J’ai obtenu le rapport de SeeThruEquity aujourd’hui. Si vous le voulez écrivez-moi en privé!

C’était pas le genre de placement auquel je m’attendais. C’est bien que la dilution ait été gardé au minimum à ces prix-là. Un seul investisseur aussi :

Additionally, UGE has closed a private placement offering totaling 1,250,000 units (the “Units”) from a single investor at a price of $0.35 per Unit for aggregate gross proceeds of $437,500. Each Unit consists of one common share in the capital of the Company and one common share purchase warrant, with each Warrant being exercisable for one common share at an exercise price of $0.40 per share for a period of 24 months from the date of issuance. Net proceeds of the Offering will be used to fund the Company’s general working capital. All the securities issued pursuant to the Offering will be subject to a four-month hold period which will expire four months and one day from the date of closing.

Le communiqué de presse complet :

UGE LEVERAGES ENGINEERING EXPERTISE TO HELP NEW MARKETS TRANSITION TO SOLAR ENERGY

TORONTO, ONTARIO - (June 14, 2018) - UGE International Ltd. (“UGE”) (TSX VENTURE:UGE), a global leader in solar energy solutions for the commercial and industrial sector, is proud to announce that it has been contracted to provide engineering services on two independent solar portfolios totaling 1.85MW.

One portfolio, located across eight properties in Nigeria, includes ground-mounted, rooftop, and container-mounted solar systems, primarily for schools and hospitals. This marks the company’s first time doing business in this country. UGE primarily serves Canada, the USA, and the Philippines, however the company is able to extend its reach by offering engineering services as a global business line.

UGE’s multidisciplinary engineering team is comprised of NABCEP certified engineers and licensed professional engineers with experience at the desk and in the field designing pragmatic commercial and utility solar solutions for the real world.

Separately, UGE has been contracted as the owner’s engineer for a portfolio of ground-mounted projects in Maryland. UGE will provide an independent review and reporting of site conditions, project/construction management, facility testing, and commissionin reporting.

“Our in-house engineering team has developed a reputation of excellence over the years and is one of the areas that really sets us apart from industry peers,” said Robert van Duynhoven, UGE’s Vice President of Sales and Marketing. “Our goal is to leverage our comprehensive best-in-class engineering capabilities to assist an industry going through a rapid growth stage.”

Additionally, UGE has closed a private placement offering totaling 1,250,000 units (the “Units”) from a single investor at a price of $0.35 per Unit for aggregate gross proceeds of $437,500. Each Unit consists of one common share in the capital of the Company and one common share purchase warrant, with each Warrant being exercisable for one common share at an exercise price of $0.40 per share for a period of 24 months from the date of issuance. Net proceeds of the Offering will be used to fund the Company’s general working capital. All the securities issued pursuant to the Offering will be subject to a four-month hold period which will expire four months and one day from the date of closing.

UGE Announces Concurrent Offerings of Units and Project Green Bonds

Toronto, Ontario–(Newsfile Corp. - July 30, 2018) - UGE International Ltd. (TSXV: UGE) (the “Company” or “UGE”), a leader in renewable energy solutions for the commercial and industrial sector, is pleased to announce that it has entered into an agreement with Leede Jones Gable Inc. (“LJG”) pursuant to which LJG will act as lead agent with Haywood Securities Inc. (collectively, the “Agents”) to sell, by way of private placement on a commercially reasonable best efforts basis, up to 6 million units (the “Units”) of the Company at a purchase price of $0.27 per Unit for aggregate gross proceeds of up to $1,620,000, with each such Unit consisting of one common share of UGE (the “Common Shares”) and one half of one warrant (the “Warrants”), and with each such whole Warrant being exercisable by the holder for one Common Share at an exercise price of $0.40 per share for a period of 24 months from the date of issuance (the “Unit Offering”). The Agents have also been granted the option (the “Over-Allotment Option”), exercisable for a period of 30 days following the closing date of the Unit Offering, to purchase up to 900,000 additional Units for aggregate gross proceeds of up to $243,000 (being 15% of the maximum Unit Offering) to cover any over-allotments.

