RLV Halted

Je m’attend qu’un communiqué annonce que le deal est clos définitivement

12 Jun 2017 12:32 HE

12:32 PM EDT, 06/12/2017 (MT Newswires) – Relevium Technologies Inc. (RLV.V), a consolidator of e-commerce assets in Health and Wellness has completed the acquisition of all of the business and assets of BioGanix Ltd. as well as the initial closing of its concurrent debt and equity financing.

Initial closing of the Equity Private Placement

The Company has completed an initial closing with gross proceeds of $2 million and issued 20.1 million units at a price of $0.10 per Unit. The company expects to close a second and final tranche on or before June 19, 2017.

Relevium has also executed a Note Purchase Agreement with AIP Asset Management, AIP Private Capital and a private lender consisting of a two year secured convertible debenture facility of up to $5 million with a coupon of US Libor plus 8% and a conversion price of $0.15 per share.

Il devrait y avoir plusieurs membres dans l’équipe de direction avec de l’expérience e-commerce alors que c’est pratiquement absent – le seul étant Quinn Roukema, qui selon LinkedIn, a sa propre compagnie et n’est qu’advisor pour RLV. Ça derait être une expertise hands-on forte.

Il y a des firmes qui achètent des sites e-commerce sous-performants et appliquent leurs recettes de marketing et d’optimisation (ex. Drew de http://www.nerdmarketing.com/) pour augmenter rapidement la performance et revendre les sites en ~6 mois.

Ça serait un modèle qui m’intéresserait, mais ce n’est pas celui proposé par RLV. Personnellement, du peu que j’ai vu sur l’entreprise, je n’y toucherais pas. Peu importe le modèle, j’ai senti que les acquisitions étaient la finalité et non le début.

Edit: Ceci dit, ça ne veut pas dire que c’est un mauvais investissement. Je m’en remettrais à votre expertise pour ça ! Mon approche d’investisseur-tout-nouveau est très qualitative.

Disclosure : M.Sc. en e-commerce, travaille dans une agence web et gère quelques clients dans le domaine de la santé.

Ton commentaire est très intéressant.

Je crois que la stratégie consiste à garder les fondateurs des entreprises au sein de Relevium afin que ceux-ci continuent de faire croître leur entreprise. Donc en effet, probablement peu d’optimisation externe.

D’autre part, au fil des acquisitions, il y a aura probablement de plus en plus d’opportunités de synergies / ventes croisées entre les différentes divisions de l’entreprise. Par exemple, en obtenant les droits sur une ligne de produit spécifique lors d’une acquisition, il est possible par la suite d’y mettre un nouveau branding et de le vendre sur les autres sites de commerce en ligne appartenant à Relevium.

Je suis cependant patient et j’aimerais voir une petite historique de succès avant d’acheter des actions.

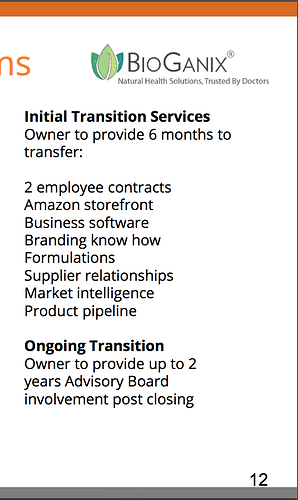

La slide suivante me donnait justement l’impression que c’est le contraire.

+1 pour attendre de voir comment ils exécutent

En effet,

C’est un investissement très risqué mais le potentiel de rendement est tellement élevé selon moi que j’ai pris ine petite position dans le PP.

Ça va être intéressant de comparer leur exécution avec le tableau assez détaillé des objectifs d’acquisition fourni dans la présentation aux investisseurs. C’est assez rare de voir une compagnie illustrer son plan à moyen/long terme comme ça et personnellement ça me plait. Par contre, je trouve l’objectif du ‘‘implied share inssuance price’’ de 1.25 d’ici le Q3 2009 un peu utopique, mais bon si l’on atterrit à mis chemin c’est pas mal non plus!

Avec toutes les difficultés et report de date qu’ils ont eu pour closer leur 1ere acquisition, je me ferais des attentes très modeste…

Mon point est juste de dire qu’au moins ils ont un plan. Vont-ils le respecter? Ça c’est une autre histoire. La première acquisition tout comme la première vente est toujours la plus difficile, je pense qu’à partir de la deuxième acquisition on aura une meilleure idée de leur capacité d’exécution.

