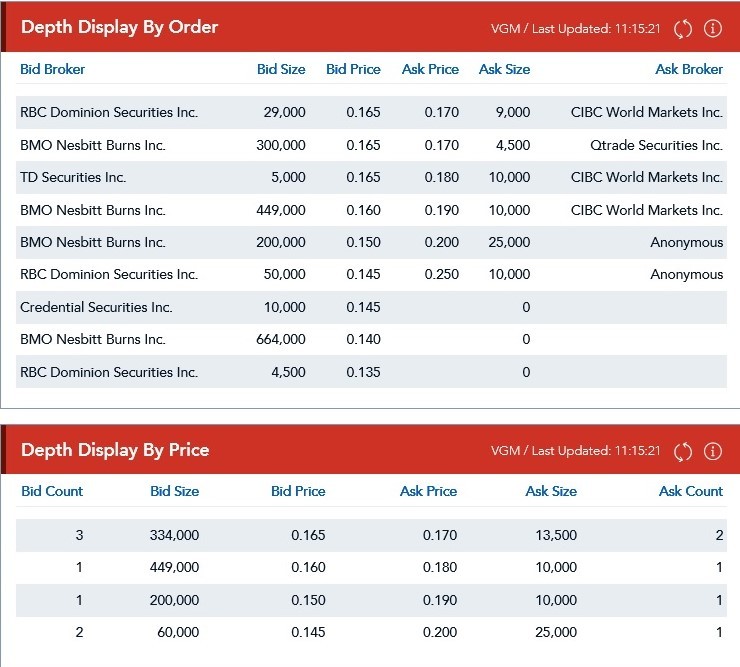

Beaucoup de dilution en effet, il mise beaucoup sur la croissance aux Etats-Unis. le titre a beaucoup de support provenant de BMO comme on voit sur le level 2

Quand même impressionnant de lever $5M pour une aussi petite compagnie et à ce stade-ci surtout.

J’ai l’impression que la dilution, surtout à ce prix là et avec des warrants, va mettre un certain plafond sur le prix de l’action pour plusieurs mois.

Juste mentionné que si vous avez un titre qui se transige sur le CSE tel que VGM-C le level 2 est gratuit. Canadian Securities Exchange

TTM.V un rapport de recherche sur 3tl technologies a été émis par Seethru equity avec un prix cible de $0.35

initiate coverage of 3TL Technologies

A mettre sur la liste de surveillance, bonne croissance pour cette compagnie avec un float de 16M d’actions

Vigil Health earns $196,283 in Q2 2016

BPL.V Bluedrop performance à fait dernièrement un “royalty deal” avec Grenville royalty et vient maintenant de sortir son Q3 et la croissance est au rendez-vous. Bluedrop Performance earns $200,000 in Q3 2016

BPL.V suite au Q3 d’hier le titre a baissé de 20% aujourd’hui, quand même étonnant, je crois que BPL.V mérite un meilleur sort. La compagnie a un backlog de plus de 45 million, a des contrats provenant de Boeing et Sikorsky. La société paradigm a émis ce commentaire aujourd’hui;

Conclusion (from paridigm intraday report on August 24 2016): BLP continues to deliver on milestones in each of its two operating divisions, with Q4 expected to post similar levels of y/y growth. Shares are up 200% YTD. Despite that, BPL still trades below both Learning Network and T&S comps, at 5.9x 2017e EV/EBITDA versus T&S peers at 10x and LN peers at 19.7x. The next 12 months could be transformative for BPL on the back of the Boeing program, with long awaited pilot deliveries starting next quarter. We remind investors this could double T&S’s current revenue with just 10 units sold.

http://ottawacitizen.com/news/national/defence-watch/the-latest-update-on-defence-contracts-awarded

J’ai initié une position dans EnWave Corp (ENW.v) hier et aujourd’hui entre $1.20 et $1.30 - le titre n’est pas nécessairement une aubaine à 6x les ventes, mais je crois avoir affaire ici à une compagnie plateforme avec beaucoup d’optionalité.

Plus de détails bientôt, je vais essayer de partir un nouveau sujet sur la compagnie dès que j’ai plus de temps.