In addition, LJG will act as lead agent on the sale, by way of private placement on a commercially reasonable best efforts basis, of up to 2,000 bonds (the “Project Bonds”), secured by projects to be owned by UGE indirectly through a subsidiary, at a purchase price of $1,000 per Project Bond for aggregate gross proceeds of up to $2,000,000, with each such Project Bond accruing interest at a rate of 7% per annum and maturing on the date that is 60 months from the date of issuance. Each purchaser of Project Bonds shall also receive, for no additional consideration, one hundred units of the Company (the “Bond Units”) for every Project Bond purchased, resulting in the issuance by the Company of up to 200,000 Bond Units, with each such Bond Unit consisting of one Common Share and one half of one warrant (the “Bond Unit Warrants”) and with each such whole Bond Unit Warrant entitling the holder thereof to purchase one Common Share at an exercise price of $0.35 per share for a period of 24 months from the date of issuance (the “Bond Offering”).

Lettre aux investisseurs avec un peu plus de couleur sur les green bond :

Good Morning,

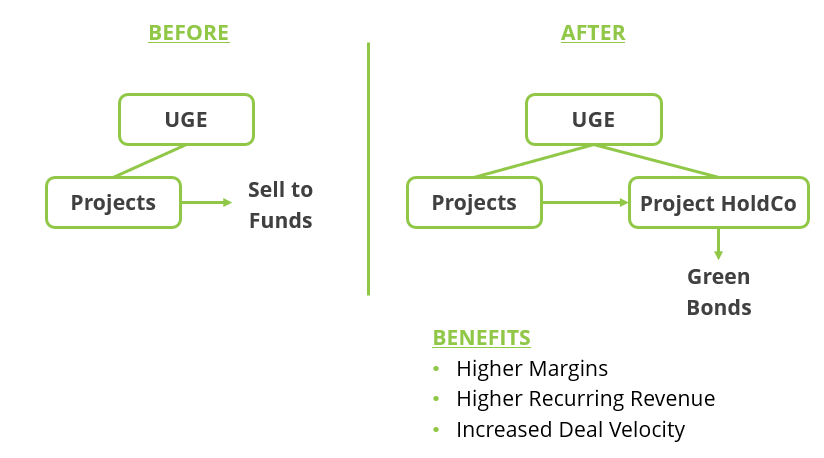

Yesterday we announced our inaugural green bond offering, an innovative and important step in UGE’s growth that will allow us to self-fund projects. Through this approach, UGE will retain more margin and recurring revenue from our projects, while welcoming investors to achieve attractive returns through the green bond product.

Our initial green bond issuance will support a range of solar projects, including a corporate power purchase agreement in New Jersey, a community solar project in New York, and a school in the Philippines. The bonds have a fixed term and yield, and provide retail investors an attractive investment opportunity based on the ever-improving economics of commercial solar.

To date, UGE has sold our projects to a multitude of investment funds looking for such assets. While the approach has been sufficient in our growth to date, we also believe we are leaving significant value on the table by selling the projects upon completion. Issuing “solar bonds” backed by the projects provides an exciting alternative that should provide far more upside for all parties involved as we continue to increase scale.

This is only the beginning. We see an opportunity for UGE to be a leading issuer in this market, and for green bonds to be a key driver of our growth. We forecast that future offerings could help fund $100 million or more worth of solar projects over the next few years.

Not only will green bonds support our rapidly growing backlog; they will also help serve the demand we have been hearing from investors seeking yield. We look forward to announcing additional issuances in response to our growing project backlog and strong investor demand.

As we continue to invest in sales and grow our backlog (which ended Q1 at USD$41.2m), and strengthen our team towards future growth, we concurrently announced a small private placement to further fund the business. The press release describing both offerings can be found here.

As always, please don’t hesitate to reach out with any questions.

