Fabrice Taylor de President’s Club vient de publier une note sur Polaris :

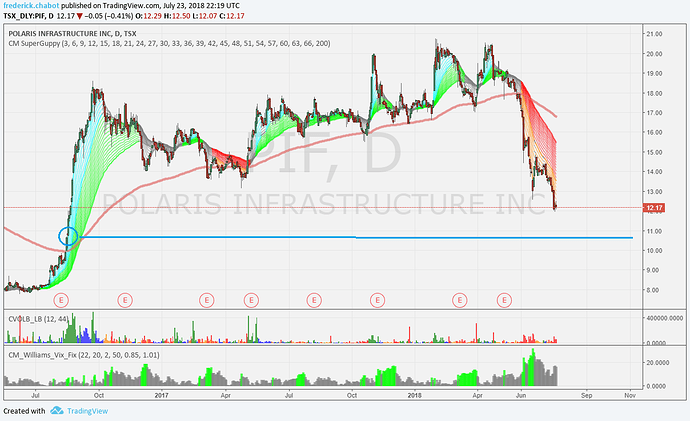

Another turnaround story I’ve been feasting on is Polaris Infrastructure (PIF). It really took the market selloff on the chin, not surprisingly, and while it has made a couple of attempts at a recovery, running not long ago from $6.75 to $8 on big volume, the relentless selling is keeping a thumb on it.

That selling emanates from funds that used to own the bonds and now own shares as part of the recapitalization. Many of these investors are funds that cannot own equities so they’re dumping shares aggressively. You should buy the shares from them.

PIF’s contract gives it an automatic 3% price increase on the power it sells every year, and new drill holes could ramp production to 72 MW (a ~40% increase), which would produce prodigious cash flow and a rising dividend.

And best of all this story has tremendous growth potential if the drill program hits and Polaris acquires the binary unit that can increase production by 10%. Ascribing modest success to these measures we could see a future dividend that, on the current price, yields more than 25%!

The company alraedy announced a 10 cent USD/quarter dividend two weeks, meaning that at the current price the yield is almost 8%. Plus the dividend is paid in US$, which I like as a cheap way to build a balance of greenbacks (no foreign exchange fees).

The stock is cheap, trading at a large discount to hard book value, and these discounts never last long.

Once these sellers are gone this stock should march higher.

Warmest regards,

Fabrice Taylor, CFA | Publisher