Est-ce que quelqu’un suit ce titre? En 2014, il a connu une belle monte de 25c à 75c avec un sommet de 120c début 2015, mais après le titre a de nouveau tombé jusqu’au 54c. Les dernières résultats (Q3) qui avaient été annoncé pendant le mois de mai me semblait quand-même tres fort.

Sur le site web de EBN, il ya un rapport de Cantor Fitzgerald, qui donne un bon overview de l’entreprise: Rapport Cantor

Leur prix cible est de CAD 1,65

Je l’ai sur ma watchlist, si je finis par creuser un peu plus éventuellement (après mes vacances) je partagerai mes trouvailles haha

Le rapport d’analyse a l’air assez bien, je l’ai survolé rapidement. Toutefois il faut être prudent avec les rapports d’analystes, puisque ces compagnies peuvent être payées pour l’écrire ou bien avoir des intentions quelconques derrière le rapport (ex: dire que cest un sell quand eux veulent en acheter moins cher, dire que c’est un buy une fois qu’ils ont acheté, etc). Les price targets c’est vraiment n’importe quoi en tk.

As-tu fais un peu de recherches que tu voudrais partager EskiMo ?

Je n’ai pas encore fait assez de recherche non plus, mais ce que j’aime:

- l’entreprise a créé des profits pendants les 11 dernières trimestres

- le CAGR des ventes du dernières 15 ans est de 20%

- le bilan est très fort (position net cash)

- ils ont pu modifier leur usine avec du cash flow interne (coût: environ USD 1m) cet année-ci. L’usine leur permettra d’optimaliser le proces de production et de générer des ventes de USD 20m (comparé à USD 7,5m en FY 2014)

- environ 25% des actions est détenu par des insiders

Je ne me sens pas encore à l’aise avec:

- l’opportunité de marché (selon le rapport environ USD 220m - basé sur des chiffres du management)

- le fait que EBN va continuer à augmenter les ventes (gagner part de marché ou addresser des nouveaux marchés)

- si EBN a vraiment un avantage compétitif comparé à la compétition

Je partagerai aussi mes nouveautés

Salut! Je suis nouveau sur ce forum.

Avez-vous une idée de ce qui a causé le peak puis la descente aux enfers durant les années 90?

J’ai pris une petite position dans Epicore, le dernier trimestre fut un trimestre record avec des profits de $696,000(U.S) Epicore Bionetworks earns $696,000 (U.S.) in fiscal Q2. Ils semblent avoir une forte croissance des ventes du coté asiatique et les prévisions pour le prochain trimestre semblent bonne aussi.

Financial Highlights

Q2 revenue of $3.0 million was 36% higher than Q2 last year

Q2 gross profit of $1.8 million was 54% higher than Q2 last year

Q2 operating expenses of $1.0 million were 1% higher than Q2 last year

Q2 earnings before taxes of $0.8 million were 382% higher than Q2 last year

Q2 net income of $0.7 million was 603% higher than Q2 last year

Q2 EBITDA of $0.9 million was 280% higher than last year Q2

Q2 basic earnings per share of $0.03 were 575% higher than Q2 last year

Q2 shareholders’ equity of $10.4 million was 22% higher than Q2 last year

Q2 cash balance of $3.5 million was 107% higher than Q2 last year

YTD cash flow from operating activities was $0.3 million

As of February 14, 2017, the Company has issued and outstanding 26,411,229 common shares and 1,108,334 options outstanding with an average exercise price of Canadian $0.36. The Company has in place a Normal Course Issuer Bid (NCIB) through the facilities of the TSX Venture Exchange whereby it 9 may purchase for cancellation up to 500,000 of its issued shares. As of the date of this MD&A it has acquired 33,500 shares under its NCIB at an average price of $0.57

Voici un article ci-dessous en date du 27 février 2017 qui dit que le gouvernement vietnamien vise à améliorer massivement l’industrie de la crevette du pays en vue de stimuler les exportations.

http://www.prnewswire.com/news-releases/ubm-launches-aquaculture-vietnam-2017-300414542.html

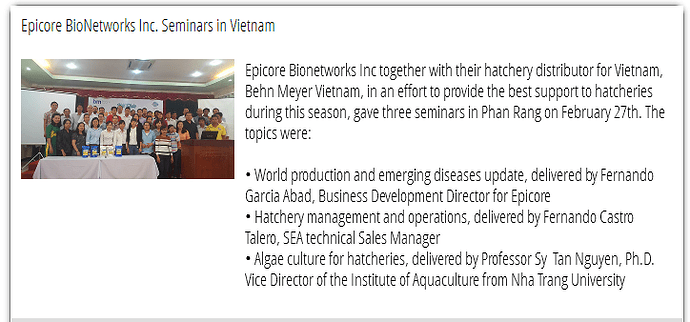

Voici une photo prise sur le site d’epicore qui fait un séminaire au Vietnam chez leur distributeur. Epicore semble être bien placé pour profiter de la croissance de ce pays