Kind Regards,

Nick

Il y a eu suspension des transactions mais le titre devrait recommencer à transiger à l’instant (10h15) :

UGE Awarded Five-Site Solar Portfolio, It’s Largest US Project to Date

TORONTO, Aug. 13, 2018 /CNW/ – UGE International Ltd. (“UGE”) (TSX VENTURE: UGE, OTCQB: UGEIF), a global leader in solar energy solutions for the commercial and industrial sector, is proud to announce that it has been awarded a portfolio of solar projects with a confidential US client, with a total project value in excess of CAD$11 million.

The portfolio consists of five rooftop solar systems, with a scope of work that includes the development, engineering, and deployment of the projects, and is expected to be carried out throughout the remainder of 2018 and most of 2019.

J’ai décidé de tremper un orteil. Si les plans se réalisent, on doublera facilement la valeur boursière. Avec leur backlog actuel c’est intéressant.

j’avais fait la meme chose, je songe à en acheter davantage suite à cette drop impressionnante.

UGE a touché 0.14 aujourd’hui, all time low, qu’est ce que vous en pensez? Occasion d’y entrer (ou rajouter à sa position)? Ma logique: rien n’a fondamentalement changé pour cette entreprise dans les 6 mois précédents, oui les derniers états financiers n’étaient pas fameux mais le plan et les perspectives à moyen terme sont sensiblement les mêmes qu’il y a 1 an (à part les tarifs américains).

C’est là le risque selon moi. Les perspectives d’il y a 1 an ne se sont pas transformées en résultats tangibles. Pour ma part, j’attend de voir des marges brutes à 20%+ et des trimestres profitables avant de conclure que le modèle d’affaires est viable.

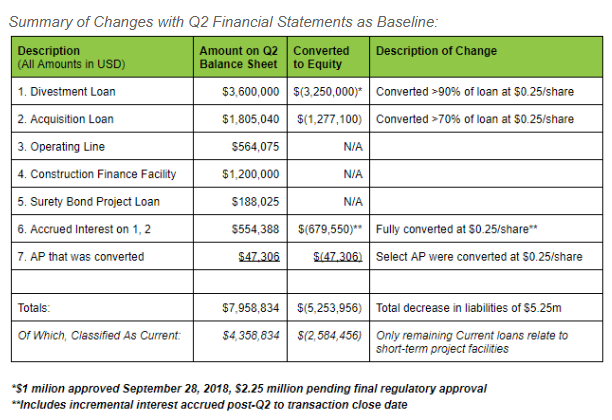

Transactions Result in $5.25 million Decrease in Liabilities, including $2.6 million Decrease in Current Liabilities, and Lower Annual Interest Payments by $0.4 million

Toronto, Ontario–(Newsfile Corp. - October 1, 2018) - UGE International Ltd. (TSXV: UGE) (the “Company” or “UGE”), a leader in renewable energy solutions for the commercial and industrial sector, is pleased to announce it is nearing completion of a series of transactions designed to strengthen its financial position. All amounts are expressed in US dollars, unless otherwise noted.

As of September 28, 2018, seven of eight transactions have received approval by the TSX Venture Exchange (the “Exchange”); the remaining transaction has received conditional approval, pending satisfactory review by the Exchange.

Summary of Transactions

- The series of transactions includes three loans and five accounts payable balances being converted to common shares of UGE. All conversions are being completed at a price of CAD$0.25 per share. Where applicable, a Canadian dollar to US dollar exchange rate of 0.774 was used. No share purchase warrants are being provided in the conversions.

- The sum of the transactions results in a net decrease in liabilities of approximately $5,254,000, including a net decrease in current liabilities of approximately $2,584,000. A total of 27,152,226 common shares of UGE will be issued in the transactions, including 13,251,200 which were issued on September 28, 2018, and 13,901,026 that are pending final approval, as noted above.

- One of the loans converted was formerly a CAD$2,400,000 loan from the M.H. Brigham Foundation, due on demand. In exchange for this loan, a new CAD$750,000 three-year loan was issued, paying quarterly interest of 8% per annum. The remaining CAD$1,741,123, which includes accrued interest, was converted to common shares of UGE.

