QUICK PITCH: Brand new healthcare listing. Strategic partnership with Rexall (Mckesson) since 2018 to develop the “Be Well” Pharmacy app. Also seeking to develop and commercialize a unique COVID-19 screening solution, ‘My Vitals’, which can assess the risk of COVID-19 and other flu-like illnesses in under two minutes using only a smartphone camera. This technology is under development and its viability is yet to be seen

What does Carebook do?

Carebook provides digital health solutions and virtual care for pharmacies, insurance providers, employers, governments and individuals. Through its digital platform, the Carebook ecosystem model connects and empowers businesses and people on their health journey. To do so, the Company has assembled experts in the fields of health, digital engagement, engineering and design along with advisors from the pharmacy industry.

Carebook has three main business verticals:

i) Pharmacy

ii) Virtual Care

iii) Insurance

Partnership with Rexall

To develop its Pharmacy vertical, in 2018 Carebook partnered with Rexall Pharmacy Group Ltd, the operating arm of Rexall Health retail pharmacies of McKesson Canada (“McKesson”). Rexall Health is Canada’s second largest pharmacy chain. This relationship has led to establishing the critical customer-facing expertise for the development a leading pharmacy management, loyalty and engagement product.

On May 1, 2020 Carebook launched the Rexall Be Well Pharmacy app in Canada on iOS, Android and web-based.

Key differentiators to Carebook’s product revolve around its ecosystem model. It harnesses digital innovation by using a Software-as-a-Service (“SaaS”) licensing model to:

i) connect pharmacies, clinics and employers to patients and consumers,

ii) support revenue streams from multiple features that are built in a modular fashion

iii) operate at little or no costs to consumers while providing maximum value to personal health and well-being.

This is further coupled with the formation of powerful partnerships, such as that of Rexall Health. The product also integrates modern technological concepts such as gamification, engagement (through loyalty offers and action centers) and eventually, artificial intelligence capabilities.

Growth Opportunities

Carebook is currently building a growing pipeline of opportunities as it relates to the pharmacy, insurance, and virtual care verticals. The Company’s approach for the pharmacy and insurance verticals is similar. Its focus has been to enter each market with a Canadian anchor client and develop a tailored digital platform by vertical, which can then be rebranded and offered to similar clients in other countries. The Company’s approach to the virtual care segment relies on integration of a third-party technology. The Company pursues growth opportunities by identifying different markets through product diversification such as patient triage, patient monitoring and back-to-work solutions.

How has COVID-19 affected Carebook?

With the emergence of the COVID-19 pandemic in March 2020, Carebook sought to repurpose some of its core technology platform to develop and commercialize a COVID-19 screening solution. Leveraging licensed leading AI 32 technology, Carebook developed “Carebook My Vitals | COVID-19” (“My Vitals”), a screening and triage tool that allows individuals and clinicians to get real-time vital signs measurements with their smartphone camera.

Specific vital signs are impacted when there is an infection in the lungs, which can be caused by the COVID-19 virus. During lung infection, also known as pneumonia, inflammation reduces the ability of lungs to take up oxygen. This is reflected in abnormal oxygen saturation, heart rate, and respiratory rate.

For people who are experiencing COVID-19 symptoms, but who have not yet been diagnosed, vital sign measurements can help determine the best course of action, as recommended by top health professionals and organizations.

For those who have been diagnosed, monitoring vital signs from home helps health professionals decide when patients can continue to stay at home or when they need go back to the hospital.

-

Blood oxygen saturation levels drop.

-

Heart rate increases due to lower oxygen levels.

-

Respiratory rate increases as the body tries to get more oxygen.

Monitoring these three vital signs at home during the COVID-19 pandemic can help health professionals triage patients and make clinical decisions about patient care.

The application was designed and tested in collaboration with the Jewish General Hospital in Montreal, Canada, and is based on up-to-date COVID-19 guidelines from WHO, Government of Canada, and Government of Quebec. Carebook is currently seeking approval from Health Canada for the My Vitals tool.

Financial Statements & Capital Structure

Below is a cap table for Carebook Health Technologies. Post-RTO, the company has 44,930,983 fully diluted shares outstanding. The company raised ~$20M at a price of $2.50 in connection with the RTO. However, ~$7.6M was used to repay debt obligations and ~$5.33Mwas used to redeem 5,330,000 shares at a price of $1.00.

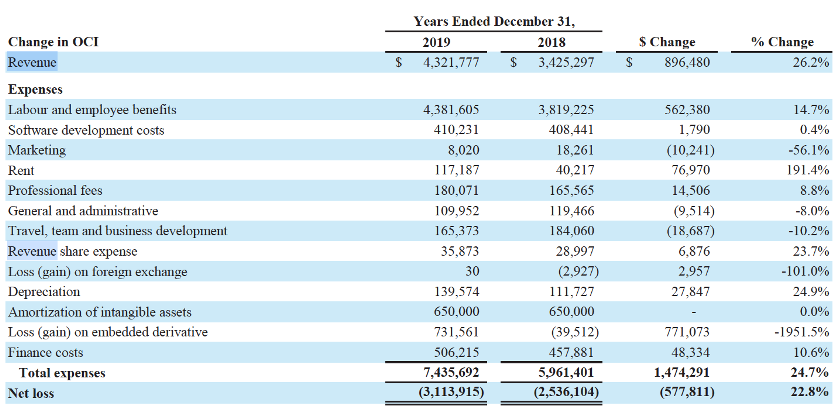

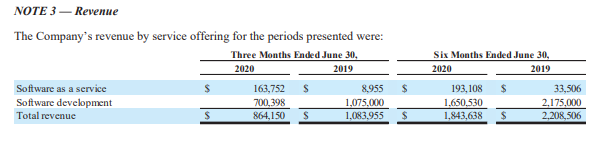

Revenue in 2019 was $4,321,777 compared to $3,425,297 in 2018. The increase of $896,480, or 26.2%, is attributed primarily to growth driven by its core pharmacy product within its pharmacy vertical. Virtually all the revenue in 2019 (and 2018) was attributed to the pharmacy vertical and the development of the pharmacy application.

Carebook is not currently cash-flow positive. Total comprehensive loss was $3,113,915 for the year ended December 31, 2019, compared to a loss of $2,536,104 for the same period in 2018, an increase in loss of $577,811, or 22.8%. This is primarily due to labour and software development costs of building its virtual care platform.

The CRBK business model seems to be more speculative than WELL, DOC, JNH. Great backers and some interesting Israeli tech if it really works. I’m sceptical. They can use a phone camera and Algos to do a lot. Can measure HR, respiratory, alcohol, glucose, BP. This eliminates need for lots of wearables. Still remains to be seen. But if they do manage to succeed with their submission to Health Canada for the MyVitals app, the stock may see explosive growth. And even if that fails, they still have the virtual pharmacy vertical (rexall partnership) which is generating $4M revenue per year right now as well as the insurance vertical. Not a lot but its an anchor clients in other countries and markets.

But with more risk, comes reward. If CRBK can successfully attract new clients for its virtual pharmacy platform and build upon on its insurance, and virtual care verticals as well, then I would expect the share price will get a significant rerating as it is currently trading at only 3x EV/sales compared to the peer group average of 9x.