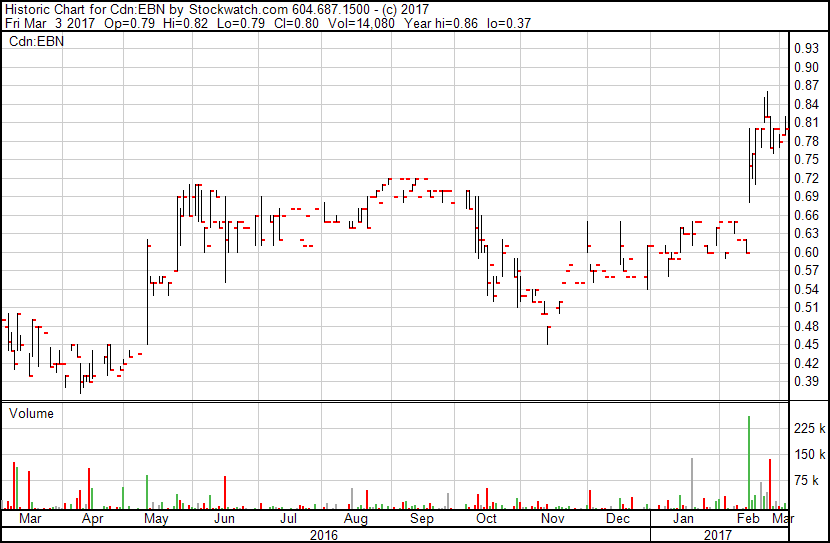

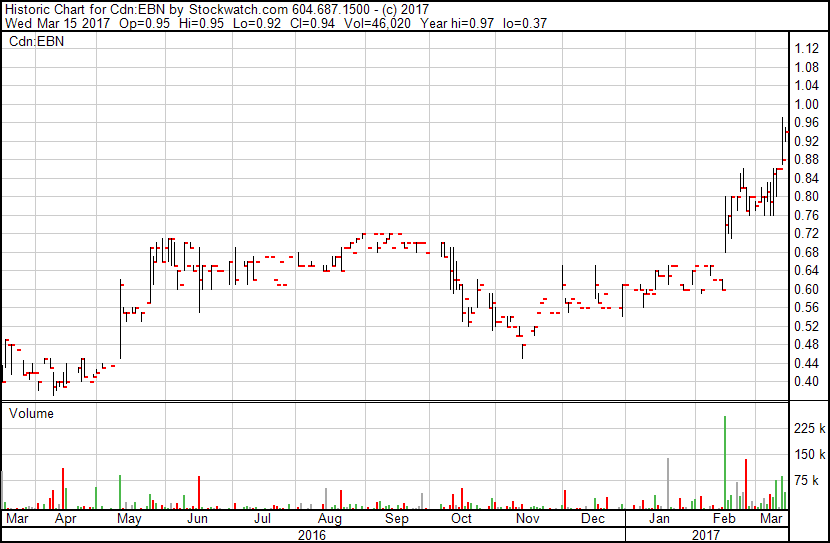

Breakout a $0.97

Vietnam targets 10 billion USD in shrimp exports by 2025

vovworld.vn | WEDNESDAY, MARCH 15, 2017

Tuesday, March 14, 2017 - 15:11:32

(VOVworld) - The Ministry of Agriculture and Rural Development is outlining a plan to develop Vietnam’s shrimp industry towards an export revenue of 10 billion USD by 2025.

Vietnam has become the world’s third largest shrimp exporter after China and Indonesia. Vietnamese shrimp is available in 100 countries and territories. Vietnam is the biggest shrimp supplier to Japan, the third biggest to the US, and the fourth biggest to the EU.

Truong Dinh Hoe, Secretary General of the Vietnamese Association of Seafood Exporters and Processors, says Vietnam has an advantage over Thailand, India, and Indonesia with respect to white leg shrimp and giant tiger prawn exports.

“In the past shrimp prices were high because we depended totally on fishing. Now that white leg shrimp and lobsters are cultured, prices have dropped. This has boosted the supply, consumption, and profitability of Vietnamese shrimp products”, Hoe explains.

