Rêves brisés

Je suis impressionné par le nouveau CEO. Il ne niaise pas.

(J’ai vendu ma position il y a quelques temps pour re-rentrer dans URL. Si je n’avais pas eu besoin d’argent, j’aurais gardé les 2.)

Perso j’ai tout vendu quand le premier PP était vendable.

Je vais attendre de voir des resultats concrets avant de rerentrer

Atlas Engineered Products’ Satellite Plant Doubles Capacity

“Our partnerships with clients continue to grow as we move towards a turn-key construction project solutions model for Satellite, and for all our current and future locations.”

The new 14’ x 60’ Roller Gantry increases assembly by as much as 60%, while the linear feed custom cutter saw more than doubles cutting capacity.

Semble y avoir eu un cross aujourd’hui,

Beacon Securities a acheté 500 000 actions.

Dirk Maritz continue d’exécuter sur sa stratégie :

New Lumber Supply Agreement Reduces Costs and Increases Cash-Flow

Canada NewsWire

NANAIMO, BC, June 11, 2019

NANAIMO, BC, June 11, 2019 /CNW/ - Atlas Engineered Products (“AEP” or the “Company”) (TSX-V: AEP; OTC Markets: APEUF) is pleased to announce completion of a new, guaranteed lumber supply agreement (the “Agreement”) for five of its operating facilities. The Agreement is expected to result in cost savings of up to 14.7% per facility depending on plant location, and potentially result in between $750,000 and $1,000,000 in additional cash flow for the Company due to the favourable consignment terms.

“This agreement, with an experienced private company with operations across Canada and the Western US, is part of AEP’s strategic plan to capitalize on the efficiencies of consolidating the engineered wood products industry,” said AEP CEO Dirk Maritz. “All of our current facilities in BC, Manitoba and Ontario will benefit from this supply certainty and cost savings.”

In addition to the immediate bottom line benefits, the guaranteed lead times, re-order and delivery elements of the Agreement will make a significant impact on client satisfaction and project schedules.

“The seasonality of the lumber business and construction industry has, in the past, resulted in supply and delivery challenges for all manufacturers of roof and floor trusses, wall panels, windows and doors,” explained Executive VP Hadi Abassi. “This comprehensive approach to lumber supply will ensure we receive full load deliveries throughout the busy summer building season, a competitive advantage for our clients.”

Atlas Engineered Products Reports Record Revenue and Net Income for Q2 2019

Solides résultats pour Atlas. J’avais mentionné en mai dernier avoir été impressionné suite à ma rencontre avec Dirk, le nouveau PDG. J’aime toujours sa vision, qui est d’ailleurs bien détaillée dans le rapport de gestion. Jusqu’à présent, l’exécution est au rendez-vous.

Lettre du PDG aux actionnaires: https://www.atlasengineeredproducts.com/news/letter-to-shareholders-q2-2019

Acumen Capital commence à suivre AEP (pas de couverture encore). Un de leur analyste a publié la nouvelle dans son rapport ce matin :

Atlas Engineered Products (AEP-V) – Not Covered, $21 M Mkt Cap

AEP-V – Management Update:

- AEP acquires and operates well established companies in Canada’s truss and engineered wood products industry.

- Products and Services – AEP’s products include floor joists, floor trusses, floor panels, roof trusses, wall panels and windows. AEP also provides various services including design, engineering, permitting, project management and site assembly.

- Roll-up Strategy – Since November 2017, AEP has acquired 6 companies spanning across Canada (BC, Manitoba and Ontario). AEP targets companies with annual revenue of between $3-$15 M of which there are hundreds of acquisition opportunities across Canada (highly fragmented industry). Notably, AEP has become a preferred exit choice for many of these smaller companies.

- Post Acquisition Synergies – Once acquired, AEP implements it’s processes, enhances efficiencies, rips out costs and improves overall company operations. This leads to increased margins and a significant improvement in overall company profitability.

- Macro Trend – Mgmt. highlighted the growth in popularity of multi-family and multi-floor residential wood-framed buildings as affordable housing drives increased consumption of engineered products.

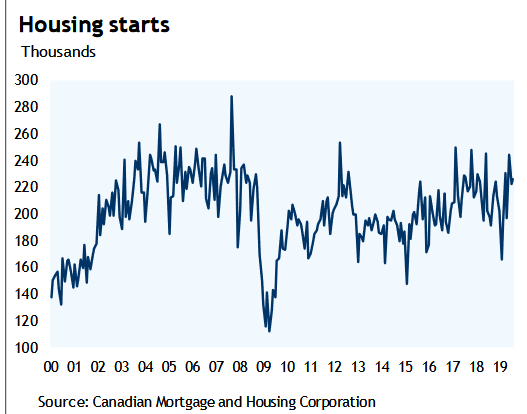

- Growth Drivers - Key drivers of the business include – 1) value of residential construction 2) housing starts 3) value of non-residential construction 4) CAD dollar exchange rate.