- Two of the loans being converted are ones that were issued in UGE’s divestment of its former wind subsidiaries in 2016. The two loans were for $1,000,000 and $2,600,000. The smaller loan, along with accrued interest, has been converted to common shares as of September 28, 2018. In exchange for the larger loan, a new $350,000 loan will be issued, paying quarterly interest of 8% per annum over a three-year term. The remaining $2,689,848, which includes accrued interest, will be converted to shares of UGE once final approval is granted by the Exchange.

- The five accounts payable totaled $47,306 and were converted in full to common shares of UGE.

- As of Friday, September 28, 2018, the seven transactions that have been completed, as described above, decrease liabilities by $2,564,107. The remaining conversion, once approved, will decrease liabilities by the remaining $2,689,848, resulting in a total decrease in liabilities of approximately $5,254,000.

“We are pleased to have received such a strong vote of confidence from our partners,” said Nick Blitterswyk, CEO of UGE. “Our second quarter 2018 results did not meet our goals, but we are confident that we have made the necessary adjustments to be a significant player in the fast-growing commercial solar sector for many years to come. These transactions significantly improve our balance sheet and overall financial position, putting us in a stronger and more flexible position as we continue to target additional growth opportunities.”

Status of Previously Announced Equity Financing

The Company also announces that the equity financing announced by press release on July 30, 2018 has been cancelled. The Company believes that the conversion transactions announced today are a significant step forward in helping the Company achieve its goals and continues to consider alternative financing options. In addition, since the release of the Company’s second quarter results, selling, general and administrative expenses have been cut by approximately 15%.

Exercise of Special Warrants

The Company would like to announce that Xiangrong Xie, a member of UGE’s board of directors and a Control Person of the Company, has exercised 2,000,000 Special Warrants for 2,000,000 common shares of UGE. The Special Warrants were acquired in connection with UGE’s Qualifying Transaction on July 28, 2014, with each Special Warrant exercisable for one common share for no additional consideration. After the exercise there are 3,100,000 Special Warrants remaining, held by the founders of the Company, Nicolas Blitterswyk, Yun Liu, and Xiangrong Xie.

La lettre aux investisseurs contient un tableau un peu plus concis sur les changements :

Énorme dilution mais un mal nécessaire…Point positif est que la conversion est fait à un premium de 56% du prix actuel et ce sans bons de souscriptions :

The above conversions are being completed at a share price of $0.25, representing a 56% premium to Friday’s closing price; no share purchase warrants were included in the transactions. These transactions are a strong vote of confidence from partners looking to deepen their ties with UGE moving forward. For this, we are incredibly grateful.

The reduction in debt also decreases annual interest costs by over US$400,000, improves our working capital position by US$2.6 million, and significantly improves our debt ratio, resulting in a balance sheet that is stronger, more bankable, and more flexible going forward.

In the past month, we also cut SG&A expenses by 15%, in addition to refinements we had made throughout the first half of the year, as we continue to adjust to the market while focusing on our goal of sustainable profitability.

Make no mistake, we weren’t happy with our Q2 results; however, the bigger picture is crystal clear. This is an industry where opportunity continues to expand and where we are very well positioned. We are as excited about our prospects now as we have been at any other time, especially after completing these transactions.

We greatly value our shareholders and know this year hasn’t been favorable to you. We fought hard to protect shareholder value when executing these transactions, as we always will. We are excited about the end result and look forward to discussing it further with you in the near future.

Sincerely,

Nick

UGE Announces Financed Solar Contract with Central Seafoods

Central Visayas, Nov 6, 2018 (Issuewire.com) - UGE International Ltd. (TSXV: UGE) (“UGE” or the “Company”), a global leader in solar energy solutions for the commercial and industrial sector, is pleased to announce it has signed a financed contract to provide Central Seafoods in Cebu, the Philippines with a rooftop solar system.