Nhu Van Can, Director of the Aquaculture Department of the Directorate of Fisheries, says in the first quarter of this year, the aquaculture sector submitted an action plan for the shrimp industry to the Ministry of Agriculture and Rural Development to gather expert opinions before sending it to the government. According to Can, the Ministry will add lobsters and green clawed crayfish to the list of export items.

“The sector’s development will focus on boosting the production output of its farming areas, which cover about 600,000 to 700,000 hectares”, Can added.

Shrimp remains the biggest hard currency earner, accounting for 44% of Vietnam’s total seafood export values in 2016. (Photo: Nguyen Hue)

Deputy Minister of Agriculture and Rural Development Vu Van Tam said to earn 10 billion USD from shrimp exports by 2025, the sector needs scientific and technological breakthroughs, in breeding, production, and disease control. It also needs to expand export markets and respond appropriately to protectionism such as technical barriers. In 2017, the aquaculture sector will energetically carry out the action plan for the shrimp industry, Tam said.

“Scientific and technological breakthroughs will increase productivity. The current shrimp farming area of 140,000 hectares can be expanded in a short time. The current average productivity of 4 tons per hectare can be raised to 6 to 8 tons per hectare for leg shrimp and brackish shrimp that are cultured on an industrial scale. We need to create policies to attract new businesses, gather small producers into cooperatives and connect them with enterprises, and apply science, technology, and new models to production and export”, Deputy Minister Tam elaborates.

In recent years, due to climate change effects like large-scale saline intrusion, shrimp farming has been boosted to increase export revenues. Prime Minister Nguyen Xuan Phuc has said that in order to reach Vietnam’s target of 10 billion USD by 2025, shrimp must become a spearhead export.

Epicore Bionetworks to sell Reed algal concentrate

2017-03-15 16:43 ET - News Release

Mr. William Long reports

EPICORE BIONETWORKS INC. REPORTS NEW PRODUCT OFFERING

Epicore Bionetworks Inc. has closed a new arrangement that expands Epicore’s line and delivers to shrimp hatcheries an alternative to the challenging practice of growing live algae.

Larval shrimp require a varied diet to achieve optimum growth. In addition to compound feeds like Epicore’s EPIFEED and EPIBAL products, they require live Artemia and algae. Most shrimp hatcheries possess a large amount of competence when it comes to growing algae on site. But algae crashes do happen. When they do, what is “plan B”? Now Epicore has that answer.

Epicore has recently negotiated an arrangement with Reed Mariculture Inc. to sell a special fresh algal concentrate specially developed for hatchery shrimp rearing. Reed is the largest producer in the world of marine algae concentrates and has been in business over 20 years. Their INSTANT ALGAE products are used around the world in fish hatcheries and other applications. Their products are whole cell, whole food microalgae that offer hatcheries a clean, convenient, long shelf-life feed to replace or supplement live algae.

Reed and Epicore have collaborated for two years to develop an algae mixture that will replace or supplement all the live algae now grown in shrimp hatcheries. Epicore is the exclusive distributor to the shrimp industry for this new product. Epicore is launching the product under the name EPI-ALGAETM. EPI-ALGAE is a highly nutritious blend of three species of marine microalgae in a liquid concentrate form. The microalgae used in EPI-ALGAE are grown in closed photo reactors under optimal growing conditions and packaged with a proprietary process that eliminates cell breakage.

EPI-ALGAE offers the following benefits to shrimp hatcheries:

EPI-ALGAE is an instant algae product always available when it is needed for,

Emergency back-up

Peak load supplement

Live algae replacement

EPI-ALGAE offers hatchery production flexibility (replace all live algae or just one species)

EPI-ALGAE stimulate Zoea feeding and reduces the effect of Zoea Syndrome

EPI-ALGAE offers more complete nutrition than a single alga.

EPI-ALGAE is pathogen free - grown in bio-secure bioreactors in an inland facility

Epicore BioNetworks Inc. is a leading producer of environmental biotechnology and animal nutrition products. It manufactures in the USA and markets worldwide to a variety of industries to reduce environmental pollution and increase operational productivity.

We seek Safe Harbor.

J’ai hâte de voir la réaction demain, un arrangement avec le plus gros producteur de concentrés d’algues marine au monde

Epicore Bionetworks earns $386,000 (U.S.) in fiscal Q3

2017-05-17 16:38 ET - News Release

Mr. William Long reports

EPICORE BIONETWORKS INC. REPORTS QUARTER THREE RESULTS FOR FISCAL YEAR 2017 FOR THE QUARTER ENDED 31 MARCH 2017, IN US DOLLARS

Epicore Bionetworks Inc. has released its results for the third quarter of fiscal 2017. All figures are in U.S. dollars, unless otherwise specified. The company had third quarter revenue of $3-million and net income of $400,000, or 1.5 cents per share, for the period ended March 31, 2017.