Relevium completes final tranche of financing

2017-06-22 10:19 ET - News Release

Mr. Aurelio Useche reports

RELEVIUM PROVIDES CORPORATE UPDATE AND FINAL CLOSING OF THE EQUITY FINANCING

Relevium Technologies Inc. has provided a corporate update on its recent acquisition of BioGanix and the closing of the final tranche of the equity financing.

Final closing of the equity private placement

The company has completed the final tranche of the equity private placement as announced on Feb. 22, 2017, with gross proceeds of $200,000 and issued two million units at a price of 10 cents per unit. Each unit comprises one common share and one common share purchase warrant; each warrant entitles the holder to acquire one additional common share of the company at an exercise price of 15 cents per share for a period of two years from the date of issuance. The company raised a total gross debt and equity financing of $4,461,500.

The company also announced that, in addition to the participation other investors, this final tranche of its private placement included the subscriptions from two additional officers and directors of Relevium, namely: Aurelio Useche, chief executive officer (1.25 million units), Andre Godin, chairman (300,000 units), which in addition to the previous participation of Michel Timperio, director (100,000 units) and Pierre Bertrand, director (100,000 units) represents an aggregate investment of $175,000. The foregoing subscriptions by each of the officers and directors are considered a related party transaction under Regulation 61-101 respecting protection of minority securityholders in special transactions (Quebec) and the corresponding Policy 5.9 of the TSX Venture Exchange. The company relied on sections 5.5(a) and 5.7(1)(a) of Regulation 61-101, respectively, for exemptions from the formal valuation and minority approval requirements under Regulation 61-101, as neither the fair market value of the units issued to the related parties nor the amount of consideration paid therefor exceeds 25 per cent of the company’s market capitalization. A material change report in respect of the related party transactions was not filed at least 21 days in advance of the private placement, as the subscriptions from the related parties were not confirmed until immediately prior to the closing and the company wished to close the offering on an expedited basis for sound business reasons.

As a result of the foregoing issuances, the company will have now 65,971,466 common shares issued and outstanding. All of the securities issued in connection with the BioGanix acquisition as well as the debt and equity financing are subject to a restricted period of four months and one day.

Chief executive officer update on the recent acquisition of BioGanix

As announced in a press release dated June 12, 2017, the company completed the acquisition of BioGanix and it is currently operating the business under BGX E-Health LLC, a U.S.-based wholly owned subsidiary of Relevium Technologies. In the first two weeks of operations, BGX E-Health has generated close to $200,000 in sales revenues from its existing BioGanix brand of nutraceutical products.

Mr. Useche stated: “The addition of BioGanix is a stepping stone in our strategic plans to building a portfolio of e-commerce brands in the health and wellness space. In addition to expanding the current product offering of BioGanix through the introduction of new products, the company plans to also launch parallel brands under BGX E-Health in order to target specific segments.”

Mr. Useche continued: “In addition to focusing on the organic growth of the BioGanix brand and the launch of market specific subbrands, we have now turned our attention to our acquisition pipeline. The company is currently in discussions and negotiations with several targets that fit the business model. The company has initiated discussions with nutraceutical and cosmeceutical brands with the objective of consummating a binding transaction by the end of 2017.”

Final closing of the equity private placement

The entire financing and acquisition are subject to final approval by the TSX-V.

About Relevium Technologies Inc.

Relevium is a TSX-V-listed company focused on growth through the acquisition of businesses, products and/or technologies with a focus on e-commerce in the growing health and wellness sector. Relevium Technologies also holds patented intellectual property for the use of static magnetic fields for application on wearable devices.

We seek Safe Harbor.

Une autre acquisition est prévu d’ici la fin 2017

Donc selon leur plan:

Revenu: 5.1M$

Total share outstanding: 71.6M (@0.10$/share)

New equity raised: 3.7M$ (@0.10$/share)

Cash spent: 3.6M$

New debt: 2M$

New VTB: 2.1M$

Selon les communiqués, à date:

Revenu projeté : 100k x 52 = 5.2M$

Total share outstanding: 65.9M

New equity raised: ??M$

Cash spent: ±2.6M$

New debt: ??M$

Cout d’acquisition global : ±6M$ (’‘the aggregate purchase price of US$4.45 million payable by Relevium for the acquisition of BioGanix’’)

PS j’ai utilisé un taux de conversion USD CAD de 1,35

C’est également intéressant de voir du ‘‘skin in the game’’ par l’équipe de direction : (1.25M + 0.3M+0.1M+0.1M = 1.75M shares @0.10$/share = 175k$). Par contre, ça ne représente que ±2,6% de l’equity global. C’est comme pas clair s’il s’agit de leur participation globale (incluant les fonds avant acquisition) ou non.