The contract for Central Seafoods is UGE’s second financed contract in the Philippines, after announcing one with Lonbisco two weeks ago. The project is expected to be installed over the next six months. The initial project size is 165 kW and is estimated to save the client almost half a million US dollars over the project’s useful life.

Once operating, the system will offset over 3,000 tons of carbon annually and will significantly reduce electricity costs for Central Seafoods. By converting to solar energy, the facility will pay 40% less than the utility rate for electricity, while also reducing volatility in energy prices and its carbon footprint.

Central Seafoods is a leading processor and exporter of marine products and crab meat. UGE looks forward to completing this initial project over the next six months, and to working with Central Seafoods to lower its energy costs and decrease its carbon footprint across its broader portfolio thereafter.

La lettre aux investisseurs donne un peu plus de couleurs sur les progrès de l’entreprise :

Good morning,

We are excited to announce the signing of a new financed solar contract with Central Seafoods, a top-tier manufacturer and exporter of marine packaged foods in the Philippines.

The solar project is fully financed and offers the client savings of approximately 40% on their electricity costs, with an estimated total of almost half a million US dollars over the project’s lifetime. Central Seafoods has facilities across the Philippines and clients around the world; we are excited about exploring future opportunities with the company, following this initial project’s eventual success.

The Philippines has been a strong growth market for us this year, with revenues increasing more than 20X during the first nine months of 2018, driven by strong economics and a robust customer base. We look forward to converting more of our pipeline into projects in that market in the coming months.

On a related note, we are proud to announce that last week we reached substantial completion on our project for Robin Toys, one of our largest clients in the country. The initial 500kW project commenced construction earlier this year and serves to power part of one of Robin’s marquis facilities. With the success of this initial installation we look forward to expanding the relationship further, as well.

Lastly, we hope you caught our improved Q3 results last week. As always, if you have any questions on the business just let us know.

Kind regards,

Nick

UGE Announces Corporate Planning Initiatives

Toronto, Ontario, Dec 07, 2018 (Newsfile Corp via COMTEX) – UGE International Ltd. (UGE) (the “Company” or “UGE”), a leader in renewable energy solutions for the commercial and industrial sector, is pleased to announce it is working on several corporate initiatives as it looks to rebound and achieve stronger results in 2019.

The initiatives include:

● Identifying additions to its board of directors that can best support the Company going forward;

● Forming a shareholder advisory group, which will actively support the company in identifying new board members as well as providing feedback and guidance on the Company’s strategy; and

● Updating its strategic plan and corporate branding, as it completes its shift from the majority of its revenue coming from EPC (Engineer, Procure, Construct) services, to one primarily focused on developing, deploying, and owning its projects.

The Company would also like to bring attention to several recent achievements aimed to position it for a strong 2019:

● A number of new customer wins in high growth US and international markets, including the Company’s first financed projects in the Philippines;

● Reduction of overhead expenses in less profitable and lower growth markets, which were estimated at 30% on an annualized basis as of our September 30, 2018 financials, compared with beginning of year numbers;

● Exploring opportunities that exist in the cannabis sector; and

● The issuance of the Company’s first green bond, which helps position UGE to own its self-developed projects for the first time.

“We are excited about the high growth our sector is experiencing, and is poised to experience in the coming years,” stated Nick Blitterswyk, CEO of UGE. “We look forward to executing on these initiatives, among others, in the coming weeks and into early 2019, as we build our business in the high growth solar industry.”

Bien mais assez vague/floue de la part de UGE.

Plus généralement (et surtout pour mon éducation), est-ce qu’il y a une corrélation entre ce communiqué et le fait que le prix de UGE vient de baisser en dessous de 0.10$ (un bas historique)? Peut on faire une généralisation et dire que ce genre de communication est tout à fait normale pour une entreprise qui, suite à une période difficile pour le prix de l’action et en l’absence de nouvelles financières tangibles et concrètes, veut (se doit de) montrer que les affaires vont toujours bien et que le management garde l’œil et le cap?