Third quarter revenue was 3% higher than last year’s Q3. Revenue for the first nine months at $8.5 million was 18% higher than last year. Net income was $0.4 million in Q3, a decrease of $0.3 million or 41% less than prior year Q3. Q3 earnings before interest, tax, and depreciation (EBITDA) were $1.0 million or 7% above prior year. Taxes increased by $0.3 million over prior year Q3 because of a reduction in tax provision estimated earlier in the year in anticipation of completing a new building in NJ. The building start is delayed so the tax depreciation will move to fiscal 2018. Sales grew in most business sectors with the largest increase in Latin America.

The shrimp industry continued to recover in Q3 of fiscal 2016 as shrimp prices slowly increase. Early mortality syndrome disease affects most of Southeast Asia so inhibits shrimp production recovery to 2015 levels. The use of improved culturing systems, like raceways, has helped Asia start to recover from disease. But, with higher shrimp prices farmers are more willing to try a crop, which is good for Epicore’s hatchery product sales.

Results versus prior fiscal year quarter two are as follows:

Q3 revenue of $3.0 million was 3% higher than Q3 last year Q3 gross profit of $2.1 million was 13% higher than Q3 last year Q3 operating expenses of $1.2 million were 19% higher than Q3 last year Q3 earnings before taxes (EBT) of $0.9 million were 7% higher than Q3 last year Q3 net income of $0.4 million was 41% lower than Q3 last year Q3 EBITDA1 of $1.0 million was 7% higher than last year Q3 Q3 basic earnings per share of $0.015 were 44% lower than Q3 last year Q3 shareholders’ equity of $10.8 million was 17% higher than Q3 last year Q3 cash balance of $4.4 million was 61% higher than Q3 last year YTD cash flow from operating activities was $1.3 million

Gross profit increased 13% in Q3 versus prior year due to the increase in revenues and to a higher average gross margin. The cost of goods sold was lower in Q3 versus prior year and average selling price was lower due to product sales mix. Operating expense increased 19% over prior year Q3 and 8% for the first three quarters. Selling expenses accounted for the largest increase and was due to increased travel. Corporate expenses increased due to increased board activity.

Higher tax expense offset higher EBT so decreased net income by 41% to $0.4 million. The following table summarizes the Q3 results (rounded to thousands of US dollars):

For the Quarter ended March 31

2017 2016 Increase (Decrease)

Revenue $3,026 $2,930$96 3%

Gross profit $2,063 $1,829$234 13%

Operating expenses $1,150 $964 $186 19%

Net income $386 $656 ($270) (41%)

Earnings per share $0.015 $0.027($0.012) (44%)

Shareholders’ equity$10,750$9,207$1,543 17%

Cash balance $4,372 $2,715$1,657 61%

Epicore continues to generate positive net income from operating activities. Cash at the end of the quarter was $4.4 million versus $2.7 million at the end of Q3 fiscal 2016. With these funds, expected sales revenue growth and continued relatively low operating costs, management expects there will be sufficient cash to meet the fiscal year’s financial requirements, to fund expansion of aquaculture and environmental remediation marketing efforts and to pursue new strategies for enhancing shareholder value.

Over the last two years, Epicore has invested materially in a second building and automated packaging equipment. This added space has been critical to our ability to increase production levels. All automated packaging equipment is in place and operational. The board has approved an ongoing capital program to increase production capacity and enhance operational efficiencies.

The financial statements of the company have been prepared in accordance with International Financial Reporting Standards. Epicore BioNetworks Inc. is a public corporation with a registered office in Calgary, Alberta, Canada and with shares listed on the TSX Venture Exchange (symbol EBN). [Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.]

We seek Safe Harbor.

Même si le titre ne se transige pas beaucoup, Epicore demeure sous-évalué, le secteur est en pleine croissance, juste cette semaine, un communiqué de Cargill et une acquisition de Biomar.

Cargill eyes shrimp farming potential in Latin America

Shrimp production may see double digit growth for the next few years for India, Ecuador, Indonesia and Thailand, Cargill Group Director and VP Dan Burke told

et une acquisition aujourd’hui de Biomar

This is a market currently witnessing very high growth rates – not least in South America, and the growth momentum is expected to continue.

BioMar acquires South American shrimp feed manufacturer

Epicore earns $1.86-million in fiscal 2017

2017-07-27 18:15 ET - News Release

An anonymous director reports

EPICORE BIONETWORKS INC. RELEASES PRELIMINARY QUARTER 4 RESULTS FOR FISCAL YEAR 2017

Epicore Bionetworks Inc. is providing an update on fourth-quarter and fiscal year results for the period ended June 30, 2017, in U.S. dollars. Revenue was $3.1 million and net income was $0.55 million or $0.02 per share for the quarter ended June 30, 2017.