Je vous invite à compléter l’info ou me corriger si vous voyez une erreur. Ainsi, on aura un portrait plus juste de la situation.

J’étais in hier @0.11$ Bon succès à tous!

Total share oustanding est-ce que ça inclut ou exclus les warrants ?

Belle transition!

Le management semble conscient des enjeux du e-commerce, ce qui est rassurant.

En attente de l’annonce d’une nouvelle acquisition d’ici la fin d’année.

Des bonnes nouvelles, espérons que les résultats du trimestre seront dans la même veine …

RLV donne signe de vie! Beaucoup plus de volume qu’à l’habitude… Aurelio Useche (Ceo) achète régulièrement sur les marchés depuis quelques semaines. Hâte de voir les prochains “press release”! La société est supposé faire une autre acquisition avant 2018.

Relevium Technologies begins technology build

2017-09-07 12:05 ET - News Release

Mr. Aurelio Useche reports

RELEVIUM LAUNCHES FIRST STAGE BIG DATA & AI PROJECT AND ENGAGES AGILEDSS INC.

Relevium Technologies Inc. has kicked off its maiden technology build.

Highlights

RLV executes on initial tech guidanceRLV kick starts maiden technology buildRLV engages Montreal based leader agileDSS as Data ArchitectRLV takes initial step for building use case for Consumer Trend Recommendation Engine

Following the initial 90 days since the acquisition of BioGanix Ltd., management and the operations team have jointly identified a multitude of areas of the business that can be optimized and automated with technology. These areas include developing new products, dynamic pricing of products, logistics and supply chain management.

Following the Guidance on Technology issued in the August 2, 2017 news release, the Company is pleased to announce the activation of the first technology build that seeks to optimize the product development cycle. At the moment, the product development cycle is heavily reliant on human interpretations of vast amounts of data to decide what products to launch and where to launch them. The Company believes that the most interesting risk-reward profile for a technology investment, at this stage, is to build a recommendation engine that is designed to offer quantitative methodology to launch profitable products ahead of trends in the appropriate jurisdictions.

Relevium Technologies has engaged agileDSS, a leading strategic data services consulting firm headquartered in Montreal, Quebec, Canada that specializes in business and data intelligence to build the use case for the Product Trend Recommendation Engine and confirm the commercial viability of the project

Aurelio Useche, President and CEO of Relevium Technologies stated: “The Company is focused on executing the strategy laid out in the August 2, 2017 news release and the initiation of this tech build is the first box management can check off of strategic objectives before calendar year end.” Mr. Useche continued: “Montreal is fast becoming a global hub for data analytics and artificial intelligence as demonstrated by recent investments made by Google, Microsoft and the Element AI record setting Series A round. We intend on leveraging all of the local resources and talent we can in order to create shareholder value while operating highly profitable businesses in our portfolio brands. The way we see it, with a reasonable investment, the Relevium brands can gain the upper hand, perhaps even months of sales momentum in products or locations that are or will become trending. If we draw a parallel to the financial industry, we believe that e-commerce is where the financial industry was before high frequency trading and that Relevium has the opportunity to be a pioneer and a leader in the industry the same way Virtu Financial, Renaissance Technologies and many others were in the financial markets.”

About Relevium Technologies

Relevium is a TSXV listed company focused on growth through the acquisition of businesses, products and/or technologies with a focus on e-commerce in the growing health and wellness sector. Relevium Technologies Inc. also holds patented intellectual property for the use of static magnetic fields for application on wearable devices.

We seek Safe Harbor.

Donc si je comprend bien RLV se lance dans une industrie complètement différente que Bioganix ?

Moteur de recherche sur comment developpé des produits.

Je trouve ça un peu bizarre comme initiative.

Je crois que c’est plutôt une optimisation du fonctionnement de la vente. Ils semblent vouloir automatiser le processus de vente des produits

Following the initial 90 days since the acquisition of BioGanix Ltd., management and the operations team have jointly identified a multitude of areas of the business that can be optimized and automated with technology. These areas include developing new products, dynamic pricing of products, logistics and supply chain management.