- Addressable Market – The addressable market for trusses, joists, and engineered beams in Canada = $1 B. Adding in prefabricated walls and floors = $2.5 B.

- Organic Growth – Mgmt. highlighted ~20% organic growth Y/Y in AEP’s founding Nanaimo market. Notably, AEP’s Nanaimo business has grown from $8 M in revenue to $16 M over a 2 year period. Overall industry growth from 2012-2017 has averaged 8.8%.

- Secret Sauce – AEP’s design, engineering, and speed of construction is what sets it apart from its competitors. Notably, the company is able to construct a 2,100 sq ft house to lock up (roof, windows and doors) in 5-10 days vs the standard time of 8 weeks.

- Note, AEP has the facilities and infrastructure in place to generate north of $100 M in revenue.

- Automation – Only a few of AEP’s facilities are currently automated representing a significant opportunity to further increase automation across its existing facilities.

- US expansion – Mgmt. highlighted the US market as a significant opportunity for AEP. The company is currently working on a small boutique hotel in Michigan, which Mgmt. is particularly excited about.

- EBITDA Margins – The company noted that is current run rate EBITDA margin = 15%-17%. With additional plant automation and operational efficiencies, Mgmt. expects ongoing improvement in margins.

- FCF – Mgmt. expects to generate between $3-$4 M in FCF in 2019 = strong FCF yield and ROIC.

- Capex – AEP has minimal capex and expects to spend ~$1 M in 2019.

- Balance Sheet – The company currently has ~$12 M in net debt (~1.9x net debt/EBITDA). Note, debt includes $3 M (IFRS) from lease obligations.

- Outlook – For 2019, Mgmt. expects to generate between $40-$50 M in revenue and $6-$7 M in EBITDA.

- Valuation – AEP currently trades at ~5.0x 2019 EV/EBITDA.

Pris sur un autre forum :

This from latest RBC Economics report- bodes well for companies like AEP.

Another strong month for homebuilders.

Housing starts picked up to 227,000 annualized units in August, building permits for July came in at a solid 221,000. Canada’s housing recovery is on. The 6-month trend in housing starts is now just shy of 2017’s annual pace, which was the fastest in a decade. The pickup in starts, after a slowdown through much of 2018 and the first half of this year, mirrors a recovery in resale markets in recent months. The residential sector added to growth in Q2 for the first time in more than a year, and it looks like we’re in for a repeat performance in Q3. Regionally, the trend in housing starts in Quebec and BC is running close to cycle highs while the Prairies are seeing a modest recovery. Ontario, which was a laggard over the first half of the year, saw a nice increase in August and that helped the 6-month trend hook higher.

J’ai rencontré Dirk (CEO) et Melissa (CFO par intérim) au Fall Investor Summit plus tôt cette semaine. Voici quelques notes:

-

Au dernier trimestre, l’amélioration de la marge brute était le résultat de quelques facteurs:

– Économies sur les matériaux grâce à une nouvelle entente d’approvisionnement pour le bois de charpente.

– Meilleure efficacité dans les processus de fabrication.

– Restructuration des services de design. -

Le 3e trimestre est généralement le plus fort de façon saisonnière. Cette année, la saison de construction a débuté un peu plus tard qu’à l’habitude donc l’activité devrait déborder dans le 4e trimestre et générer de bons résultats également.

-

À long terme, Dirk croit qu’il serait possible d’atteindre 40% de marges brutes (avec 20% de marge BAIIA) grâce à plus d’automatisation des usines.

-

L’entente avec Mitek procure plusieurs avantages:

– L’accès à un logiciel de design à la fine pointe de la technologie

– Des prix préférentiels sur les plaques d’acier (connecteurs)

– Des services de consultation gratuits pour l’optimisation des usines (l’objectif de Mitek étant éventuellement de vendre des équipements d’automatisation à Atlas)

– La possibilité de faire sous-traiter des services de design par Mitek lors de la saison forte quand la demande est trop importante pour l’équipe d’Atlas. -

Dirk estime que le CapEx (investissement) requis pour augmenter l’automatisation de toutes les usines à un niveau satisfaisant est entre 3 et 5 millions $.

-

La dette bancaire a été légèrement restructurée récemment (voir les derniers états financiers). Il s’agit de la phase 1 et le management tente d’apporter d’autres changements afin que la dette s’agence mieux à la saisonnalité de l’entreprise.

-

L’entreprise est toujours à la recherche active d’acquisitions potentielles. Au cours des derniers mois, Dirk semblait plus réticent puisqu’il voulait d’abord atteindre la profitabilité. Les éléments importants semblent maintenant être en place pour aller de l’avant si une bonne opportunité est sur la table.

En date de janvier 2019 :

source : http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/vebitda.html

Substantiellement sous-évalué selon ces comparables si les chiffres projetés de 2019 sont atteints évidemment.