Historically, quarter four is a weaker sales period for the Company than other quarters. In fiscal 2017, Q4 was the strongest of the fiscal year and was particularly strong when compared to Q4 fiscal 2016.

Unaudited fourth quarter revenue was $3.1 million versus $2.3 million in Q4 2016, a 37% increase. Revenue for the 2017 fiscal year was $11.5 million, 22% higher than fiscal 2016. Quarterly net income was $0.55 million or 337% higher than prior year Q4. Annual net income at $1.9 million was $0.7 million or 67% higher than prior fiscal year. Fourth quarter earnings before tax (EBT) were $0.9 million or 134% higher than prior year Q4. Annual EBT at $3.0 million was $1.2 million or 72% higher than prior fiscal year. Taxes for the quarter increased by $0.1 million or 28% over prior year Q4. Taxes for the year increased by $0.5 million or 80% over prior fiscal year. Cash flow provided year-end cash of $4.6 million, a 33% increase.

The shrimp industry has continued to recover throughout the fiscal year and shrimp prices have slowly increased. Early mortality syndrome (EMS) disease still affects most of Southeast Asia and some areas in the Americas but the use of improved culturing systems, like raceways, has helped farmers start to recover from disease. But, with higher and steadily increasing shrimp prices farmers are more willing to try a crop.

Epicore sales in Q4 and the fiscal year grew in most world business sectors with the largest increase in Latin America. The Company set sales records in every quarter of fiscal 2017. Epicore’s Ecuadorian subsidiary had strong and increasing sales throughout the year with the industry reporting record shrimp exports. Sales in the rest of Latin America also were strong except for Mexico, which has been hit hard with EMS. Most Asian countries also booked sales increases in Q4 and fiscal 2017. Newer areas like Australia and Madagascar contributed strongly. Our newest product, EPI-ALGAE, made impressive early sales.

Results versus prior fiscal year quarter four are as follows:

Q4 revenue of $3.1 million was 37% higher than Q4 last year

Q4 gross profit of $2.0 million was 60% higher than Q4 last year

Q4 operating expenses of $1.1 million were 17% higher than Q4 last year

Q4 earnings before taxes of $0.9 million were 134% higher than Q4 last year

Q4 net income of $0.55 million was 337% higher than Q4 last year

Q4 basic earnings per share of $0.02 were 300% higher than Q4 last year

Q4 cash balance of $4.6 million was 33% higher than Q4 last year

Gross profit increased 60% in Q4 versus prior year due to the increase in revenues and to a higher average gross margin. The unit cost of goods sold was lower in Q4 versus prior year and average selling price was slightly higher, both due to product sales mix. Higher production was achieved without a significant increase in production labor costs. Operating expense increased 17% over prior year Q4 and 12% for the fiscal year. R&D and corporate expenses accounted for the largest increases. Corporate expenses increased due to increased board activity. Tax expense increased in line with higher EBT. The following table summarizes the Q4 and fiscal 2017 results (rounded to thousands of US dollars):

For the Quarter ended June 30

2017 2016 Increase (Decrease)

Revenue $3,076$2,250 $826 37%

Gross profit $2,015$1,257 $758 60%

Operating expenses $1,135 $968 $167 17%

Earnings before tax $864 $369 $495 134%

Net income $555 $127 $428 337%

Earnings per share $0.02$0.005 $0.015 300%

Cash balance $4,615$3,478 $1,137 33%

For the Year ended June 30

2017 2016 Increase (Decrease)

Revenue $11,542 $9,437 $2,105 22%

Gross profit $7,295 $5,482 $1,813 33%

Operating expenses $4,300 $3,848 $452 12%

Earnings before tax $3,034 $1,767 $1,267 72%

Net income $1,866 $1,117 $749 67%

Earnings per share $0.07 $0.04 $0.04 75%

Cash balance $4,615 $3,478 $1,137 33%

Audited financial results will be available in October.

Epicore BioNetworks Inc. is a public corporation with a registered office in Calgary, Alberta, Canada and with shares listed on the TSX Venture Exchange (symbol EBN).

Neovia S.A.S. to Acquire Epicore BioNetworks Inc.

Neovia will acquire all of the issued and outstanding shares of Epicore on a fully-diluted basis for a price per share of Cdn$1.30, valuing Epicore at approximately Cdn$ 35.6million. The purchase price represents a premium to the closing trading price of the Epicore shares prior to this announcement of 25%.